The bank reports record income and revenues in first quarter while remaining the number one structured product provider in US.

JP Morgan has reported record net income of US$9.2 billion in the first quarter of 2019, up 5% from the same quarter last year.

Net revenue of US$29.9 billion was also a record while non-interest revenue was up 5%, driven by the absence of net losses on investment securities, with lower markets revenue more than offset by lower funding spreads on derivatives, according to the bank.

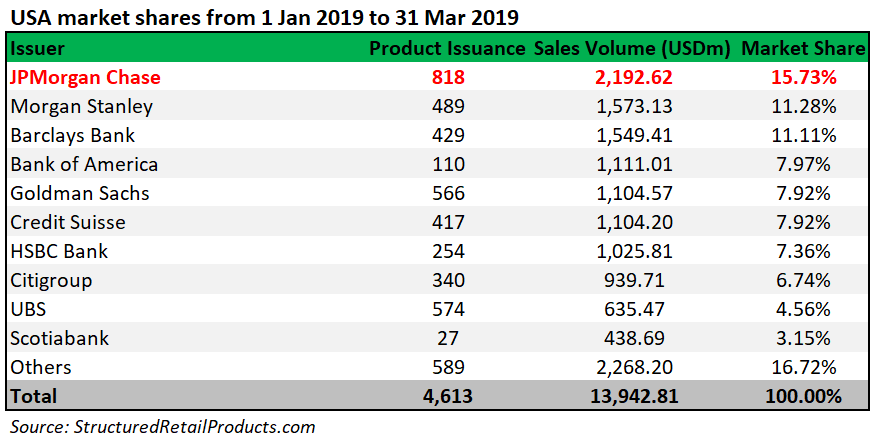

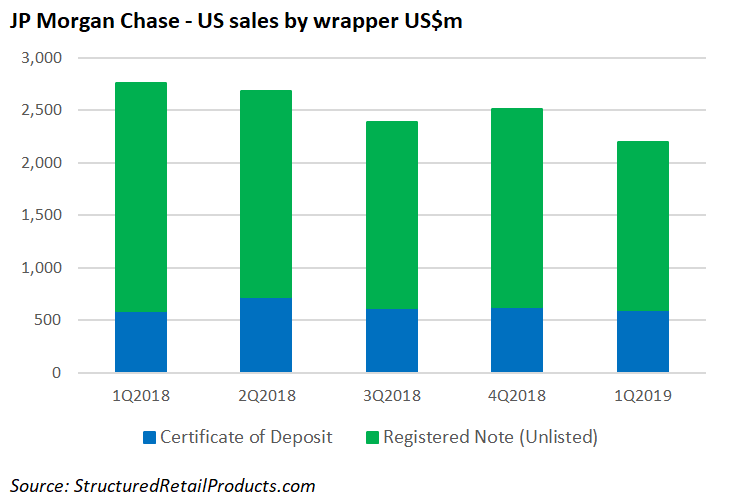

JP Morgan remained the number one issuer in the US with a 15.7% share of the market in 1Q2019, according to SRP data. The bank sold 818 structured products worth US$2.2 billion between January 1 and March 31, including 588 structured notes (US$1.6 billion) and 230 certificates of deposit (US$0.6 billion).

JPM’s best-selling structured note in the quarter was a capped enhanced participation note linked to the S&P 500, which was distributed via Goldman Sachs Private Banking and collected sales of US$40m in the subscription period. The highest selling certificate of deposit came in the shape of an absolute return market CD linked to the DJ Industrial Average Index which was issued in collaboration with UBS Financial Services and sold US$12.8m.

Almost 50% of the total sales in the quarter was accumulated from 335 products tied to a single index. They included 69 products linked to the S&P Economic Cycle Factor Rotator Index which attempts to provide a dynamic rules-based allocation to one of four equity indices and the S&P 5-year US Treasury Note Futures ER Index, while targeting a level volatility.

A further US$642.7m was collected from 284 products linked to a basket of indices while there were also products linked to a single share (US$143.5m from 43 products), FX rates (US$22.6m from 11 products) and commodities (US$8m from four products).

In the corporate and investment banking division, equity markets revenue, at US$1.7 billion, reflected lower client activity, predominately in derivatives, while fixed income markets revenue of US$3.7 billion reflected lower revenue in currencies & emerging markets and rates, a decline which was partially offset by improved performance in credit trading and commodities from higher client flows, according to the bank.

Click the link to view the full JP Morgan Chase first quarter 2019 results, presentation and earnings supplement.