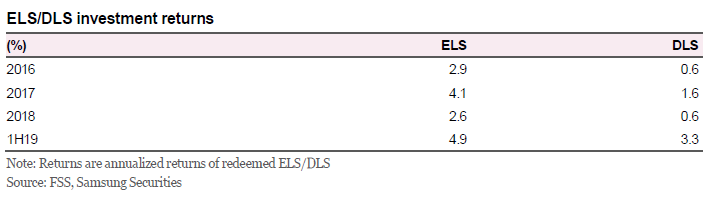

Despite the recent controversy around equity-linked securities (ELS) and derivative-linked securities (DLS), ELS/ equity-linked bond (ELB) issuances will hit KRW89 trillion in 2019 and KRW91 trillion in 2020, while DLS/derivative-linked bonds (DLB) issuances will reach KRW26 trillion in 2019 and KRW27 trillion, respectively, in 2020, according to Samsung Securities.

Because these are the most promising Korean financial products, issuances should edge up year on year in 2020, said Gyun Jun (pictured), a senior analyst at Samsung Securities in Seoul.

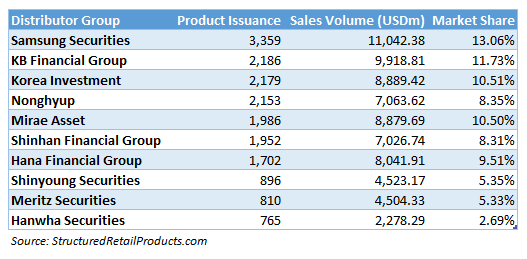

According to Jun, the mis-selling scandal highlighted the importance of distribution channels

‘More than 50% of ELS and DLS issuances are distributed via banks to retail investors,’ he said. “If banks with strong sales power fail to understand DLS and protect investors, it would affect consumer demand for the products as well.”

ELS/DLS restrictions

Samsung’s outlook takes into consideration recent guidelines from the Korean financial regulators to strengthen asset quality control at non-banking financial institutions such as insurers, brokers, capital and asset management firms.

‘As those institutions account for an increasingly portion of the financial system, authorities are taking measures to control risks inherent to them,’ said Jun.

In order to expand repo trading from products with one-day maturity to those with much longer maturities, authorities are demanding securities brokers and investment trust companies (ITCs) hold a certain level of cash in relation to repurchase agreement (RP) borrowed; and tightening regulations on notification for non-registered securities and expanding the scope of such targets.

The Financial Services Commission (FSC) measures also included provisions for ELS/DLS products including the adoption of a ‘volatility-based asset ratio’ to prevent concentration on certain underlying assets.

The financial regulator also suggested that when DLS/ELS-related risk indicators surpass a normal level, brokers should be asked to offer risk control-strengthening measures and notify the fact. The ‘risk indicators’ are likely to include a self-hedging-to-shareholder equity ratio and a liquidity-gap ratio, according to Jun.

‘The measures announced last January should take effect in 2020,’ said Jun. ‘If the volatility-based asset ratio regulation does take effect, assets such as the Eurostoxx 50 and Hang Seng China Enterprises Index (HSCEI) - the most heavily used one in ELS, are likely to be subject to [the new guidelines].

Exposure to those assets should be cut via diversification of underlying assets; or cuts to issuances.

‘Although the regulation is aimed at reducing excessive focus on certain assets, it may lead to a reduction in the offerings available to buyers, and cuts to issuances will be inevitable in cases when underlying asset diversification is impossible,’ Jun said. ‘If ELS/DLS distribution channels contract due to the DLF controversy, demand from banks—the biggest distribution channels of such products—is likely to fall.’

Diversification

One point to note in 2020 will be the diversification of underlying assets in the market as the government’s measures to activate the derivatives market, including a provision seeking the expansion of the usage of underlying assets in public derivatives begin to trickle down the market.

The new provision is aimed at improving ELS issuance practices, which were heavily geared toward a few underlying assets, such as the EuroStoxx 50 or the HSECI, according to Jun.

Going forward ‘strategic indices’ will be allowed to be used as an underlying asset for public placement ELS/DLS.

‘Since public-placement derivatives target the public, financial authorities encourage them to use key equity indices, healthy individual stocks, and international gold and crude oil prices as underlying assets, as these are both easy to understand intuitively and easy to follow in terms of price,’ said Jun. ‘Thus far, a strategic index has rarely been allowed as an underlying asset in public-placement derivatives in Korea.’

Jun expects a diverse range of strategic indices such as risk control, and low-volatility indices as well as smart beta, protected, and an options strategic indices will increase their profile as derivatives’ underlying assets.

‘The adoption of strategic indices should provide a new growth engine to the derivatives market, giving rise to the birth of new derivatives with a mid-risk structure,’ said Jun, adding that this will be appealing for ‘those seeking a stable return over a long period of time, suitable for pension funds; and those with a simplified profit structure, rather than a step-down one’.

‘True, hedging should be key to the utilisation of strategic indices, and it should take a long time for investors’ understanding of them to reach a certain level. The use of strategic indices should allow derivatives to circumvent many existing regulations. If they are also adopted in structured products, active funds will see their advantage further eroded.’

With passive funds already considering smart beta and ESG metrics, the adoption of strategic indices in structured products, which offer pre-determined profit structure, should further erode active funds’ presence.

According to the Financial Supervisory Service (FSS), banks sold KRW27.7 trillion worth of ELS in H1 2019 (or 58.2% of total issuance), brokers sold KRW10.4 trillion (21.9%), and ITCs’ equity-linked funds KRW5.2 trillion (10.9%).

Such data for DLS/DLB products is unavailable, but DLS issuances have largely been absorbed by banks, brokers, and ITC funds. The problematic DLFs were developed by ITCs and sold at banks and non-banking institutions.

Click in the link to read the full report.