A tough trading environment was to blame for the bank’s lacklustre performance in several businesses.

Morgan Stanley’s second quarter earnings dropped nine percent year-on-year, the latest US bank to be affected by sluggish market conditions. Net income fell to US$2.2 billion, as revenues took a four percent tumble to US$10.25 billion.

Trading revenue dropped 12% to $3.3 billion, while sales from its investment banking business saw a 13% drop to $1.47 billion. It said in a statement that fixed Income sales and trading net revenues decreased reflecting the effects of a decline in interest rates and lower volatility, as well as a ‘subdued level of structured transactions’.

Only its wealth management unit reported growth, with revenue up two percent year-on-year to US$4.4 billion. It said higher asset levels were behind the rise. Investment management revenues were up 21% to $839 million, from the second quarter of 2018.

Morgan Stanley lagged behind other large US banks in the second quarter, with a market share of nearly nine percent, behind Barclays (15.1%) and JP Morgan (13.2%).

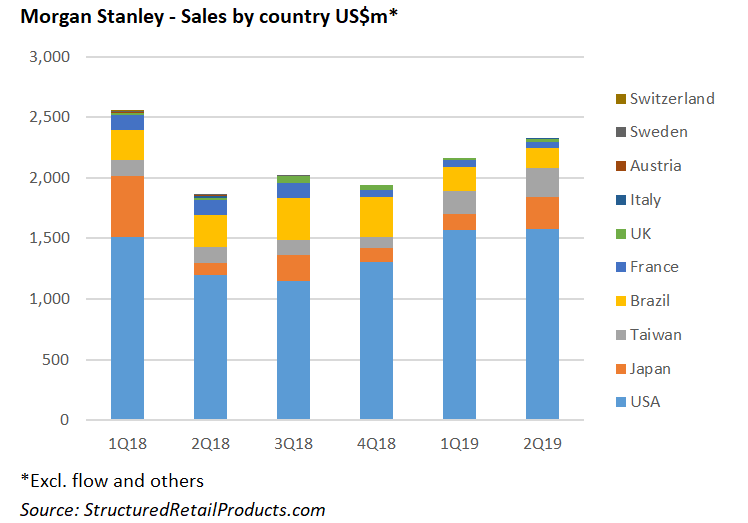

It sold 781 structured products during the second quarter, worth a combined US$2.3 billion. A majority of products were issued in the US (502), far ahead of the second spot Taiwan (71) and Brazil (46), the third destination. Morgan collected over 60% of sales from the US.

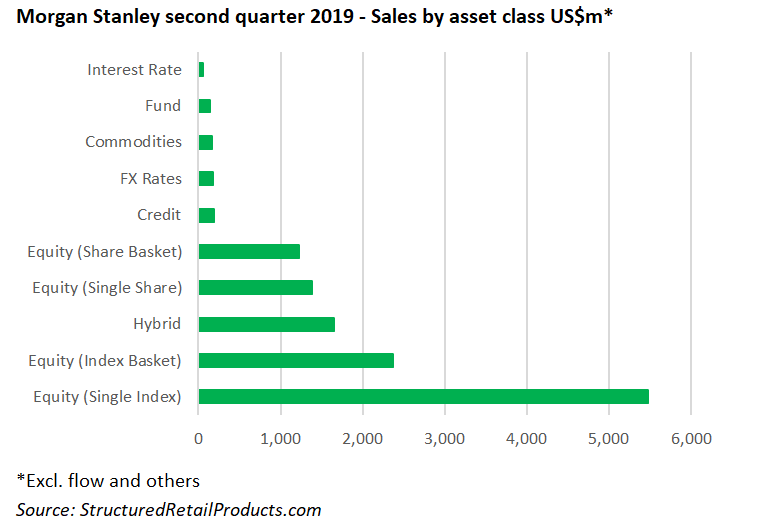

Over half of products (462) were issued with either the S&P500 (230 products), the Eurostoxx50 (117) or the Russell 2000 (115) as underlyings. A further 73 products were sold using the Morgan Stanley MAP Trend Index.

The bank’s wealth management unit sold one of the best-performing products this year in the US, the autocallable linked to Netflix.

Most of the bank’s products were linked to equities, as either a single index (245), index basket (209) or a share basket (123).

SRP awarded its Personality of the Year award Morgan Stanley’s managing director in equity derivatives sales, Larry Wilson, at its Americas conference, held in Chicago on May 22.

In comparison, Bank of America reported record earnings of US$7.3 billion for the second quarter of 2019, an increase of eight percent year-on-year, while JP Morgan income was up 16% to US$9.7 billion during the same period.

Click here to access Morgan Stanley second quarter earnings report.