The UK bank’s profit has been dented as misconduct provision relating to structured notes blunder increases.

The UK bank has reported a pre-tax profit of £3.7 billion (US$4.5 billion) in H1 22, down 24% year-on-year (YoY) after absorbing charges net of tax of £600m relating to the over-issuance of structured notes.

The charges comprise £400m post tax expected net impact of the rescission offer losses, driven by £1.3 billion of costs as a result of market movements and interest, which was substantially offset by £800m of income from the hedging arrangements related to the over-issuance.

In addition to an internal review, I have commissioned a counsel-led external review of the over-issuance matter - C.S. Venkatakrishnan

The remaining £200m was the cost relating to an estimated monetary penalty from the US Securities and Exchange Commission (SEC).

Attributable profit fell by 34% to £2.5 billion although income rose 17% to £13.2 billion at Barclays, according to the bank’s 2022 interim report.

The group’s costs increased by 24% to £9.1 billion, including litigation and conduct charges of £1.9 billion regarding the over-issuance in the US market.

Barclays booked a balance sheet provision of £1.76 billion in relation to the over-issuance - £1.59 billion out of it is due to the structured notes and exchange-traded notes, which were issued in excess of the amounts Barclays Bank had registered with the SEC, known as the ‘shelf’, while the remaining £165m is liabilities that could be incurred arising out of ongoing discussions on a potential SEC resolution.

The £1.37 billion increase in the provision of predominantly reflects a reduction in the market value of the structured notes and additional accrued interest that would be payable to investors on rescission.

‘The US equity markets have been volatile during the first half of 2022, with significant reductions in the value of US equity indices such as the S&P 500 from the year end 2021 levels, which has led to a reduction in the market value of the structured notes, and increased the size of the provision,’ stated the bank.

The structured notes also accrue interest on a monthly basis (at current prevailing interest rates and participation rate assumptions this is around £34m per month) until the rescission price has been paid. The provision also assumes that not all structured note investors whose securities are out of the money will accept the offer. If all investors were to accept the offer, the provision would increase by approximately £60m.

‘As such, certain offers and sales were not made in compliance with the US Securities Act of 1933, as amended (Securities Act), giving rise to rights of rescission for certain purchasers of the securities,’ stated the bank in the report. ‘As a result, Barclays Bank Plc has elected to make a rescission offer to eligible purchasers of the relevant affected securities.’

The UK bank said it will buy back as much as US$17.6 billion of securities, between 1 August and 12 September. Barclays separately said it plans to resume the issuance and sales of some iPath exchange-traded notes, which had been suspended in March, after filling an automatic shelf registration on Form F 3 in the second quarter, under which it can issue unlimited amount of securities.

The rescission offer is open from 1 August to 12 September with communication of initial results to be announced on 14 September, as SRP reported.

‘We are making good progress to resolve this matter,’ C.S. Venkatakrishnan (pictured), Barclays Group chief executive, said during the H1 2022 results management speech on 28 July.

‘In addition to an internal review, I have commissioned a counsel-led external review of the over-issuance matter. This will report to the Board shortly. We will consider all its findings carefully and take appropriate actions in response,’ Venkatakrishnan added.

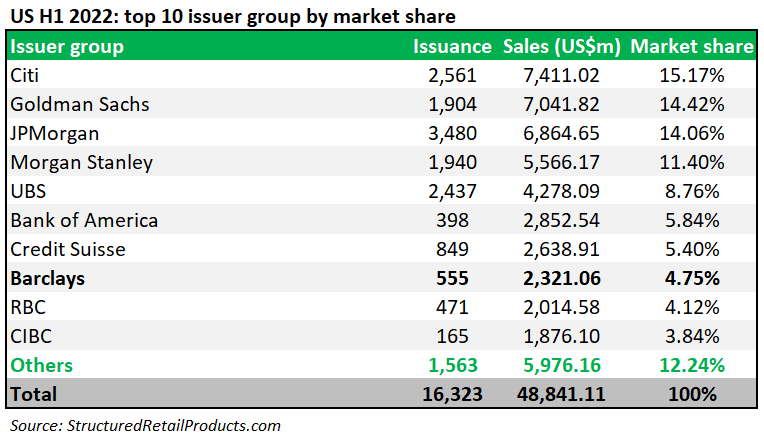

In the US market, Barclays has slipped from the top to the eighth place in the league table by sale volume in H1 22, owning 4.75% of the market share, SRP data shows. Its volume plunged to US$2.3 billion from US$7.2 billion compared with the prior-year period as the issuance dropped to 555 from 1,382.

Click here to view Barclays Plc’s H1 2022 earnings report.