A survey conducted by two Hong Kong SAR financial watchdogs has found that structured products accounted for nearly half of the OTC investment transactions in 2020, led by equity underlyings.

The survey results were released today (7 October) by the Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA).

They are based on responses from 308 licensed corporations (LCs) and 64 registered institutions (RIs), which sold non-exchange traded investment products with an aggregate transaction amount of HK$5.7 trillion (US$732 billion) to over 700,000 investors during 2020.

The sell-side included retail, private and corporate banks, investment advisors, securities brokers and international financial conglomerates, while the buy-side comprised non-professional investors (PIs), individual PIs and certain corporate PIs for whom intermediaries cannot be exempted from a waiver of the suitability obligation.

This SFC-HKMA’s first joint survey provides an overview of what is described as an ‘active investment products market,' according to the regulators.

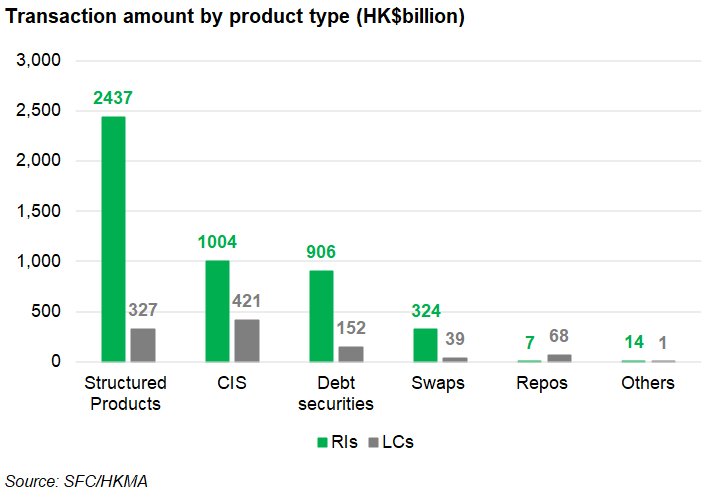

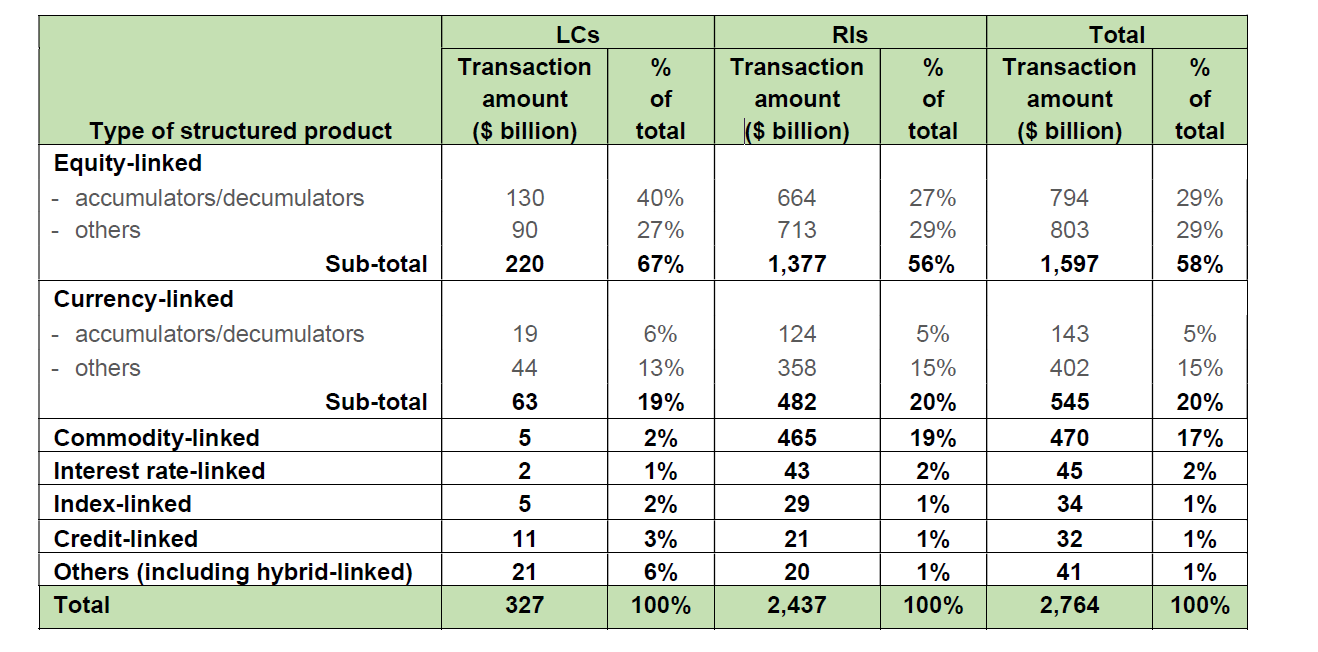

By product type, structured products were the most popular making up 48%, or HK$2.77 trillion, of the total transactions followed by collective investment schemes (CIS) at 25%, debt securities at 19%, swaps at 6% as well as repurchase agreements (repos) at 2% in 2020, the survey shows.

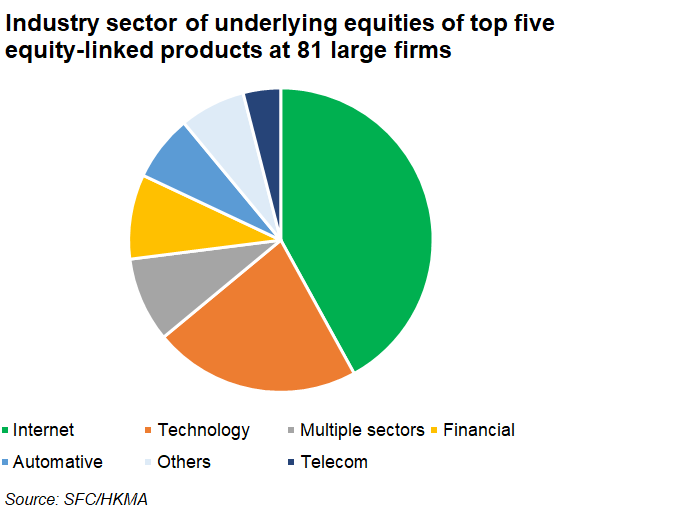

Specifically, 57.8% of the structured products, or HK$1.6 trillion, came from equity-linked investments, including equity-linked accumulators and decumulators. The underlying assets concentrated on internet and technology stocks, which were ‘in high demand’.

‘Globally, economic activities during the reporting period were greatly affected by the Covid-19 pandemic, with a few remarkable exceptions such as businesses in the internet and technology sectors which facilitated non-face-to-face interactions and online activities,’ stated the survey report. ‘Firms generally responded that their clients sought greater exposure to these two sectors during the reporting period.’

According to the survey, a number of leading distributors of equity-linked products recorded an increase in client interest and activity in equity derivatives, as equity prices rose due to monetary easing and stimulus packages introduced by global central banks.

‘To capture these opportunities, some clients preferred to invest in equity-linked products which offered higher yields (arising from the premium of writing options) than investing directly in stocks,’ stated the report.

Foreign exchange rates were the second most favoured underlying asset, leading to a transaction amount of HK$545 billion, or 20% of all structured products sold.

‘Some top sellers noted an increasing trend of clients investing in dual currency notes under the current low interest rate environment for yield enhancement or short-term liquidity management purposes,’ it said.

The most common currencies were the British pound, Japanese yen and Euro, with the US dollar used mainly as the base or quote currency, according to the individual top five offerings at 81 large firms.

Commodity-linked products contributed to HK$470 billion, representing 17% of all structured products sold. Out of the top five offerings reported by the large firms, 98% tracked the performance of gold.

‘Some top sellers commented that gold was generally considered a safer asset in a volatile market and some clients invested in gold-related products for portfolio diversification purposes.’

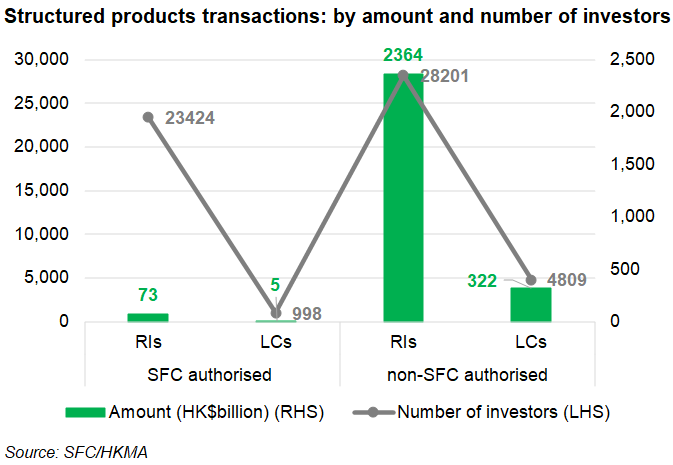

Non-authorised products, which are not subject to the SFC’s regulation, accounted for 84% of the entire transaction amount – 56% of them were structured products while 22% were debt securities. The remaining 16% were authorised products, of which over 90% were CIS.

Registered institutions, which are mainly banks, were the leading distributors in the structured product market by trading HK$2.36 trillion non-authorised products for 28,201 clients.

The OTC market is dominated by large players - the top 20 firms accounted for HK$4.83 trillion, or 85% of the aggregate transaction amount while the remaining 15% was shared among 352 firms.

The product of choice by the top 20 firms were structured products (HK$2,499 billion), which accounted for over half of the top 20 firms’ aggregate transaction amount.

For the other 325 firms, CIS and structured products brought HK$307 billion and HK$265 billion, representing 35% and 30% of their aggregate transaction amount, respectively.

Click here to view the survey.