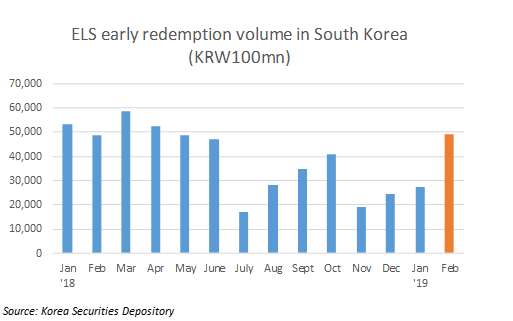

The recent global stock rally has raised February’s early redemption volume of equity-linked securities (ELS) in South Korea to its highest level since April last year

The early redemption volume of ELS products in February came in at almost KRW5 trillion (US$4.3bn), up 80% from January this year, according to Korea Securities Depository data. ELS’ sales also rose to over KRW4.5 trillion, up around 5% from the previous month.

The sales volume of ELS in South Korea has been on the rise since the beginning of the year, recording an increase of over 50% in January compared to December last year. This figure also stood higher than the monthly average recorded in Q4 2018 which was around KRW3.8 trillion.

This compares with the sales volume of all Asia Pacific products which came in at below the monthly average of the fourth quarter last year. Apac’s sales volume in January stood at around US$16 billion, while the monthly average of Q4 was over US$18 billion, according to SRP data.

The sales increase in South Korea was triggered by the market rally that set off the products’ early redemption feature, prompting investors to enter into new products.

“In 2016, the stock markets has kept on falling, making it impossible for products to satisfy early redemption conditions and, as a result, locking funds in the products for several years,” said Gyun Jun (pictured), a derivatives analyst at Samsung Securities in Seoul. “This year, the circumstances look different.”

Korea’s structured products market took a massive hit from the plummeting Hang Seng China Enterprises Index (HSCEI) during 2015 and 2016 as the country’s equity-linked products were heavily concentrated on autocallables linked to the Hong Kong index. In 2015, the index dropped by some 40% to breach the knock-in levels which resulted in investors incurring losses. Although some products may have survived the deep correction, issuers had to struggle managing the products as the benchmark continued its downward trend until early 2016.

Nikkei 225 takes over

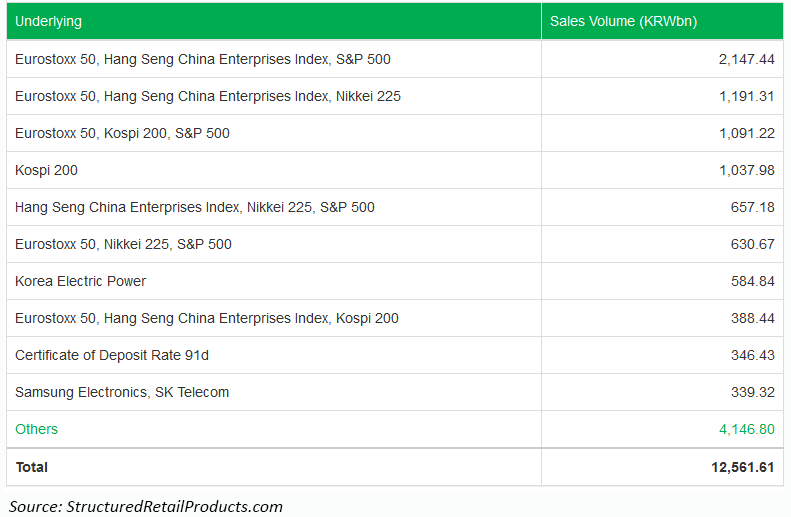

Issuers of ELS products in the first two months of this year have increasingly replaced the Kospi 200 index with Nikkei 225 as the index of choice for these products.

Autocallables in South Korea usually track a basket of three indices mainly comprising the Eurostoxx 50, S&P 500 and an Asian benchmark that has a higher volatility. This way, product manufacturers are able to offer better coupons to investors.

“The sales volume of products linked to the Nikkei 225 was larger than that of the Kospi 200 in January,” said Jun. “The volatility level in Korea came down so issuers are shifting to indices overseas.”

Additionally, product issuance linked to a corporate stock along with popular indices such as the Eurostoxx 50 and HSCEI has gained momentum this year, according to Jun.

“The average coupon rate of an autocallable product tracking a basket of indices that is made up of three benchmarks stood at around 6% in January,” he said. “The rate rises up to 10% when the share basket includes a large-cap stock like Samsung Electronics. We have seen products like this before but the issuance really started to rise this year.”