Structured investments show their worth once more in the face of a market sell-off and increasing volatility

More than 90% of structured product distributed by UK intermediaries maturing last year delivered gains and no single product matured at a loss, according to the 2018 Structured Product Performance Review produced by Lowes Financial Management.

“In a year that saw the FTSE 100 fall over 12% in capital terms, the fact that so many structured products still matured with a gain demonstrates their value as part of a diversified investment portfolio,” said Lowes Financial Management investment manager Doug Milward (pictured).

The report reviewed 381 structured products maturing in 2018. It found that not a single capital at risk product reaching maturity in 2018 delivered a loss, despite the wild swings seen across financial markets. In total, just 23 products (6.04%) returned the initial investment alone while the remaining 358 (93.96%) generated positive returns, with an average 6.33% gain across the products.

“While approximately 6% of all retail plan maturities returned no gain, the fact that there were none that matured with a loss is an exceptional result for the sector and indeed the first time this has occurred,” said Milward, adding that Lowes’ own list of preferred plans delivered exemplary gains, with an average of 7.88% pa. over an average term of 3.4 years.

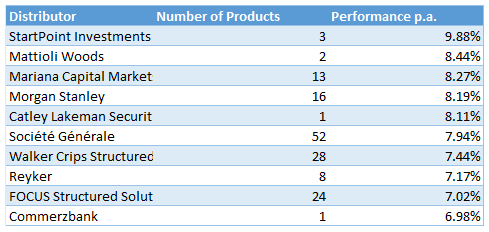

SRP data is in line with Lowes findings and shows average returns of 7.9% pa from the top 10 product providers in the UK market.

Milward said that it should be acknowledged that a handful of share-linked autocall structures that failed to mature in 2018 face their final maturity date later this year, with some in 2020. The dire performance of one or two shares underlying these products means that “the retail sector is unlikely to see another year of no negative maturities, at least for some time”.

“Those aside, the sector continues to go from strength to strength and we believe structured investments are quite rightly, once again, starting to gain traction amongst advisers,” he said.

The majority of structured products maturing in 2018 were linked to the FTSE 100 which accounted for 68% of maturities, with the Eurostoxx50, S&P 500 and Investec’s Even 30 among other linked indices. Of the 23 products that did not return a gain, all but two were deposit based or capital protected contracts and they were, with one exception, linked to measures other than mainstream indices.

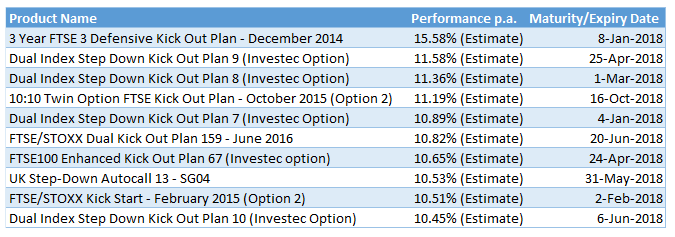

Among the best performing structured products last year was Investec’s Dual Index Step Down Kick-Out Plan 9 (Investec Option), which gained 24.5% after two years. The knock out, worst of option, reverse convertible structure inked to the FTSE 100 and the Eurostoxx 50, it delivered an annualised return of 11.58%.

The Mariana 10:10 Twin Option FTSE Kick Out Plan, launched in cooperation with Lowes in October 2015, was also among the top performers, with a gain of 37.5% after three years, equating to an annualised return of 11.19%.

“It is great to see the sector continuing to deliver,” said Ian Lowes, managing director at Lowes. “Once again we have seen some standout performers in 2018, but without a doubt the biggest achievement for the sector is that our 'Black Hole' award given to the worst structured product to fail investors was empty this year as no products produced a loss. This is the first time this has happened.”

Lowes Financial Management manages almost £1bn of assets and has invested over £380m into structured investments on behalf of clients.