French bank sells more than 100 structured products in 3Q2018 including products linked to the FTSE Custom 150 in the UK and the first ever zloty denominated structure in Belgium

Natixis has reported a ‘strong momentum’ in equity derivatives during the third quarter of 2018. Equity derivatives performed particularly well in France, balancing challenging market conditions in Asia, according to the bank's quarterly results.

Underlying net revenues from corporate and investment banking were up year-on-year, both in the third quarter and the first nine months of 2018. In global markets, revenues were up 1% year on year in the third quarter 2018 while revenues in fixed income, commodities and treasury (FICT) were flat in the third quarter, with good activity levels across credit and FX and resilient rates, amidst unfavourable market conditions.

Natixis sold 117 structured products worth an estimated €950m across nine global markets in the third quarter of 2018, up from 51 products with a combined sales volume of €1.1 billion during the same quarter in 2017, according to SRP data.

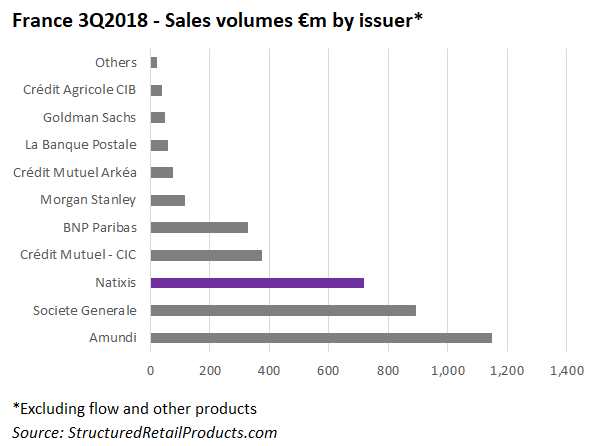

In France, where Natixis had a 19% share of the market in 3Q2018 – third behind Amundi and Societe Generale – the bank was the issuing company behind 23 products (€710m) which were distributed via, among other, Aviva, Equitim, Groupama, Hedios Vie and i-Kapital – compared to €356m, also from 23 products in the same period of 2017.

In the UK, Natixis was the manufacturer behind eight structured products distributed via Mariana (four), Meteor (three), and Reyker (one). Six of the products marketed in the UK were tied to the local FTSE 100 with the remaining two product, both from Mariana, linked to the FTSE Custom 150 Equally Weighted Discounted Return Index. Natixis was also active in Belgium, where it collaborated with Crelan (€12m from two products) and Deutsche Bank (€2.7m from one product). The latter was the first structured note denominated in Polish zloty on the SRP Belgium database.

Outside of Europe, the bank was the bond provider for seven products – from Daiwa Securities (four) and Mitsubishi UFJ Morgan Stanley Securities (three), respectively – worth an estimated JPY17.33 billion (€134m) in Japan while in Taiwan four products were marketed via Taishin Bank and Mega International Commercial Bank.

Another 68 securities with sales of approximately US$104m were added to the SRP International database. These products included six offerings linked to the bank’s own NXS Risk Parity Fund Allocator ER Index which offers exposure to a basket of global multi-asset funds. The index follows a dynamic rule-based strategy with an embedded risk parity mechanism, which aims to regularly allocate the same volatility budget between the funds based on their realised volatility.

Natixis’ third quarter 2018 underlying net revenues from asset & wealth management, at €818m, were up 7% year-on-year and up 14% y-o-y at constant exchange rate in the first nine months of 2018. Asset management underlying revenues increased by 10% in North America (€1.2 billion) and 22% in Europe (€747m) over 9M2018 while wealth management revenues were up 11% y-o-y in the same period.

Asset management assets under management (AUM) reached €861billion as at September 30, 2018 of which €420 billion in Europe and €425 billion in North America. Over the quarter, AUM progressed through net inflows, a positive market effect of €6 billion, a positive FX impact of €2billion and a positive scope effect of €2 billion.

‘Natixis posted solid results in the first nine months of 2018 with solid growth and profitability improving across all business lines, illustrating the relevance of our strategic choices,’ said François Riahi (pictured), chief executive officer, commenting on the results.

Click the link to view the full Natixis 3Q18 and 9M18 results and presentation.