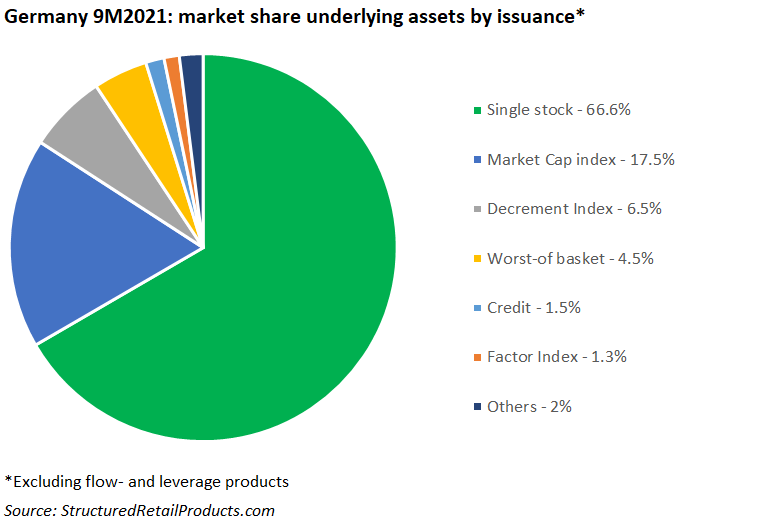

Products linked to single stocks dominated the German market in the first nine months of 2021.

Some 14,505 structured products (excluding flow and leverage) worth an estimated €8.8billion had strike dates in Germany during the first nine months of 2021 – a significant increase from the 11,197 products with combined sales of €6.5 billion that struck in the prior year period, according to SRP data.

Two-thirds of all products issued were linked to single stocks. They were mainly reverse convertibles, often with a knockout feature, and sometimes also including a snowball option.

Shares of domestic companies were in demand with Daimler, seen in 760 products, the most popular, followed by Volkswagen (717), Basf (570) and Bayer (546).

Market cap indices, which were used as single underlying in 2,470 products, came second, with a 17.5% share of the market by issuance. More than 85% of those were linked to the Eurostoxx 50 (2,144 products) while the S&P 500 and Dax were also frequently used.

Next up were decrement indices, with a 6.5% market share from 948 products that were issued predominately via Dekabank (768 products), and, to a lesser extend, Landesbank Baden-Württemberg (119).

The MSCI World Climate Change ESG Select 4.5% Decrement EUR Index was the most used (494 products) but there was also healthy demand for structures tied to the MSCI Germany Climate Change ESG Select 4% Index (185), MSCI EMU SRI Select 30 Decrement 3.5% Index (117), and MSCI EMU Climate Change ESG Select 4% Decrement Index (96).

The most used non-MSCI decrement index was the Euronext Eurozone 100 ESG Decrement 5% Index (five products).

Worst-of baskets, which were the preferred underlying asset in many markets, including Italy, South Korea and the US, held a 4.5% market share from 656 products.

Some 223 products were linked to the credit risk of 58 individual companies, of which Volkswagen (29 products) was the most often used.

Products tied to factor indices such as the Eurostoxx Select Dividend 30 and Stoxx Global Select Dividend 100, captured 1.3% of the market while the ‘others’ category included products linked to, among other, sector indices (72), ETFs (31), strategy indices (20), and commodities (11).

Check out the below chart for the preferred underlying assets of the German investor.

Main image credit: Christian Lue/Unsplash