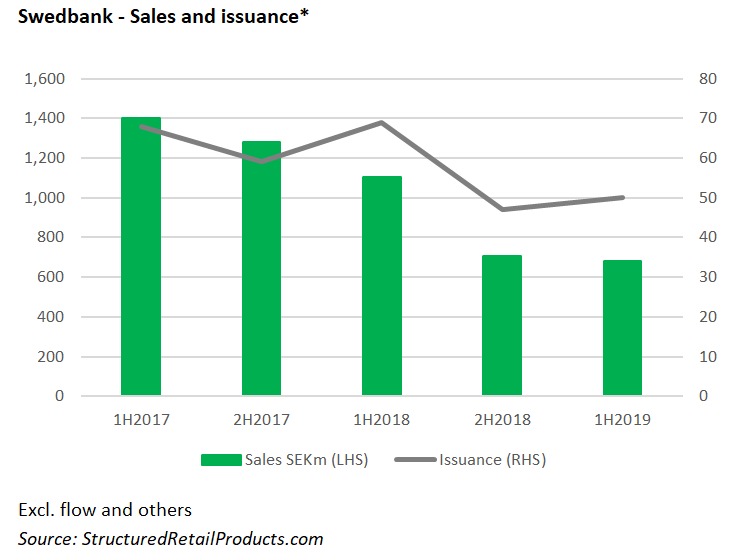

The Swedish bank reports a 18% year-on-year decrease in volumes from structured products in issue for retail investors.

Swedbank’s income from structured products decreased in the period January-July 2019. As of June 30 2019, the outstanding volume for structured retail bonds stood at SEK10.2 billion (US$1.1 billion), a five percent decrease from end-December (SEK10.7 billion) and down 18% compared to June last year (SEK12.4 billion).

Thirty-one of the bank’s products in 1H2019 were tied to a single index, including, among others, the Solactive Sustainable Development Goals World Index (SEK210m from 18 products), OMX Stockholm 30 (SEK72m from six products), and the Eurostoxx Banks (SEK29m from three products).

A further 17 products were linked to a basket of (predominately Swedish) shares while two products were linked to appreciation of a currency basket comprising Brazilian real, Mexican peso, Russian ruble, South African rand, and the Turkish lira, relative to the euro. The latter included Bevis Nu Tillväxtvalutor, the bank’s best-selling product for the quarter, collecting SEK29.3m during its subscription period – which ran from January 7 until January 25 2019.

Seventy-five structures matured in the first half of 2019. Of these, Kreditderivatbevis Industribolag 3 delivered the highest return. The credit-linked note, which sold SEK62.3m at inception and was linked to the credit risk of five companies (Arcelor Mittal, Securitas, Stora Enso, Peugeot, UPM-Kymmene) returned 160.4% after five years, or 9.49% per annum.

Long-term debt issuance in the first half year amounted to SEK102 billion. Total issuance volume for the full-year 2019 is expected to be ‘slightly higher’ compared with 2018, according to the bank.

As of 30 June outstanding short-term funding, commercial paper, included in debt securities in issue amounted to SEK185 billion while at the same time available cash and balances with central banks as well as excess reserves with the Swedish National Debt Office accumulated to SEK247 billion.

Swedbank reported total income of SEK22.7 billion for the period January-June 2019, up two percent from the same period last year. Earnings per share were SEK9.46 (1H2018: SEK9.87), after dilution, while the return on equity was 15.9% (1H2018: 17.1%). The bank’s board of directors decided to change the divididend pay-out policy from 75 to 50% of annual profit in order to further strengthen its capital position.

‘Our financial results were positively affected by both increased loan demand and the rise in the stock market,’ said Anders Karlsson (pictured), acting president and CEO, commenting on the bank’s results. ‘Net interest income strengthened thanks to higher lending volumes, both to businesses and individuals, at the same time that a lower resolution fund fee for the full-year also contributed positively.'

Click the link to view the Swedbank interim report January-June 2019.