The Dutch bank’s structured products business reported an increase of more than 80% in sales volumes with ‘strong positive returns’ from structured notes for investors in 2019.

Van Lanschot Kempen posted an underlying net result of €108.8m in full-year 2019, up from €103m the prior year period.

The bank’s structured products business closed a total of 103 deals worth €327m in new notional in 2019, up from 143 deals worth €181m in 2018.

In line with equity markets, structured notes showed ‘strong positive returns’ while demand for structured investments ‘remained strong’ in the reporting year as private investors searched for alternatives to earn a positive yield in the current low interest rate environment, according to the bank.

Van Lanschot Kempen’s structured products platform made ‘significant’ improvements to its risk framework, as well as to the digitalisation of the information flow to and from the platform. It invested heavily in hardware and dashboards to gain a better view of its exposures to manage its risks more effectively.

In the first half of 2019, the bank’s valuation model for structured products was found to contain an inaccuracy, with H1 2019 seeing a negative adjustment of €2.7m, recognised under ‘other income,’ which also includes the interest charges on medium-term notes.

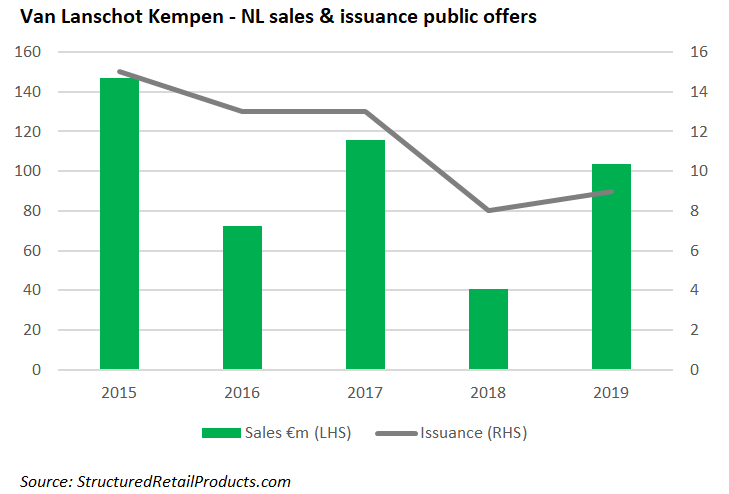

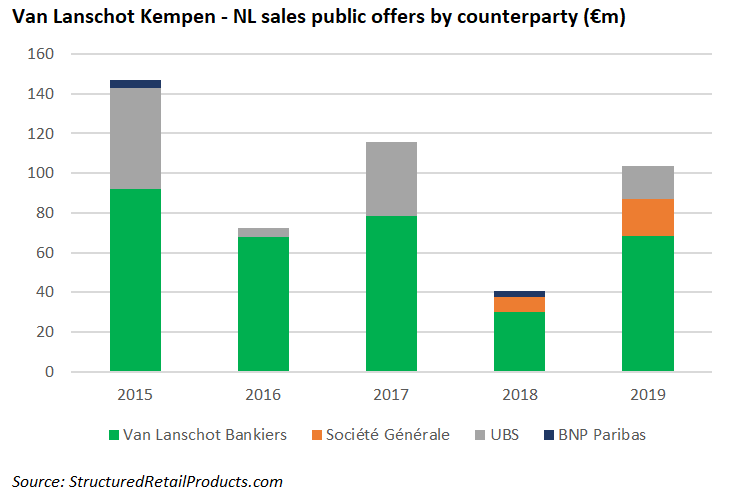

Van Lanschot Kempen launched nine public offers worth approximately €100m in its domestic market of The Netherlands between 1 January and 31 December 2019 (FY2018: €41m from eight products), according to SRP data.

The bank’s structured products desk further optimised capabilities to issue notes on third-party paper to adapt to the lower funding needs of Van Lanschot Kempen, with two products each issued via Société Générale and UBS.

The latter also saw two products autocalled: UBS Trigger Certificaat Eurozone 17-22 and UBS Trigger Plus Certificaat Eurozone 17-22 delivered annualised returns of nine percent and six percent, respectively.

Van Lanschot Kempen also issued its first public offer in Belgium in five years. The US dollar denominated Capped Wereld Note 19-26 has a seven-year tenor and participates 100% in the upside performance of a weighted basket comprising S&P 500, Nikkei 225, FTSE 100, SMI, and Eurostoxx 50.

In Belgium, the bank received sustainable certification from Forum Ethibel and Febelfin.

Risk-weighted assets declined by eight percent to €4.2 billion in 2019 as a result of changes in market risk, which stemmed from improved netting of hedges related to structured products.

Commission income for merchant banking stood at €52.2m of which €2.6m was related to structured products.

Client assets grew to €102 billion from €81.2 billion, while assets under management were up 31% to €87.7 billion, driven by a net inflow of €9.9 billion and a positive market performance.

‘Like most years, 2019 had its own set of challenges but on the whole we have fared reasonably well financially and in the execution of our strategy,’ said Karl Guha (pictured), chairman of the statutory board.

Click the link to view the full annual report 2019 for Van Lanschot Kempen.