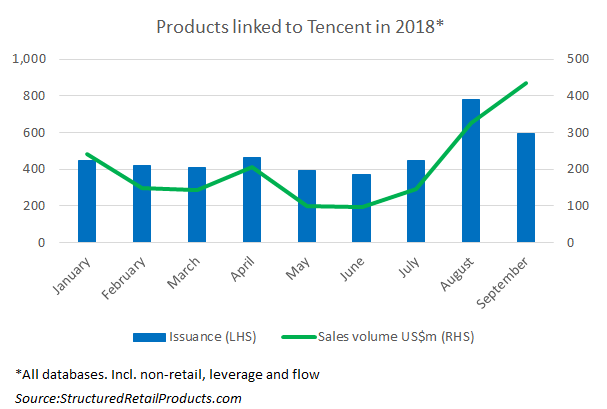

The monthly sales volume of structured products linked to Tencent Holdings reached a new high in September despite the accelerating downward trend in the Chinese internet company’s share prices, with sales figures for around 600 products issued last month estimated at roughly US$434 million, accounting for 1.7% of global market share, according to SRP data.

The increase in sales of products tracking Tencent’s share prices has been picking up pace in recent months, moving in the opposite direction to the company’s stock prices. The volume first went up in April this year to around US$200 million, while the share prices of the tech giant started to dive after reaching its peak earlier in the year. Despite the sales volume of products linked to Tencent dropping below the US$100 million mark and remaining subdued in that level between May and June, the figure has been back on an upward trend since July.

Hong Kong is the biggest market for structured products tracking the share prices of Tencent - mostly in the form of warrants and callable bull or bear contracts (CBBCs).

Market insiders in Hong Kong say investors might be bottom fishing as stock prices of Tencent are finally going down after enjoying an uninterrupted rally since 2004 when the company went public. The Chinese tech giant’s share prices rose almost 80 times since then, but nosedived this year.

“As the stock price drops from its all-time high, bullish investors surface for bargain hunting,” said Long Lee, head of financial products for Asia at Vontobel.

“Investors were chasing the HK$700 level [per Tencent share] in 2017 to early 2018 and they hoped the stock prices to go down, so that they can ‘buy cheaper,’” said an equity derivatives sales director at a global investment bank. “When share prices started going down in March from their historic highs, investors, especially those who were longing for Tencent, started doubling down.”

Both added that some investors may be entering the market to hedge their risks. “But to a lesser extent, investors that are less bullish on the stock may also enter into bearish products to reduce exposure to the market movement, or simply to speculate on the next piece of negative news to hit the market,” said Lee.

The massive sell-off of Tencent’s shares, however, has taken a toll on Hong Kong investors, according to another senior structured sales manager for the Asia Pacific at a global investment bank. “There may be a bullish sentiment that, once the trade war is out of the way, things can recover quite quickly and people can make money, but with the around 40% drop in Tencent [from the peak of this year], people lost money," said the banker. "When people lose money, they are more reluctant to roll over and to enter into new products."

Increased sales of warrants linked to Tencent in recent months might be a result of investor confidence winding down in the market, according to Lee. “Investors in general are less convinced about the direction of the market, so, very frequently, we see investors turnover their positions intra-day, instead of holding onto them for much longer as they did in the beginning of the year,” said Lee.