The French bank implemented the first transfer of structured derivative positions and front office staff following the acquisition of Commerzbank’s equity derivatives business.

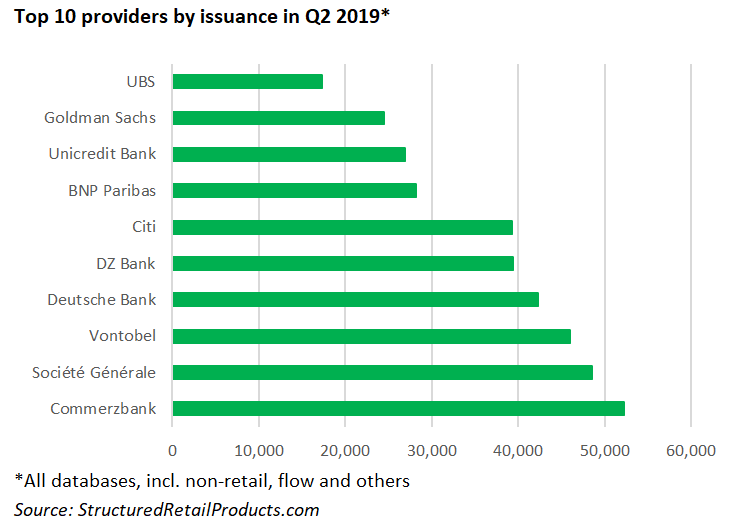

According to SRP data, Société Générale launched 48,468 structured products between April 1 and June 30 2019, making it the second most active issuer in the period, behind Commerzbank – the bank whose equity markets & commodities (EMC) business it acquired, via an agreement signed in November 2018.

The EMC business comprises manufacturing and market making flow and structured products as well as part of asset management activities. The integration process of staff, trading books and infrastructure started in the first half of 2019 and is expected to continue until the beginning of the first half of 2020.

The initial transfer of Commerzbank’s structured products and exchange-traded funds was implemented in the second quarter with integration costs amounting to €21m.

Based on the progress of the integration process at June 30, Société Générale has already taken control of the exotic, vanilla and funds (EVF) business and the asset management activities leading to the recognition of goodwill: €63m for the EVF business and €49 million for the asset management business.

The vast majority of products issued in the second quarter were listed flow and leverage certificates targeted at retail investors in Germany. In France, the bank sold 158 products, worth approximately €1 billion, which were distributed via 24 different distributors, including A2D Finances, Adequity, DS Investment Solutions, Equitim, Oddo & Cie and Swiss Life Banque Privée.

Other European markets where the bank was active were Italy (€81m from 29 products), Belgium (€26m from three products), Ireland (€20m from nine products), and the UK (€15m from eight products).

Outside Europe, it was the bond provider behind 215 products in Taiwan (US$714m) targeted at private banking investors. In Japan the bank issued three products (US$26m) which were distributed via local securities firms while in Hong Kong 1,162 structured warrants were introduced to the market.

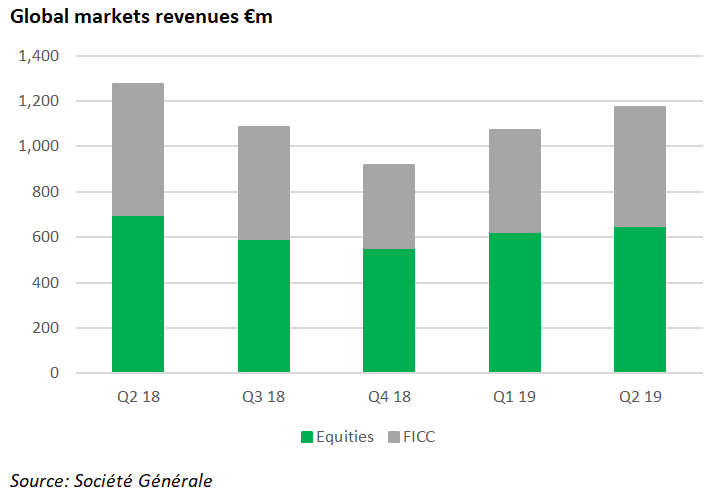

Société Générale’s revenues in its global markets & investor services division, at €1.4 billion, were down 9.2% in Q2 2019 compared to Q2 2018, impacted by ‘challenging market conditions’. Revenues were 6.3% higher than in the first quarter of 2019.

At €524m, the revenues of fixed income, currencies & commodities (FICC) were down 9.7% in Q2 2019 versus Q2 2018, and up 16.4% from Q1 2019. The low interest rate environment in Europe and low volatility observed in currency activities adversely affected rate and currency activities in Q2 19. These declines in revenue were mitigated by the good performance of credit and emerging market activities.

Equities and prime services’ revenues, at €650m, were down 6.6% compared to the prior-year quarter, against a backdrop of low volumes on flow activities. Revenues were up 4.2% versus Q1 2019, benefiting from better market conditions at the beginning of the second quarter.

The group’s consolidated balance sheet included an outstanding for hedging derivatives and debt securities issued of €9.7 billion and €127.3 billion, respectively, as of June 30 2019.

Funding conditions were competitive and the average maturity was 4.6 years. The parent company funding programme for 2019 is similar to 2018 – €17 billion of vanilla debt, balanced across the different debt formats and the annual structured notes issuance volume of approximately €19 billion is in line with amounts issued over the past years.

As of July 15 2019, 69% of the funding programme was already achieved including €10.6 billion of structured notes while an additional €1.4 billion was issued by subsidiaries.

Click the link to view the full Q2 and H1 2019 results, presentation and consolidated financial statements