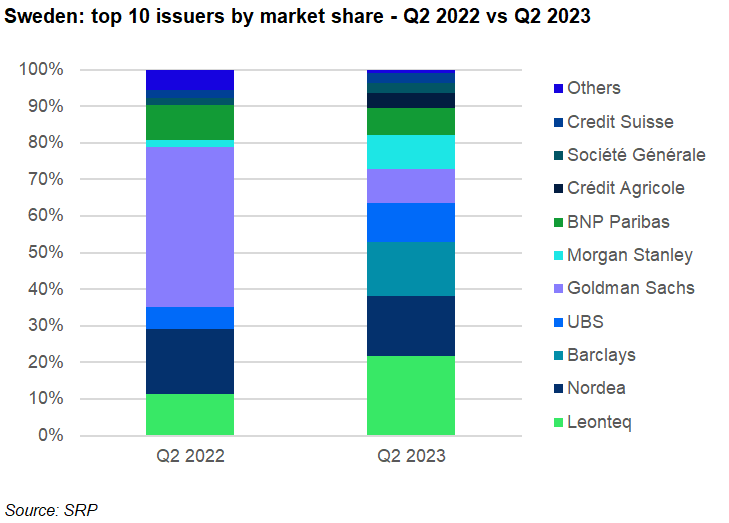

Leonteq was the surprise frontrunner in a quarter which saw Goldman lose significant market share.

Some 66 structured products targeted at Swedish retail investors collected an estimated SEK985m (US$93m) during the second quarter of 2023 – down almost 50% by sales volume compared to the prior year period (Q2 2022: SEK1.8 billion from 119 products).

Average volumes, at SEK14.9m per product, remained stable compared to Q2 2022 when products sold on average SEK15.3m.

Despite the slowdown in sales, the number of active issuers increased to 11 (Q2 2022: 10). They were a mixture of Nordic financial institutions and European and US investment banks.

Leonteq was the number one issuer 21.6% share of the market – an increase of 10.3 percentage points year-on-year (YoY).

The Swiss structured product provider collected SEK213m from six publicly offered products, which were distributed via Garantum and SIP Nordic Fondkommission (three each). Leonteq’s offering included Warrant Europa HY OS Lock in pay out Flex Tak nr 4807, a five-year structured warrant on the Solactive European High Yield Bond Funds 4% RC Index, which tracks an equally weighted basket comprising four actively managed funds with a focus on high-risk bonds: Nordea European High Yield Bond Fund, Robeco European High Yield Bonds, Aberdeen Select Euro High Yield Bond Fund, and HSBC Euro High Yield Bond. The product was the best-selling Swedish product of the quarter with sales of SEK81.5m.

Leonteq is a relative newcomer in the Swedish retail segment, issuing its first public offers in Q2 2022, although it has been selling private placements in the country since 2014.

Nordea, in second, registered a slight drop in market share: from 17.7% in Q2 2022 to 16.4% this quarter. The bank gathered an estimated SEK160m from 10 products, with most of its sales coming from four credit-linked notes.

Barclays claimed 14.8% of the Swedish market in Q2, on the back of eight equity-linked notes distributed via Garantum that sold approximately SEK145m. The UK bank was not active in the retail segment during the prior year quarter.

UBS increased its market share to 10.6%, up by 4.5 percentage points YoY (SEK105m from eight products) while Goldman Sachs, which was the main provider in Q2 last year when it claimed 43.8%, saw its market share drop to a mere 9.5%. Goldman accumulated sales of SEK93m (from 10 products) in the quarter, compared to SEK800m (from 39 products) in Q2 2022.

Morgan Stanley, on the other hand, which sold seven products worth an estimated SEK91m, saw its market share grow to 9.3% (Q2 2022: 1.9%)

BNP Paribas (7.3% market share), Crédit Agricole (4.1%), Société Générale, Credit Suisse (2.7% each), and Natixis (1%) were also active during the quarter, while Deutsche Bank and Danske Bank, which were both among the top 10 manufacturers in Q2 2022, refrained from issuing products this time around.