The Singaporean bank has reported a surprise increase in its first-quarter profit thanks to gains in lending margins and trading income.

DBS Group’s net profit climbed 9% to a record SGD1.65 billion (US$1.21 billion) in the first quarter of this year from the same period a year earlier. Southeast Asia’s largest bank attributed the rise to a ‘higher net interest margin’ that has offset the drop in wealth management fees.

Trading income also rose 20% to SGD443 million on the back of gains in interest rate and credit activities, boosting the overall non-interest income to SGD511m.

During the first three months of this year DBS marketed 251 products worth an estimated US$813.5m , according to SRP data.

Most of the DBS products listed on SRP database were issued in Taiwan, including some of the best performing notes in the region (autocallables such as 7M USD Knock-in Memory Autocallable Note 078000006422 and 8M GBP Knock-in Memory Autocallable Note 078000006421 as well as range accrual notes like 12M USD Memory Autocallable Range Accrual Note 078000006419).

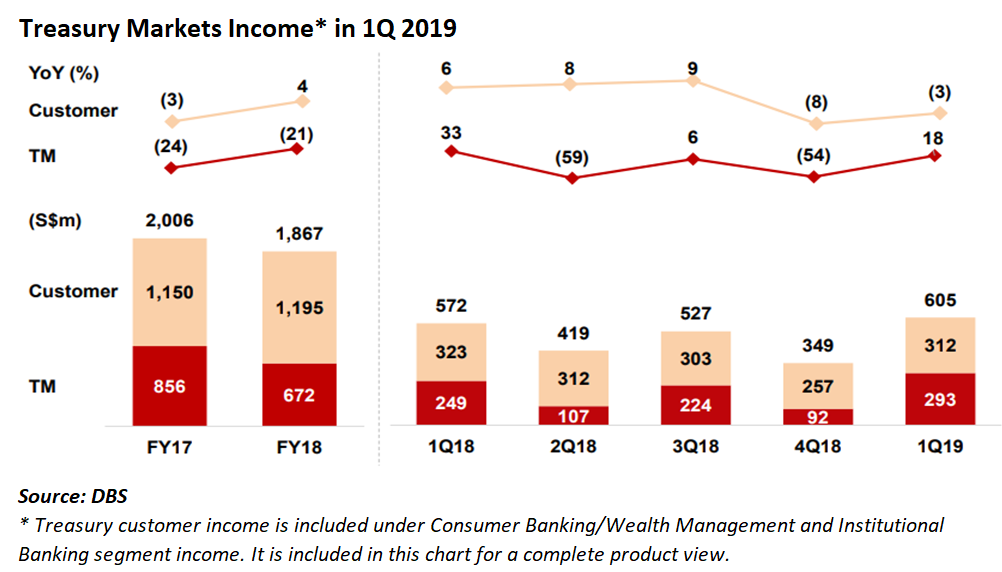

The bank’s treasury markets business, meanwhile, saw pre-tax profits jump 36% on-year to SGD152 million, while its total income rose 18% to SGD293 million. DBS cited strengthened activities in the interest rate, foreign exchange and credit products as the reason behind the increase. It did point out though that its equity activities dampened a further rise in treasury markets’ income.

DBS’ treasury markets business primarily includes structuring, market-making and trading across a broad range of treasury products. However, it does not reflect the income from selling treasury products to consumer banking/wealth management and institutional banking customers.

Treasury customer income dropped 3% in the first quarter of this year from the same period a year ago to SGD312 million due to sluggish sales of equity and fixed income products.

DBS released its financial results for the first quarter of this year on April 29. Click here to view the full CFO presentation.