The French banking group benefited from good momentum in its equity derivatives business during Q4 2023.

Société Générale (SG) posted revenues of €6 billion (US$6.5 billion) in the fourth quarter of 2023 – down 10% compared to the prior year period. Revenues for full year 2023, at €25.1 billion, decreased by 7.6% year-on-year (YoY).

The revenue contribution remained high in the fourth quarter on the back of a supportive market conditions for equities, with notably strong client demand for derivatives products - Claire Dumas, CFO

Global markets & investor services posted revenues of €2.2 billion for the quarter and €9.6 billion for the year, down 11.1% and 4.6%, respectively, compared to prior year reporting periods.

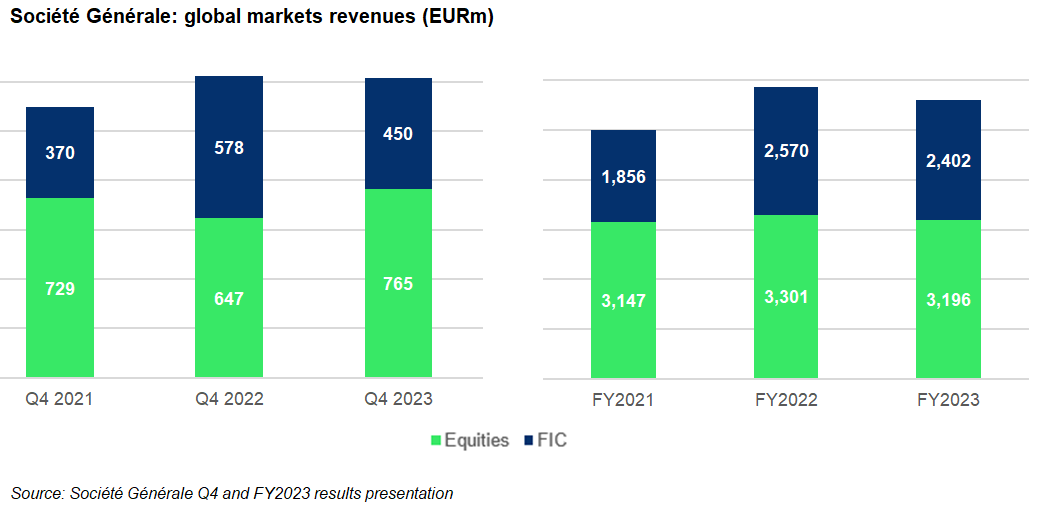

The global markets franchise turned in a mostly stable performance in Q4 2023 versus Q4 2022 with good commercial momentum in the equity derivatives business and robust activity for fixed income products. Revenues for the quarter reached €1.2 billion, slightly down (-0.8%) from Q4 2022, which was a record fourth quarter. In 2023, revenues reached €5.6 billion – a 4.6% decrease YoY.

Equity activities performed very well in Q4 2023, up 18% compared to last year, according to Claire Dumas (pictured), group chief financial officer.

‘The revenue contribution remained high in the fourth quarter on the back of a supportive market conditions for equities, with notably strong client demand for derivatives products,’ said Dumas, speaking during the presentation of the results on 8 February.

Fixed income and currencies recorded revenues of €450m, notably owing to solid commercial momentum in the investment solutions business. They were nonetheless down 22.1% versus Q4 2022, which ranked among the best performing quarters for this business. Over 2023, revenues decreased by 6.5% versus 2022 to €2.4 billion.

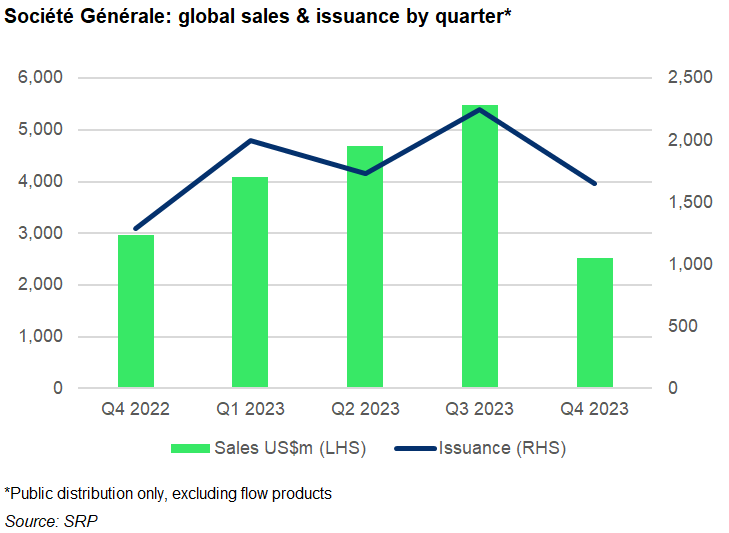

According to SRP data, the bank was the manufacturing company behind 1,654 primary market structured products worth an estimated US$2.5 billion in Q4 2024 – down 15% by sales volume YoY.

In the quarter, SG’s products were available across 15 different jurisdictions of which Switzerland saw the highest issuance (1,188 products), followed by Taiwan (190), France (89), Italy (75), and Germany (66).

In Switzerland, more than 90% of the bank’s Q4 offering was linked to equities, with some 805 products linked to a basket of shares and a further 304 tied to a single stock while in Taiwan some 70% of all issued products was linked to a basket of equities.

In its domestic market of France, the offering was more diverse, with the 29 products linked to a single equity index responsible for the highest sales volumes (US$330m) followed by those linked to a mutual fund (US$220m). The former included seven products tied to the iStoxx Europe 600 Basic Resources GR Decrement 50 Index; six linked to the Eurostoxx Banks index; and single structures linked to, among others, the Solactive Transatlantic Biodiversity Screened 150 CW Decrement 50 Index and Euronext France Climate Screened Decrement 50 Points EUR Index.

Fund-linked products were mostly linked to Global Horizon, a mutual fund managed by SG29 Haussmann that aims to outperform its benchmark the Solactive GBS CW DM Int Large & Mid Cap EUR Index by gaining exposure to a portfolio composed of 250 companies from Europe, the US and Japan – selected on ESG and financial criteria and coupled with risk management mechanisms.

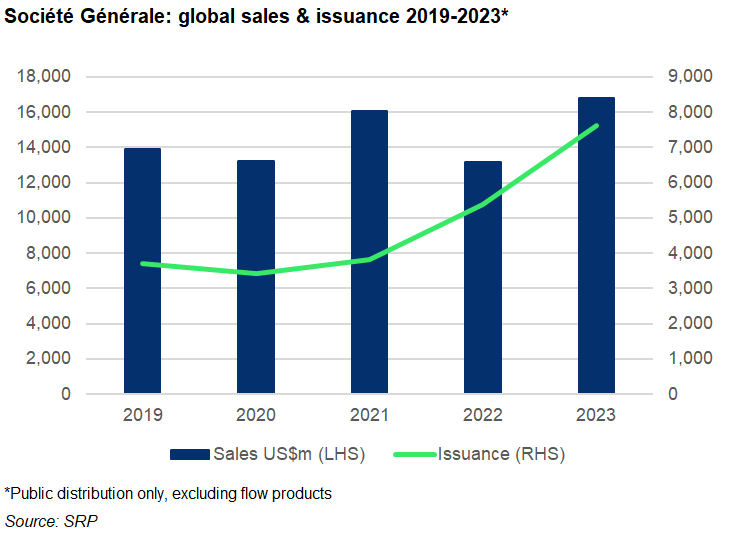

In full year 2023, SG issued 7,631 publicly distributed products that sold an estimated US$16.8 billion across 18 different markets (FY2022: US$13.2 billion from 5,389 products).

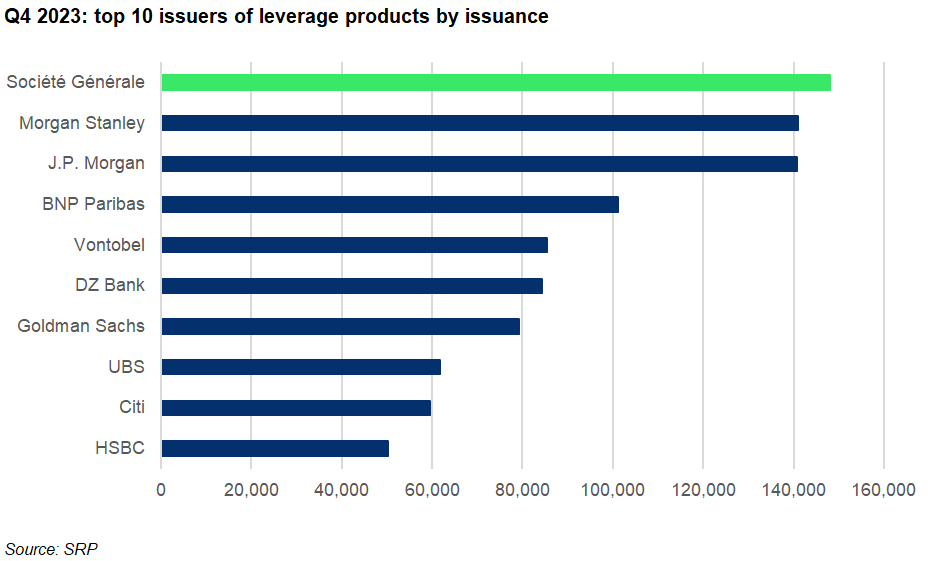

On the secondary market, SG was the number one provider of listed products (by issuance) in Q4 2023, ahead of Morgan Stanley, J.P. Morgan, and BNP Paribas, according to SRP data. The bank issued some 147,974 turbo certificates in the quarter (Q4 2022: 147,046 turbos), the vast majority of which were listed in Germany (146,769) while other countries where its turbos were traded include France, Belgium and the Netherlands.

In Hong Kong SAR it issued 937 leverage products, including 804 callable bull bear contracts and 133 warrants.

Some 578,155 turbos were issued by SG during the whole of 2023 compared to 590,916 the previous year.

The group's 2023 vanilla funding programme was fully completed, with €24.8 billion of vanilla notes (including €7.1 billion of pre-funding raised in 2022).

In 2023, the group issued approximately €27.8 billion worth of structured notes.

SG’s 2024 vanilla funding programme is well advanced with around €16 billion issued as of 25 January 2024, including €6.4 billion of pre-funding raised in 2023. The 2024 programme includes €25 billion worth of structured notes of which around €3.2 billion has been issued already.

End-December 2023, the group’s consolidated balance sheet included €160.5 billion worth of debt securities issued (31 Dec 2022: €133.2 billion) and an outstanding for hedging derivatives of €18.7 billion (€46.2 billion).

The group’s common equity tier 1 ratio stood at 13.1% at the end of December, or around 340 basis points above the regulatory requirement of 9.77%.

Click the link to read the Société Générale fourth quarter and full year 2023 results, presentation, and financial statements.