British bank doubles issuance of core structured products in 9M2018 with investment distribution revenues in wealth management up 8% year-on-year.

HSBC has reported the profit before tax for the first nine months of 2018, at US$16.6 billion, was 12% higher than for 9M2017, reflecting revenue growth in all of its global businesses, partly offset by higher operating expenses.

Revenue for 9M2018 of US$41.1 billion was 5% higher year-on-year, notably driven by a rise in deposit revenue across all global businesses, primarily in Asia, according to the bank.

In wealth management, higher revenue in investment distribution – which includes investments such as structured products and securities trading, mutual funds (HSBC manufactured and third party), and third-party life, pension and investment insurance products – reflecting increased investor confidence, more than offset lower life insurance manufacturing revenue, which included a net adverse movement in market impacts, in the first nine months of the year.

However, although wealth management revenue was broadly unchanged in the third quarter of 2018, investment distribution was down US$78m, mainly due to lower sales in Hong Kong driven by weaker investment sentiment.

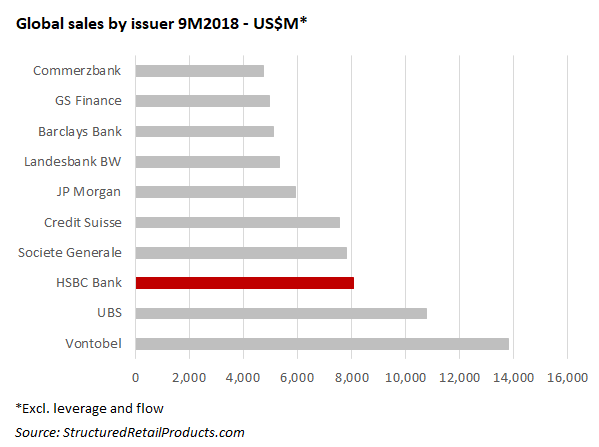

HSBC issued more than 1,500 structured products globally (excluding leverage and flow) worth an estimated US$8 billion in the first nine months of 2018, significantly up – both in issuance and sales – from the 750 products with a combined volume of US$4.5 billion the bank launched during the same period in 2017, according to SRP data.

In the US, HSBC sold approximately US$3.7 billion from 800 structured products between January 1 and September 30, 2018 (9M2017: US$2.7 billion from 580 products) – predominately wrapped as notes and certificates of deposit (CDs). One hundred and twenty CDs were linked to the bank’s own Vantage 5 ER Index which is designed to balance a strategic combination of US and Emerging Market equities, bonds, real assets, an inflation ETF, and cash to deliver overall market growth potential in a low volatility index.

In Asia Pacific, the bank was active in China, Hong Kong and Japan in 9M2018. In China, the bank launched more than 300 products in the period, including 65 products linked to the China AMC CSI 300 Index ETF while in Hong Kong, HSBC sold 233 securities, the majority of which were linked to a basket of shares. In Japan, meanwhile, HSBC acted as the bond provider for 43 products distributed via, among other, 82 Securities, Daiwa, Hirota, SBI and Yutaka Securities.

In Europe, HSBC issued more than 26,000 listed certificates, which were targeted at investors in Germany and Switzerland, while in the UK, the bank distributed 36 investment plans via Walker Crips (28) and Meteor (eight), respectively.

‘These are encouraging results that demonstrate the revenue potential of HSBC,’ said John Flint (pictured), group chief executive, commenting on the results. ‘We are doing what we said we would – delivering growth from areas of strength, and investing in the business while keeping a strong grip on costs. We remain committed to growing profits, generating value for shareholders and improving the service we offer our customers around the world.’

Click the link to view the full HSBC third quarter 2018 results, presentation, and data pack.