The new label is aimed at creating a standard for sustainable products as demand sees huge increase

Febelfin, the Belgian Federation of the Financial Sector, has updated its quality standard for sustainable and socially responsible products. The new quality standard covers mutual funds, life-insurance products, structured notes and savings products, and is intended to qualitatively and quantitatively increase the level of socially responsible and sustainable financial products, and to mainstream its principles towards traditional financial products. Products that meet those conditions receive a label.

The Belgian financial sector has been working on the quality standard since 2001, according to Tom Van Den Berghe (pictured), corporate social responsibility manager, Febelfin. “At the time we made a recommendation to our members on ethical investments, as they were called back then,” he said.

The content of the latest recommendation has been regularly revised over the years because new types of products were introduced to the market while at the same time expectations of investors also changed.

The current quality standard is much more extensive than before and also includes a prominent label which aims to instil trust and reassure potential investors that the financial product is managed with sustainability in mind and is not exposed to very unsustainable practices, without requiring of investors to do a detailed analysis themselves, according to Van Den Berghe.

“In the past the quality standard was just a recommendation, a kind of ‘best practice’ but now there is also a label attached to it so that is clearly different,” said Van Den Berghe. “The main reason for the latest update is the huge increase in interest in sustainable investment products, both from investors but also from providers. We therefore felt it necessary to have some uniformity and minimum quality requirements to ensure that a certain level can be guaranteed to the end-investor.”

Although not specifically developed for structured products that are marketed as ‘green,' Van Den Berghe admits that with this type of product it is somewhat more difficult to assess whether they are sustainable compared to a plain vanilla equity fund. “With structured products you have indexes, you have derivatives, and different payoff constructions are possible, which makes it less obvious to judge whether they are sustainable,” said Van Den Berghe.

Most distributors of financial products are positive about the quality standard, according to Van Den Berghe. “There are providers who set the bar even higher for themselves,” he said. “They go much further and are much stricter for their own offering. We explicitly encourage this. However, there are others who will need to step up to meet the quality standard.”

The trade body has developed this measure as a minimum standard, according to Van Den Berghe. “We expect everyone to exceed the level we have set, preferably as far as possible. How far? We leave that to each player themselves,” he said. “We want it to be a broad movement and we don’t want to limit ourselves to a very small niche of products. We want to increase the offering of sustainable products without sacrificing quality. Because to tackle the societal challenges we face, we need the engagement from all providers and all types of investors, not just the most progressive ones.”

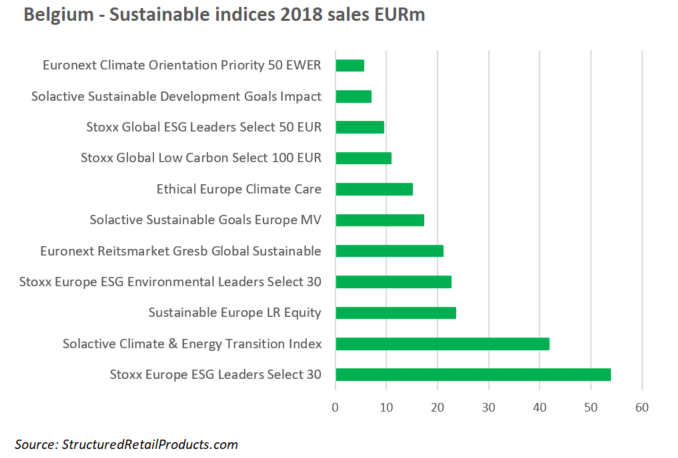

In 2018, there were 32 structured products (worth a combined €228 million) distributed in Belgium that were linked to a sustainable index. Of these, the Stoxx Europe ESG Leaders Select 30 was the most popular. The index captures the performance of stocks with low volatility and high dividends from the Stoxx Global ESG Leaders Index and was seen in nine products (€53 million), which were distributed via Belfius, BPost Bank and Deutsche Bank, respectively.

Other sustainable indices in demand last year were the Solactive Climate & Energy Transition Index (€42 million from five products), Sustainable Europe LR Equity (€24 million from two products), and the Stoxx Europe ESG Environmental Leaders Select 30 (€23 million from three products).

Click the link to read the full Febelfin quality standard for sustainable investment.