Two of the largest securities houses in South Korea have posted positive results in the second quarter despite a slowdown in the structured products market.

Mirae Asset Daewoo posted a net income of KRW304.1 billion (US$508.9m) in Q2 20, a 38.6% increase year-on-year, while its net revenue rose by 31.7% to KRW604.1 billion.

Trading income and brokerage fees doubled to KRW319.8 billion and KWR189.9 billion respectively year-on-year, together representing 84.4% of the firm’s revenue.

The majority of the trading income came from fixed income, principal investment and OTC derivatives due to ‘immediate recovery of major global indices and normalization of credit spread’.

The Korean securities house issued ELS and ELB worth KRW1.2 billion from April to June, lower than the KRW3.4 billion from a year ago and the KRW2.3 billion from a quarter ago. The DLS and DLB issuance remained stable at KRW0.1 billion.

Securities sold under repurchase agreements contributed to KRW18.2 billion while the rest came from derivative-combined securities.

Meanwhile, wealth management saw a stable income from mutual fund (KRW19 billion) and trust and pension reserves (KRW13 billion), however, ‘reduced issuance and redemption of derivative linked products’ pushed the segment revenue down to KRW46.2 billion from KRW56 billion a year earlier.

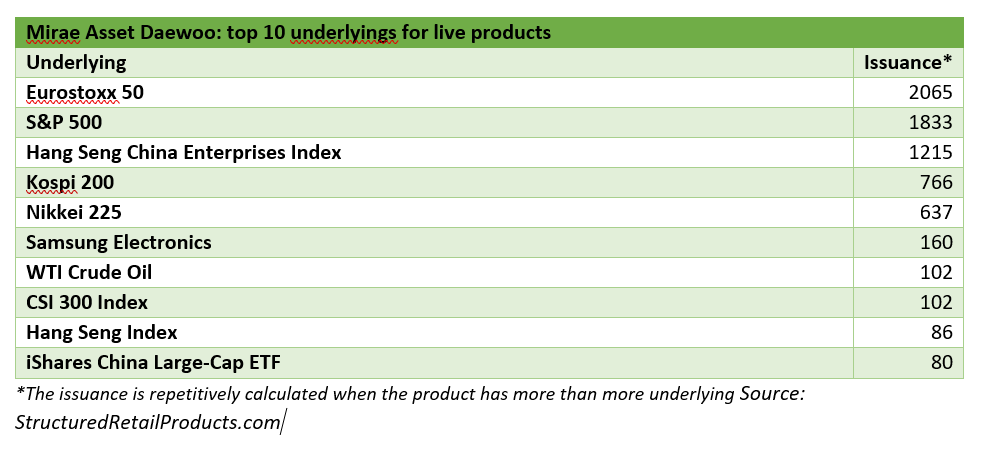

The broker-dealer, which has a market cap of KRW4.3 trillion, comes third by market share after Samsung Securities and Hana Daetoo Securities, SRP data shows. Mirae has distributed 1,153 structured products worth KRW5.5 billion during the past year, and has 2,852 live products wrapped as ELS, ELB, DLS and DLB.

NH Investment & Securities

The subsidiary of NongHyup Financial group also saw a turnaround of its net income in Q2 20, which was up 114% to KRW230.5 billion YoY, or 6.4 times the KRW31.1 billion quarter-on-quarter (QoQ).

Operating income nearly doubled to KRW296.3 billion while expenses remained stable at KRW209.9 billion YoY.

Trading income saw the highest jump from KRW45.5 billion to KRW234.9 billion YoY with ‘domestic and global stock and fixed income markets recovering’.

The ELS and ELB issuance dropped to KRW1.4 billion from KRW1.8 billion while the DLS and DLB issuance was down to KRW0.1 billion from KRW0.7 billion YoY.

In addition, the firm’s ELS and ELB outstanding remained at KRW7.1 billion while DLS and DLB slumped to KRW4 billion from KRW6.6 billion, respectively, YoY.

Brokerage commissions contributed the second largest portion to the income, which rose by 121% to KRW146 billion YoY, or a 41.7% increase QoQ. The increase resulted from ‘the market’s average daily trading value climbing 44.1% QoQ to KRW21.9 billion’.

Meanwhile, investment banking and financial product sales income saw a slight drop to KRW63.8 billion and KRW18.6 billion respectively.

NH Investment & Securities is a top 10 market player in South Korea. YTD the firm has distributed 945 products valued at KRW3.29 billion, which translates to a market share of 7.6%.

The NongHyup Financial subsidiary also delivered the best-performing product in South Korea in the first half of 2020 - NH ELS 17776, a one-year note tied to the performance of social networking service giants Facebook and Weibo ADR which delivered a 39.13% pa. return.

As recently reported, total ELS sales in South Korea plunged by almost 37% to KRW31.56 trillion (US$26.32 billion) in the first half of 2020 compared with a year ago.

Early this month, the Financial Services Commission released a series of measures to strengthen currency liquidity for securities firms and set up two platforms for investors in response to an increase in issuance of structured products in South Korea.

Click here to view the Mirae Daewo Q2 2020 report.

Click here to view the NH Investment & Securities Q2 2020 report.

Image: Shawn Ang / Unsplash