The consolidation of Credit Suisse (CS) earnings has led to expanded revenues across UBS’ divisions despite the underperformance of the global markets division.

UBS Group AG has reported net loss attributed to shareholders of US$785m in Q3 2023, against net profit of US$1.7 billion recorded in the prior-year quarter, according to the latest earnings report from UBS, which is led by CEO Sergio Ermotti (pictured).

Total revenues increased by US$1.9 billion to US$5.3 billion in Q3 23 year-on-year (YoY), mainly driven by the consolidation of US$1.9 billion of CS revenues. Meanwhile, operating expenses almost doubled to US$11.6 billion

The investment bank reported a loss before tax of US$230m in Q3 23, compared with profit before tax of US$ 447m year-on-year, mainly due to higher operating expenses associated with the CS acquisition.

In Q3 23, total revenues increased six percent to US$2.2 billion mainly due to the consolidation of CS. Operating expenses increased nearly 50% to US$ 2.4 billion YoY.

By segment, global banking revenues increased 112% to US$698m, largely attributable to the consolidation of CS revenues.

Global markets revenues dropped 15% to US$1.5 billion, primarily driven by lower derivatives & solutions revenues YoY.

Derivatives & solutions revenues declined 30% to US$605m, mostly driven by foreign exchange, rates and equity derivatives, due to lower levels of both volatility and client activity.

Execution services revenues increased on percent to US$379m. Financing revenues increased two percent to US$468m, supported by increased client balances.

By asset class, global markets equities revenues fell three percent to US$1.1 billion, mainly driven by lower equity derivatives revenues. Foreign exchange, rates and credit revenues were down 37% to US$373m primarily driven by lower foreign exchange and rates revenues.

At the same time, revenues climbed across the other three divisions primarily due to the consolidation of CS revenues. In Q3 23, global wealth management revenues increased 21% to US$5.8 billion and personal & corporate banking revenues increased 156% to CHF2.6 billion. Asset management posted revenues of US$755m, up 46% YoY.

Structured products

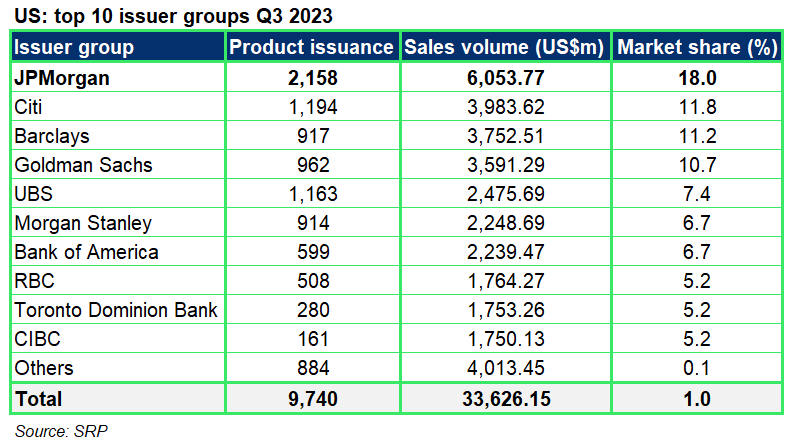

In the US market, UBS retained its position as the fifth largest issuer in Q3 23 on the back of 1,163 SEC-registered structured notes sold at US$2.5 billion, which formed 7.4% of the market – the Swiss bank trails J.P. Morgan, Citi, Barclays and Goldman Sachs, which accounted for 18.0%, 11.8%, 11.2% and 10.7% of the issuance volume, respectively, according to SRP data.

At UBS, the sales represented a 13.6% growth quarter-on-quarter, which led to a combined volume of US$6.0 billion for the first nine months, up 5.3% compared with the prior-year period.

SRP also registered a 3(a)(2) bank note issued by UBS in September, which is linked to the shares performance of Paypal. With a three-year term, the structured note was sold US$1.2m by a non-public distributor.

Outside the US, UBS in Q3 23 issued 18,816 products in Switzerland, 8,392 in Germany, 1,020 in Hong Kong SAR, 795 in Taiwan, nine in Sweden, three in Italy and two in South Africa.

The majority of the Swiss products are investment certificates while the remaining are structured notes. Listed structured products predominate the German and Hong Kong markets for the UBS issuance, SRP data shows.