SRP looks at the interim results of SEB and Nordea, the two main structured product providers in Sweden. Both banks reported a positive impact from structured product sales in the first half of 2019.

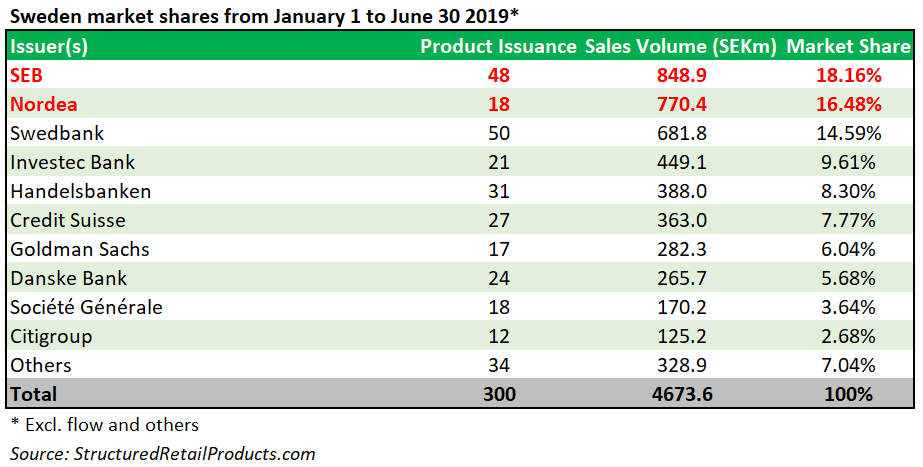

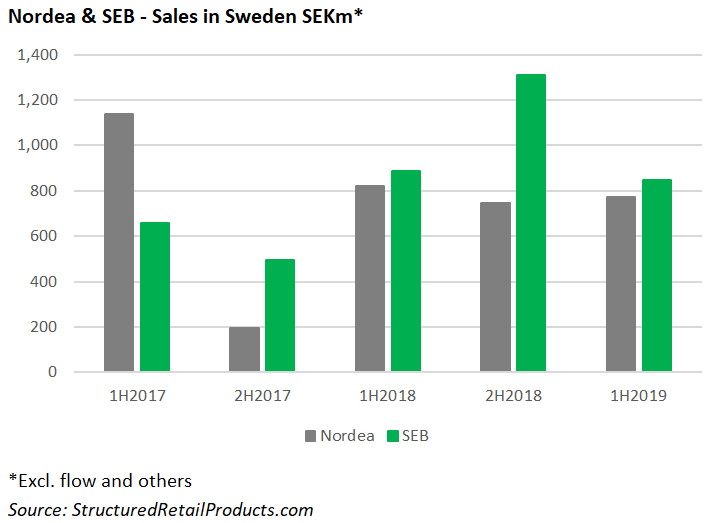

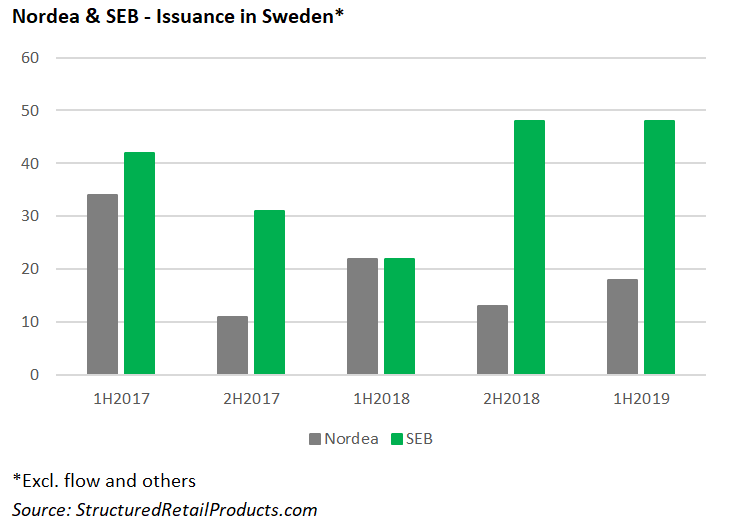

SEB issued 48 structured products worth SEK850m (US$88m) between January 1 and June 30 2019, making it the top provider in Sweden with an 18.2% share of the market, according to SRP data. Issuance was level compared to the prior six-month period, but sales were down by 35% (2H2018: SEK1.3 billion) while in the first half of 2018 the bank sold 22 products worth SEK885m.

Twenty-six products of the products sold during the semester were distributed via Garantum; 20 via Strukturinvest; one via Nord Fondkommission; and one via the bank’s own network.

SEB’s best-selling product during the period was Kreditobligation High Yield USA Kvartalsvis nr 3541, a five-year credit-linked note (CLN) tied to the Markit CDX North America High Yield index which collected SEK64m during its subscription period.

Debt securities issued on the balance sheet stood at SEK818.4 billion as of June 30 2019 compared to SEK680.6 billion year-end 2018. For the second quarter, the effect from structured products offered to the public was approximately SEK220m (Q1 2019: SEK420m) in equity related derivatives and a corresponding effect in debt related derivatives SEK-10m (Q1 2019: SEK-280m).

Short-term funding, in the form of commercial paper and certificates of deposit, increased by SEK146 billion since end-December 2018 while SEK79 billion of long-term funding matured during the first half of 2019 (of which SEK52 billion covered bonds and SEK28 billion senior debt). New issuance during the first six months amounted to SEK67 billion (of which SEK46 billion was covered bonds and SEK20 billion senior preferred debt).

‘Trade and political uncertainties remained high on the agenda of investors and businesses during the first half of the year, while market sentiment and economic data continued to diverge,’ said Johan Torgeby (pictured), SEB president and chief executive officer, commenting on the results.

Nordea was the number two structured products provider in Sweden, with 16.5% of the market. In 1H2019, the bank sold 18 products worth SEK770m, which were predominately available via its own distribution channel. Sales were slightly up from the previous semester (2H2018: SEK744.8m from 13 products) but down compared to SEK820m from 22 products in the first half of 2018.

Nordea also relied on a CLN for its best-selling product, which came in the shape of PB 31 Kreditbevis Europa Investment Grade 3-13 B990. The five-year product, which sold SEK127.3m, focuses on Europe (as opposed to North America for SEB’s offering) and pays a three percent yearly coupon linked to the performance of the Markit iTraxx Europe S31.

Outside of Sweden the bank was also active in Finland (US$93m from 31 products); Norway (US$32m from eight products); and Denmark (US$24m from two products).

The bank reported debt securities in issue included €2.4 billion issued structured bonds as of June 30 2019.

Its result in the markets business, which is part of wholesale banking, was upheld by a strong performance in the underlying product franchises, and in particular within credit and rates. Also, structured bonds sales and structured credit trading showed a positive development compared to last year.

Nordea issued approximately €5.2 billion in long-term funding in the second quarter (excluding Danish covered bonds), of which approximately €3.3 billion was issued in covered bonds, €1.6 billion was issued in senior debt and €0.3 billion in subordinated debt.

Public benchmark transactions during the quarter included a green seven-year €750m fixed rate senior unsecured bond; a seven-year NOK1.5 bbillion fixed rate covered bond; and an eight-year € 1 billion fixed rate covered bond. Nordea’s long-term funding portion of total funding was approximately 79% at the end of the second quarter.

Click the link to read the full interim report for SEB and Nordea.