The German exchange moves to expand index and portfolio/risk analytics business following Axioma’s acquisition

Deutsche Börse has acquired risk analytics and portfolio construction provider Axioma, for US$850m cash and debt free (around US$820m equity value). The UK based software developer will be combined with its Stoxx and Dax index businesses valued at €2.6 billion.

The combination will result in a fully integrated, buy-side intelligence player that will provide “unique products and analytics to meet the growing demand for an end-to-end platform”, according to Stephan Leithner (pictured), member of the executive board of Deutsche Börse, responsible for the post-trading, data & index business.

“Axioma and the exchange’s index business are highly complementary and together will offer a broad suite of index and analytics products with global coverage, which will be highly relevant for passive and structured products,” a Deutsche Börse spokesperson told SRP.

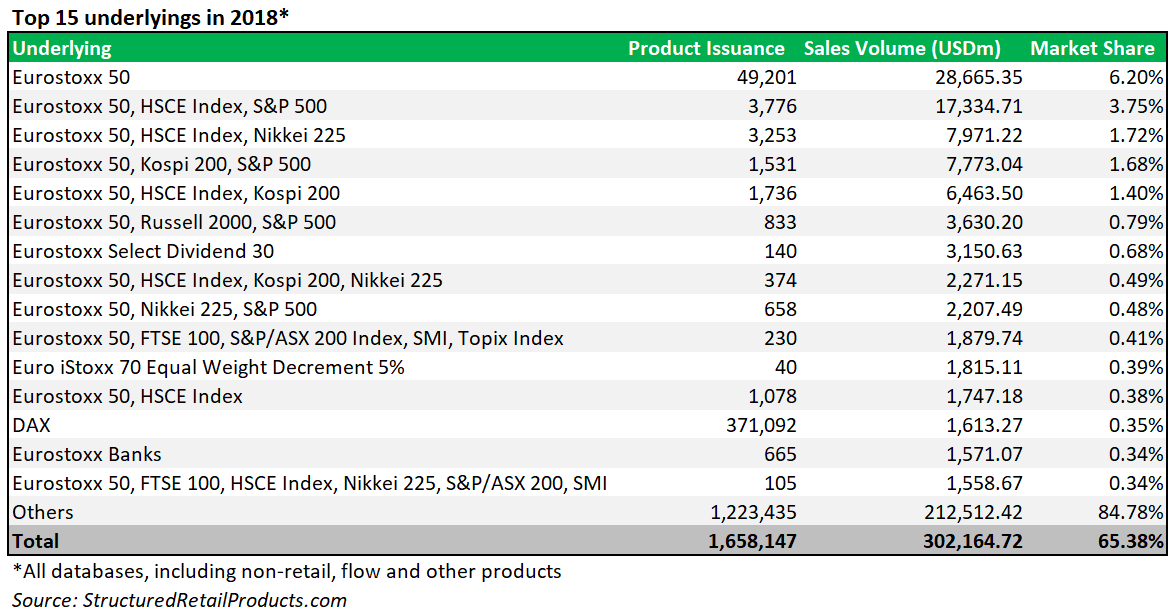

The Dax is the most utilised single equity index in the structured products market featuring on 371,092 products (US$1.6bn/0.35% market share) mostly sold in Germany in 2018. The Eurostoxx 50 index remains the top single equity underlying across markets appearing in over 49,000 products (US$28.6bn/6.2% market share) in 2018.

According to the official, the combined company will provide open infrastructure “to help clients capitalise on the critical trends now reshaping the investment-management landscape”.

“The combined company will be uniquely equipped to address trends that are reshaping investment management, including the shift to passive, the demand for smart beta and the transition towards index customization using technology,” said the official.

The new company will provide Axioma’s current clients with closer integration to data from a family of indices, which are critical components for designing investment strategies, whilst Deutsche Börse’s index business clients will benefit from access to Axioma’s analytics that allow for creation and testing of custom indices.

“The new offering will also integrate Stoxx’s indexing expertise with Axioma’s best-of-breed analytical capabilities in risk management, portfolio construction and performance attribution,” said the spokesperson, adding that the German exchange expects the new set up to act as a catalyst for an increase in the use of index-linked and structured products in investor’s portfolios.

“[This] is one of the driving forces behind this deal. We want to create new solutions and new opportunities for investors by combining Stoxx indexing expertise with Axioma’s analytical capabilities in risk management and portfolio construction.”

Going forward the exchange will offer a broad suite of index and analytics products with global coverage and capitalise on the shift to passive investing, the demand for smart beta and the transition towards index customisation using technology.

As part of the transaction, Deutsche Börse has also entered into a strategic partnership with General Atlantic, a global growth equity investor which will invest around US$715m into the new company to finance the acquisition of Axioma.

The new company will be led by current Axioma CEO Sebastian Ceria, and depending on the roll-over, Deutsche Börse is expected to own approximately 78% of the new company, General Atlantic around 19%, and the Axioma management about three percent. The transaction is subject to approval by the relevant competition authorities and further customary conditions, and is expected to close in the third quarter 2019.

Deutsche Börse and Axioma have had an existing partnership since 2011 and have jointly developed innovative products, including factor indices and ETF products. All Deutsche Börse businesses will benefit from direct access to the buy-side and the enhanced analytics platform.