The US investment bank has sold US$3 billion worth of structured products in its domestic market during Q3 2021.

J.P. Morgan has posted a firmwide net revenue of US$29.6 billion for the third quarter of 2021, up one percent from the prior year quarter.

In corporate & investment banking (CIB), net income was US$5.6 billion, up 29%, with revenue of US$12.4 billion, seven percent higher.

Markets revenue, at US$6.3 billion, was down five percent year-on-year (YoY), with fixed income markets down 20% predominantly driven by lower revenue in commodities, rates and spread products; equity markets revenue was US$2.6 billion, up 30%, driven by strong performance across products.

The quarter also included an adjustment to liquidity assumptions in the bank’s derivatives portfolio.

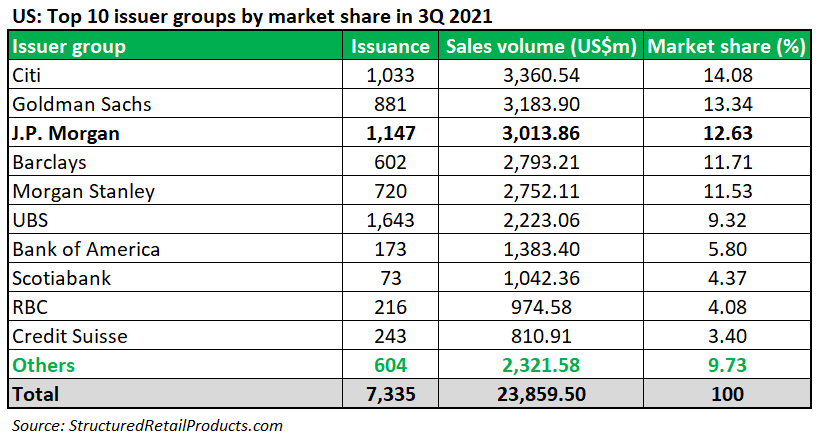

J.P. Morgan had a 12.6% share of the US structured products market in Q3 2021, making it the third most active provider in the quarter, behind Citi (14.1%) and Goldman Sachs (13.3%).

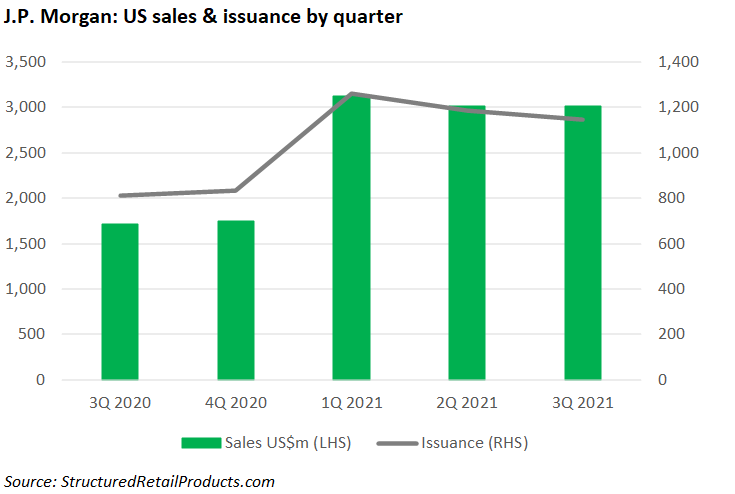

The bank collected US$3 billion from 1,147 products between 1 July and 30 September, up 75% in sales volume YoY (3Q 2020: US$1.7 billion from 812 products).

Equities dominated underlyings – the highest issuance (336) came from products linked to an index basket (US$632m) although structures linked to a single index collected the largest volumes (US$708m from 229 products). The latter included Digital Equity Notes Russell 2000 (48132UF81), which was the best-selling product in the quarter. The 1.25-year registered note, which was available via Goldman Sachs Private Banking and the Simon Markets platform, sold US$75m in August.

Apart from traditional benchmarks such as the S&P 500 (US$244m from 73 products) and the Eurostoxx 50 (US$36m from 22 products), custom indices like the J.P. Morgan Kronos US Equity Index (US$44m from 12 products) and the J.P. Morgan Kronos+ Index (US$15.2m from 16 products) were also frequently used.

Another index that caught the eye was the MerQube US Tech+ Vol Advantage Index, which was seen in 49 products that sold a combined US$111.2m. In October, J.P. Morgan led a US$5m Series A funding round for the index provider with the aim to further enhance its index solutions, as reported by SRP.

There were also 321 products (US$947.5m) linked to a single share, including the likes of Tesla (23 products), Apple (21) and Amazon (19). Some 85 products (US$330m) were tied to ETF’s of which the Ark Innovation ETF, Van Eck Vectors Gold Miners ETF, and SPDR S&P 500 ETF Trust, seen in 20, 18 and 14 products, respectively, were used the most often.

Outside of the US, the bank mainly focused on the issuance of listed certificates in Germany, where it was the number one issuer of leverage products, launching 114,850 new turbos in the quarter (Q3 2020: 123,441).

The local Dax was the preferred index for the German investor (37,363 products) followed by Dax/Xdax (9,746) and DJ Industrial Average (7,664). Gold (4,595), the EUR/USD currency pair (3,494) and Adidas (1,542) were also in demand.

A further 1,356 flow products, mainly bonus- and discount certificates were also issued in Germany.

The bank, led by Jamie Dimon (pictured), reported US$1.6 trillion of liquidity sources, including high-quality liquid assets (HQLA) and unencumbered marketable securities during the quarter.

In asset & wealth management, assets under management (AUM) of US$3 trillion grew 17% driven by higher market levels as well as strong cumulative net inflows.

Click the link to read the full J.P. Morgan third quarter 2021 results, presentation, and supplement.