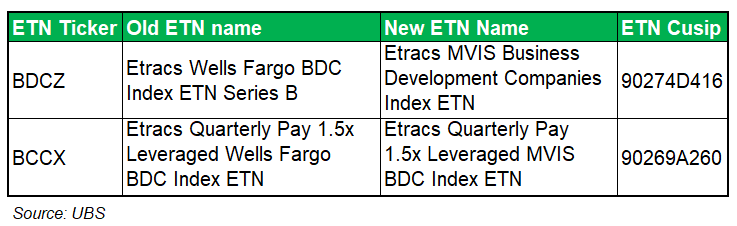

UBS has completed the index succession process for two exchange-traded notes (ETNs) following an announcement on 26 April 2021.

The original underlying index to the ETNs – the Wells Fargo Business Development Company Index, has been replaced with a successor index, the MVIS US Business Development Companies Index. The names of the ETNs have also been updated to reflect the successor Index.

The Swiss bank has also made changes to the terms of the ETNs including the adjustment of the initial index level of the BDCZ ETN to be equal to the index closing level of the successor index on the effective date (30 July 2021), times an adjustment factor which was equal to the original initial index level divided by the index closing level of the original index on the effective date.

The BDCX ETN has also seen its last reset index closing level adjusted to be equal to the index closing level of the successor index on the effective date.

The MVIS US Business Development Companies Index is a modified market cap-weighted index that tracks the performance of the largest and most liquid companies which are treated as business development companies (BDC) and are incorporated in the United States.

To qualify as a BDC, a company must be organized under the law of and have its principal place of business in the US, be registered with the SEC and have elected to be regulated as a BDC under the 1940 Act.

The Wells Fargo Business Development Company Index is a float-adjusted, capitalization-weighted index that was intended to measure the performance of all business development companies that are listed on the New York Stock Exchange or Nasdaq and satisfy specified market capitalisation and other eligibility requirements.

There are six Etracs ETNs linked to the Wells Fargo BDC index.

SEC and ECB agree to share security-based swaps information

The US Securities and Exchange Commission (SEC) and the European Central Bank (ECB) have signed a Memorandum of Understanding (MoU) to ‘consult, cooperate, and exchange information’ in connection with the supervision, enforcement, and oversight of certain security-based swap dealers and major security-based swap participants’ that are registered with the SEC and supervised by the ECB.

The MoU facilitates the SEC's oversight of all SEC-registered security-based swap entities in EU member states participating in the Single Supervisory Mechanism (SSM). The SSM refers to the system of banking supervision in the European Union - it is composed of the ECB and the relevant national competent authorities of participating EU member states.

The MoU will also support the SEC's oversight of the operation of substituted compliance orders that the Commission has issued for security-based swap entities in France and Germany, as well as any future substituted compliance orders for such firms in other EU member states that participate in the SSM.

Under the MoU the SEC and the ECB will be able to consult, coordinate, and share information with each other with respect to these entities, including in connection with cross-border inspections.

HSBC launches portfolio-based advisory for HNW investors

HSBC has launched Wealth Portfolio Plus (WPP), a portfolio-based advisory solution for the Hong Kong-based Jade segment which is targeted at investors with assets of HK$1 million or more.

With WPP, which is powered by BlackRock’s Aladdin Wealth technology, the UK bank is bringing portfolio-based advisory services to clients for the first time outside of a private bank.

The range of investment solutions offered under the WPP service includes unit trusts, bonds, equities, structured products, warrants and cash. Previously, HSBC Jade clients could only select individual products according to their risk profile, but the new service will give them a holistic view of their investment portfolio and allow access to a wider range of products.

‘By analysing all asset classes, assessing risk at a portfolio level and road-testing performance under various market scenarios, WPP provides customers a holistic picture of their holdings,’ said Sami Abouzahr, head of customer wealth, wealth and personal banking, Hong Kong, HSBC. Since WPP provides portfolio-level rather than transactional-level analysis, new investment options can then become available to customers that fit their needs.’

WPP’s offering follows the launch of an online trading platform for cash equities and exchange-traded funds (ETFs) in Asia, which will include listed structured products and structured notes next year, as well as the HSBC Jade Private Market Investments service in Hong Kong SAR, enabling Jade clients (with a total relationship balance of at least HK$7.8m) to access certain products that were exclusively offered to private banking and institutional clients.

To date, WPIS has produced over 130,000 risk assessment reports and has contributed to net revenue growth of nearly HK$30 billion (US$3.86 billion) from the rebalancing of over 70,000 investment portfolios.

HSI rolls out new Shanghai-Shenzhen-Hong Kong high div yield index

Hang Seng Indexes Company has launched the Hang Seng Shanghai-Shenzhen-Hong Kong (Selected Corporations) High Dividend Yield Index.

The new index aims to reflect the overall performance of high-yield companies listed in Hong Kong or mainland China and operating in mainland China, Hong Kong or Macau.

In light of the low interest rate environment and uneven economic recovery, many investors are exploring pivot investment strategies, which has driven growing interest in high-yield products, said Daniel Wong, director & chief index officer at Hang Seng Indexes Company, adding, that the index offers ‘onshore and offshore investors a diversified investment strategy for reaching yield targets by gaining exposure to a wide range of listed companies that have relatively lower price volatility’.

The new index tracks the performance of sizable companies that have demonstrated relatively lower price volatility and a persistent dividend payment record for the latest three fiscal years, and is targeted at investors ‘searching for yield enhancement to build an income-oriented investment portfolio’.

As of 30 July 2021, the simulated dividend yield of the new index was 8.4%. The new index is calculated and disseminated in real-time at two-second intervals.

HKEX to launch A shares index futures contract

Hong Kong Stock and Exchanges (HKEX) is gearing up to launch its first A-share derivatives product in October. The exchange’s futures contract on MSCI China A 50 Connect Index represents a ‘a key step in HKEX’s plans to build offshore Mainland China equities derivatives suite in Hong Kong ’, according to the bourse.

‘This new contract will provide international investors with a new and effective risk management tool to manage their portfolios of Stock Connect eligible A-shares, reflecting the increasing global reliance on Stock Connect to access Mainland China’s burgeoning equity markets,’ stated the exchange.

The offshore sector-balanced China A-share index futures product tracks the performance of 50 key Shanghai and Shenzhen stocks available via Stock Connect, a cross-boundary investment programme that enables investors in China and Hong Kong SAR trade shares listed on the other market via domestic stock exchanges and clearing houses.

The new launch follows the listing of a suite of MSCI Asia and Emerging Market futures and options in 2020 on HKEX, which has rolled out a total of 41 derivatives based on MSCI indices.

The Hong Kong Securities and Futures Commission (SFC), which has approved the launch of the futures contract, said it marks a major milestone in the development of Hong Kong’s capital markets, strengthening its position as a financial risk management and China market access centre of international significance.

‘The ability to trade A shares futures in Hong Kong, and to hedge pricing risks effectively, is expected to facilitate the further growth of long term capital flows into the Mainland financial markets,’ said SFC CEO Ashley Alder (above right).