Chief executive officer David Solomon (pictured) praised solid results ‘in the context of a mixed operating environment,’ despite lower net revenues in equities and derivatives in the third quarter.

Goldman Sachs has reported net revenues of US$8.32 billion and net earnings of US$1.88 billion for the third quarter ended September 30 2019. Net revenues were US$26.59 billion and net earnings were US$6.55 billion for the first nine months of 2019.

In equities, commissions and fees, at US$728m, were up eight percent year-on-year, reflecting increased client activity. Net revenues in equities client execution were unchanged, at US$681m, reflecting higher income from cash products, offset by significantly lower net revenues in derivatives.

However, compared to the second quarter, Q3 2019 net revenues in equities decreased by five percent, reflecting notably lower net revenues in derivatives within equities client execution.

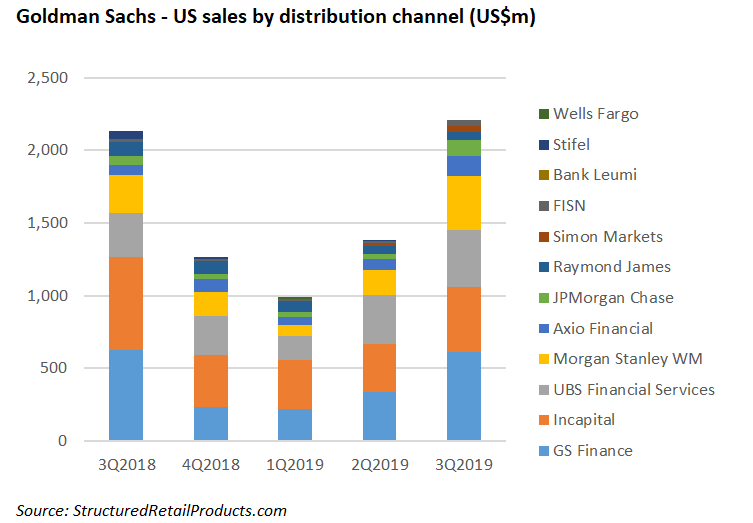

In the US, its main market for structured products, the bank collected sales of US$2.2 billion from 721 products between July 1 and September 30 2019 (Q3 2019: US$1.95 billion).

Ninety percent of Goldman’s products in the quarter were tied to equities, with single indices the preferred underlying for the US investors (US$1 billion from 346 products).

Goldman’s structured products were available via nine different distribution channels, including those of Axia Financial, FISN, Incapital, Raymond James, UBS Financial Services as well as via its own structured products platform Simon Markets.

The best-selling product for the bank in the US were the Leveraged Index-Linked Notes 40056FUN3 which sold US45.9m during the subscription period. The one-year registered note participates 150% in the upside performance of the Technology Select Sector Index, subject to an overall maximum capital return of 120.925%.

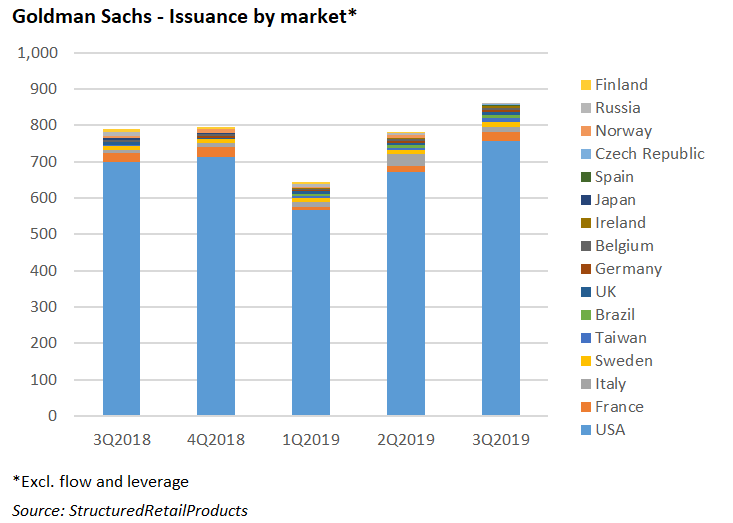

In Europe, the bank was active in 10 different jurisdictions, but predominately in France, Italy, Sweden, the UK and Belgium, while in Germany it issued almost 20,000 flow and leverage certificates which can be traded on the exchanges of Stuttgart and Frankfurt.

Other markets were the bank sold product in the quarter included Brazil and Taiwan. In Japan Goldman issued a three-year note linked to the Nikkei 225 and S&P 500 indices which was distributed via 82 Securities.

Investment management net revenues included record quarterly management and other fees of US$1.46 billion while assets under supervision increased by US$102 billion during the quarter to a record US$1.76 trillion.

Diluted earnings per common share (EPS) was US$4.79 for the third quarter of 2019 compared with US$6.28 for the third quarter of 2018 and US$5.81 for the second quarter of 2019, and the annualized return on average common shareholders’ equity (ROE) was nine percent for the third quarter of 2019 and 10.4% for the first nine months of 2019.

Click the link to read the Goldman Sachs third quarter 2019 earnings results and presentation.