First ever ZFA investor survey suggests Austrian investors are embracing structured products as an alternative means to meet their investment goals

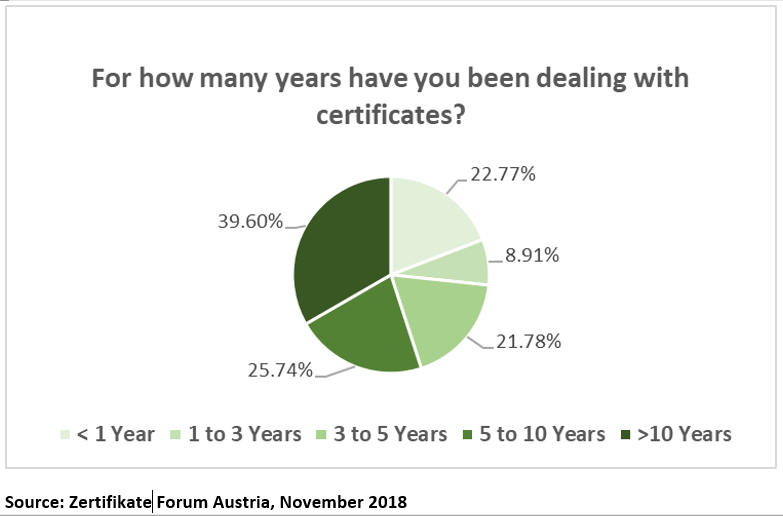

Most Austrian investors (65%) have used structured certificates for over five years and about 40% have invested in certificates for the past 10 years, according to the first online poll published by the Zertifikate Forum Austria – the country’s trade body for structured products.

However, the main trend identified by the survey is the growing number of Austrian retail investors using structured products to meet their investment goals.

"[This] is shown by the 22% of respondents who are dealing with certificates for less than a year,” said Heike Arbter, chief executive of Zertifikate Forum Austria (ZFA) and president of the European Structured Products Association (Eusipa).

Arbter, who also heads the structured products business at Raiffeisen Centrobank, said that it is obvious that “market conditions like low interest rates and sideways trending stock markets are motivating the search for alternatives that offer attractive returns over the medium to long term with limited risk.”

The Austrian trade body Zertifikate Forum Austria plans to run a monthly online poll for retail certificates investors as it seeks to find out more about the level of knowledge of investors in structured products in Austria.

The new monthly retail investor ‘trend of the month’ poll launched in October gives very valuable insight into the mindset of (potential) clients, said Arbter, adding that the current survey question relates to the reasons for buying certificates.

The market for structured products in Austria increased by 5,5% in 2018 – at a time when almost all major equity markets have declined significantly, which suggests that investors understand that structured certificates “can provide attractive yield opportunities under difficult market circumstances”, according to Arbter.

“Certificates with capital protection and partial protection have been the main drivers of this year’s growth and [it is expected they will] continue on this growth path in 2019,” said Arbter. “There is still a great need for attractive investment opportunities, especially in Austria, as shown by studies such as the Allianz Global Wealth Report. Therefore, one of our main tasks at the Certificates Forum will be education and providing information through all possible channels – online and offline

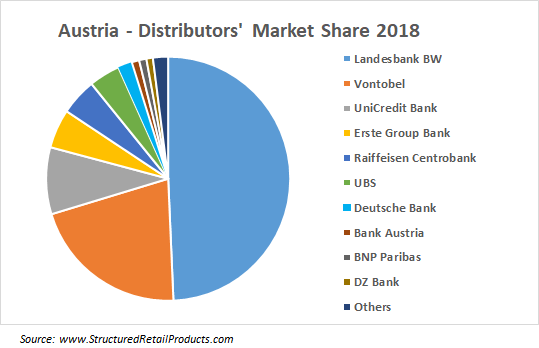

SRP data estimates show that the not flow (subscription based products) retail structured products market in Austria is dominated by Landesbank BW which has about than 49% market share on the back of €3.2bn in sales, followed by Vontobel which ended 2018 with a 21% market share (€1.39bn). UniCredit Bank (8.91% / €586m), Erste Group Bank (5.2% / €342m) and Raiffeisen Centrobank (4.9% / €321m) complete the top 5 ranking of distributor groups in the Austrian market.

Note: These market shares reflects the sales volume of products as of end of subscription period. These numbers are partially estimated. Landesbank BW and Vontobel’s are German issuers, offering their certificates in Austria simultaneously.