Nine Taiwan brokers have received approval to issue ETNs from Q2 2019; assets in actively managed ETFs globally hit record-high; BNP Paribas launches a socially responsible credit ETF; Blackrock eyes EV market; Vanguard rolls out bond ETFs and Franklin Templeton debuts its low-cost passive ETFs

The Taiwan Stock Exchange (TWSE and GreTai Securities Market (Taiwan’s OTC exchange) have granted approval to nine securities firm to issue exchange-traded notes (ETNs), according to media reports.

The Financial Supervisory Commission (FSC) first published draft guidelines in March 2018 for securities firms to issue ETNs, and in June gave the green light for the introduction delta one notes to allow brokers to expand their business scope and enhance their product offerings. As ETNs are backed by the creditworthiness of underwriting issuers, the regulator required issuing brokers to have a net worth exceeding NTD 10 billion (USD 325m) and a capital adequacy ratio of at least 250%. These requirements are only met by 10 Taiwanese brokers.

The FSC has set 29 April 2019 as the earliest date for the launch of ETNs, and has approved Yuanta Securities, KGI Securities, Fubon Securities, and Masterlink Securities. The exchange has also reportedly organised meetings with the four firms this month to discuss product distribution and marketing. Taiwan’s OTC exchange, GreTai Securities Market, has granted approval to five firms including Capital Securities, Hua Nan Securities, SinoPac Securities, President Securities and Mega Securities, as of December.

Investors flock to actively managed ETFs amid market uncertainty

Active investing is gaining popularity in the exchange-traded fund (ETF) landscape due to the current volatile market conditions. Global assets invested in actively managed ETFs have hit a record-high of almost US$112 billion last month, up 4.6% from the end of December, according to London-based consultancy ETFGI.

ETFs are increasingly considered as ways to actively manage funds thanks to the lower cost they offer compared to mutual funds although they have traditionally been seen as passive investment tools. Meanwhile, assets invested in the global exchange-traded products industry rose more than 7% at the end of January from the previous month, rising back to over US$5 trillion. The amount posted a drop in December last year to below the US$5 trillion level. The ETFs and ETPs listed globally attracted net inflows of US$17.35 billion last month, marking 60 straight months of net inflows.

BNP Paribas Asset Management pitches low carbon credit ETF

BNP Paribas Asset Management has launched a credit ETF that satisfies the environmental, social and governance (ESG) credentials. The BNP Paribas Easy € Corp Bond SRI Fossil Free UCITS ETF tracks the Bloomberg Barclays MSCI Euro Corporate SRI Sustainable Reduced Fossil Fuel Index. The benchmark provides a low carbon exposure to around 400 selected euro-denominated investment grade bonds. It also filters debt securities that do not respect UN Global Compact principles and involved in sectors such as alcohol, gambling, pornography and tobacco.

‘The launch of BNP Paribas Easy € Corp Bond SRI Fossil Free Ucits ETF is part of a dual approach to develop our low carbon footprint SRI (socially responsible investment) offering and our bond index range,’ said Isabelle Bourcier, global head of quantitative and index at BNP Paribas Asset Management. ‘At the end of December 2018, we managed €1.9 billion in ESG index funds.’

The fund trades on Euronext and Xetra with a total expense ratio of 20 basis points.

Blackrock bets on zero emmissions

Blackrock has rolled out an ETF that tracks the performances of electric vehicle and driving technology industries. The iShares Electric Vehicles and Driving Technology Ucits ETF follows the Stoxx Global Electric Vehicles and Driving Technology Index that consists of companies involved in manufacturing, battery suppliers as well as component producers.

‘We are on the cusp of another huge leap in the way we get from A to B as the irreversible trend towards electric vehicles unfolds,’ said Rob Powell, lead strategist at iShares Thematic Investing at Blackrock. ‘And beyond the vehicle manufacturers, producers of battery technology, autonomous vehicle components and charging infrastructure will all benefit from this revolution in transportation.’

The ETF has a total expense ratio of 40 basis points and trades on the London Stock Exchange and Xetra.

Vanguard deploys Bloomberg/Barclays Euro bond play

Vanguard has launched two new investment grade bond ETFs on Xetra and Boerse Frankfurt. One has exposure to euro-denominated government bonds within the Eurozone, while the other follows euro-denominated corporate bonds worldwide. Both funds have ongoing charges of 12 basis points. The Vanguard EUR Eurozone Government Bond Ucits ETF benchmarks Bloomberg Barclays Euro Aggregate – Treasury Index. The Vanguard EUR Corporate Bond Ucits ETF – (EUR) Accumulating tracks Bloomberg Barclays Euro Aggregate – Corporates Index.

Franklin Templeton debuts country/region specific passive range

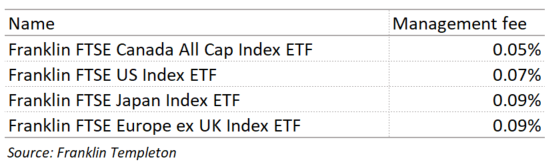

Franklin Templeton has debuted its first suite of passive ETFs that have exposure to a specific region or country with low fees of less than 10 basis points. The ETFs are as follows: Franklin FTSE Canada All Cap Index ETF, Franklin FTSE US Index ETF, Franklin FTSE Japan Index ETF and Franklin FTSE Europe ex UK Index ETF. All four ETFs are listed on the Toronto Stock Exchange.

‘With market-moving events like trade tensions and Brexit, investors and their advisors as well as institutional investors are looking to precisely act upon specific country and regional market views,’ said Duane Green, president and CEO of Franklin Templeton Investments Canada.