Nasdaq has launched the Nasdaq Custom Basket Calculation Service (CBCS) in collaboration with S&P Global Market Intelligence in response to increasing demand for a simpler and more efficient way of managing proprietary indexes, thematic baskets, and ESG investments.

CBCS allows users to design and set up equity baskets with customised features such as currency, return type, composition, and weights from a pre-approved universe of stocks. The calculated basket level and reference data is validated and distributed along with daily basket weight reports.

‘The ability to generate on-demand listed exposure for equity portfolios will introduce an exciting change in the trading vehicles available to consumers, and to the speed at which the customer demand can be satisfied.’ said Christopher Hare (pictured), executive director at S&P Global Market Intelligence.

Through the new service, Nasdaq clients will be able to calculate the basket level for each basket, managed and verified corporate actions such as stock splits, dividends, mergers and acquisitions and the implementation of these changes into the defined baskets in a ‘timely and accurate way’.

‘With CBCS, our clients get a fully managed solution for custom basket calculations, an outsourced calculation service to avoid conflict of interest by separating the calculation from the end-user’s own business,’ said James McKeone, VP head of European data at Nasdaq.

McKeone said the exchange also has plans to launch a solution in the near future enabling ‘investors to create a forward contract on customised baskets as an alternative to OTC equity swaps’.

Private equity derivatives platform eyes structured pre-IPO investment products

US private equity derivatives platform for institutional investors Caplight Technologies has secured a strategic investment from Deutsche Börse Group.

With this raise from Deutsche Börse, Caplight has now raised US$10 million, including a US$5 million seed round led by Better Tomorrow Ventures that was completed in January of 2022. Other investors include Fin Capital, Susquehanna Private Equity Investments, LLLP, and Clocktower Ventures.

The funding gives Caplight additional resources to serve the multi-billion private market – the fintech will explore collaboration opportunities with Deutsche Börse’s derivatives exchange subsidiary Eurexto bring structured pre-IPO investment products to the global financial markets.

‘Until now, the VC asset class has existed 'long only', meaning no ability to hedge or make directional investments,’ said Javier Avalos (right), CEO of Caplight.

Caplight's platform offers institutional investors price discovery tools as well as hedging, income generation, shorting, or investment strategies on private company stock. The firm completed the first ever call option on private company stock earlier this year.

‘Valuations of private pre-IPO companies have grown significantly over the last decade, a trend we expect will continue,’ said Michael Peters, CEO of Eurex. Venture capital-backed private companies represent over $3.8 trillion in value across over 1,000 companies, according to CB Insights.

Indexed annuities claim record-breaking quarter

For the second consecutive quarter, annuity sales reached new heights. In the third quarter 2022, total annuity sales were US$79.6 billion, a 27% jump from prior year results, according to Limra’s U.S. Individual Annuity Sales Survey.

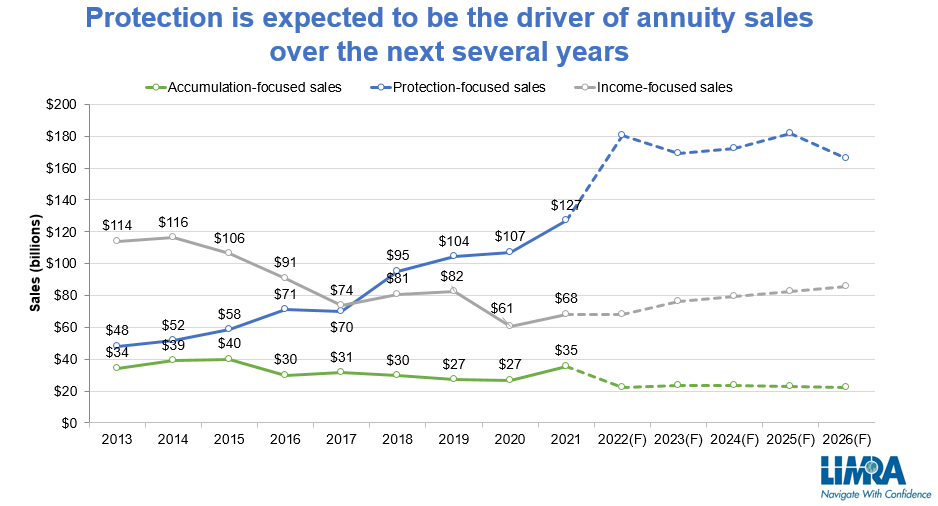

‘Continued equity market declines and rising interest rates drove investors to continue seeking protection and purchase fixed-rate deferred and fixed indexed annuities at record levels in the third quarter,” said Todd Giesing (right), assistant vice president, Limra Annuity Research. ‘Our forecast suggests that protection products will continue to propel growth in the annuity market for the next several years.’

Third quarter fixed indexed annuity (FIA) sales were US$21.4 billion, a 25% increase from 2021, breaking the previous quarterly sales record of US$20 billion set in the second quarter 2019. Year-to-date (YTD), FIA sales were US$57.4 billion, a 22% increase from last year.

‘Rising interest rates will allow insurers to improve crediting rates while protecting the principal investment from equity market volatility, making these products more attractive to investors for the foreseeable future,’ noted Giesing, adding that Limra projects 2022 FIA sales to reach as high as US$76 billion and increase each year through 2026.

Registered index-linked annuity (Rila) sales improved 13% in the third quarter, to US$10.5 billion. In the first nine months of 2022, Rila sales were US$30.9 billion, 9% higher than prior year.

‘FIA’s growth has come at the expense of Rila product sales,’ said Giesing. ‘After three years of more than 30% annual growth, LIMRA is projecting Rila sales to be flat or under 5% in 2022.’

Traditional variable annuity (VA) sales continued to struggle. In the third quarter, traditional VA sales fell 37% to US$13.7 billion, the lowest quarterly results since the third quarter of 1995. Total fixed-rate deferred annuity sales were US$29.8 billion in the third quarter, 159% higher than third quarter 2021 sales.

Limra also reported that income annuities have rebounded to pre-pandemic levels - single premium immediate annuity (SPIA) sales were US$2.5 billion in the third quarter, a year-over-year increase of 58%; while deferred income annuity (DIA) sales rose 18% to US$600 million.

UBS launches digital wealth management platform in Shenzhen

UBS’ wholly owned UBS Fund Distribution (Shenzhen) Company Limited (UBS FS) has launched the official launch of WE.UBS, a digital-led platform offering wealth management services to affluent clients in China.

This is the first digital wealth management platform in Asia Pacific under UBS and the first digital-led wealth management platform launched by a global wealth manager in China.

The mobile app offers a digital service model with proactive financial planning based on big data and UBS Chief Investment Office (CIO) views and will enable wealth management investors to access both local and global investment solutions including structured products through a ‘robust selection process, dedicated investor education as well as 24-hour tracking based on market developments’.

Iqbal Khan (above-right), president Global Wealth Management of UBS said: ‘Demand for professional wealth management services, delivered digitally, is growing exponentially in China. Following our launch in Shenzhen, we will focus on clients in the GBA before broadening out to other cities.’

WE.UBS is collaborating with a number of business partners and product providers to ‘build an ecosystem that helps clients achieve their own and their family’s financial objectives’, said Andy Ho, General Manager of UBS FS.

Qontigo adds climate risk scenarios to risk management solution

Qontigo has partnered with Ortec Finance, a provider of technology for risk management, to provide climate stress testing capabilities within Qontigo’s Axioma Risk for clients to assess climate risks in their portfolio.

The new functionality is aimed at asset managers and asset owners seeking more robust insights into their exposures to climate risk to meet increasing regulatory pressures worldwide. By combining Ortec Finance’s climate risk-aware economic and financial scenarios with Qontigo’s portfolio management and risk analysis solutions, investors can translate climate transition scenarios to their portfolios to assess exposure and climate resilience.

Ortec Finance’s Climate MAPS solution translates climate pathways and policy assumptions into their impact on financial variables, such as equity returns at country or sector level, or credit spreads at country level. These financial variables are mapped to the factors in Qontigo’s multi-asset class risk solution to enable top-down climate-informed stress tests.

The climate pathways consider both transition and physical risks and include a range of narratives including orderly and disorderly net-zero, failed transition as well as the Network for Greening the Financial System climate scenarios.

Lisa Eichler (above-right), managing director climate & ESG solutions at Ortec Finance, said: ‘As the race to net zero continues across the globe, buy-side firms not only need a better understanding of how their portfolios are impacted by climate risk. This partnership enables forward-looking climate scenario analysis across asset classes, regions, and sectors.’