Structured products generate more than 35% of exchange trading turnover in Europe in Q4 2018 on the back of higher issuance

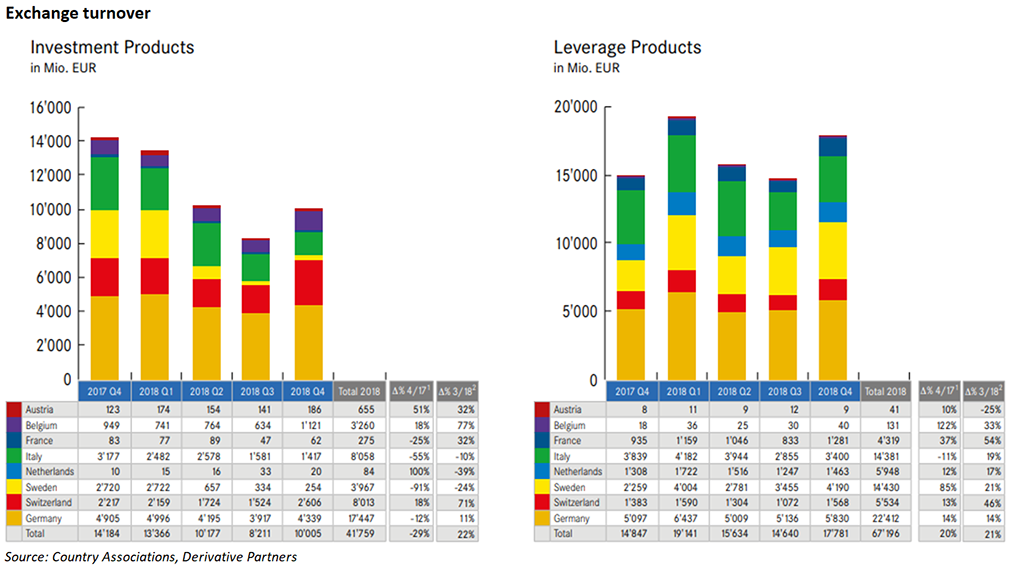

Trading turnover in investment and leverage products on exchanges across Europe’s main financial markets spiked to €27.8 billion at the end of the fourth quarter 2018 – a 22% increase compared to the previous quarter.

However, despite the rise this represented a four percent decrease year on year, according to data from members of the European Structured Investment Products Association (Eusipa).

“The last quarter of 2018 was quite distressing for investors in most markets as they reacted to an increase in geopolitical risk, and in some markets faced additional concerns about macroeconomic stability,” Thomas Wulf (pictured), secretary general at Eusipa, told SRP. “This very likely triggered a rush to fully or partially capital-protected products, for which our sector, structured instruments, is usually first port of call.”

The search for protection saw the outstanding volume of leverage products standing at €6.6 billion at the end of December, down 15% on the third quarter and 81% year on year.

Fourth-quarter turnover in investment products amounted to €10 billion – 36% of the total traded, representing a 24% from the previous quarter, but a fall of 29% year on year.

In the leverage products segment including warrants, knock-out warrants, and factor certificates turnover stood at €17.8 billion at the end of the fourth quarter December which corresponds to 64% of aggregate turnover. Leverage product turnover grew 21% quarter on quarter, and 20% year on year.

Products listed exchanges where Eusipa members operate included 557,105 investment products and 1,274,323 leverage products. The total listed products offering grew by a slight three percent quarter on quarter, and 8% year on year.

New investment and leverage products issued by banks amounted to 1,453.226 in the fourth quarter of 2018, a 29% increase in new issuance compared the previous quarter and a 48% increase year on year. In total, were launched, of new issuance; new were listed

Leverage products dominated the issuance at 1,244.225, accounting for 85.6 percent of the total, with the remaining 209,001 new investment products accounting for 14.4% of the total issuance

At the end of the fourth quarter, in Austria, Belgium, Germany and Switzerland, the market volume of investment and leverage products stood at €250.3 billion – a four percent decline both on the previous quarter and year on year. In addition, the market volume of investment products stood at €243.7 billion, a decrease of six percent on the previous quarter but an eight percent increase in volume year on year.

At a regulatory level, the association’s agenda for the next quarter will be governed by the Priips review and the need to coordinate efforts among members, according to Wulf.

“[We] will be very active in the Priip review scheduled into the 2019 legislative calendar,” said Wulf. “The review follows a requirement set up at level 1, the legislative text, and should be completed by year end.”