Risk Management; Investment Strategy; Index Creation; Trading and Hedging Strategies; Pricing Policies; Product Innovation; Fair Value Demonstration; Appropriate Tax Treatment; Competitor Benchmarking; Back-Testing/Mean Reversion; Sales; Calculating the Greeks; Management Reporting.

Track & Collect Index Licensing Fees; Index Creation; Benchmarking & Competitor Analysis; Management Reporting; Appropriate Tax Treatment; Market Share Analysis; Track New Indices.

Anticipate Volatility; Analyse Skew; Analyse Investment Banks; Exposure; Calculating the Greeks; Build Trading Models.

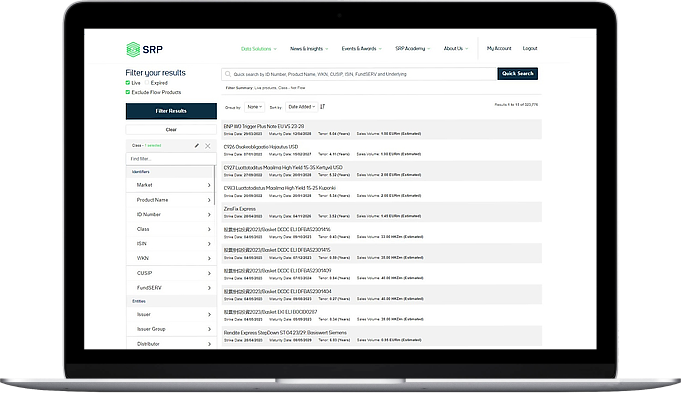

Analyse Term Sheets Product-by-Product; Investor Risk Exposure; Market Trends & Activity Overview; Compliance & Reporting; Appropriate Tax Treatment; Reconcile Products Efficiently & Correctly; Automate Alerts for Market Manipulation.