The Swiss structured products provider sees the risk profile of its products change as it broadens its product offering and aims to become a leading ESG provider for structured products.

Leonteq has posted a net profit of CHF39.9m (US$44.8m) for 2020, a 37% decrease compared to 2019 when a net profit of CHF62.7m was recorded. In H2 2020, net profit increased by six percent to CHF34.4m (H2 2019: CHF32.5m).

New features and functionalities were added to Lynqs, the company’s one-stop shop for structured products, enabling clients to manage their portfolio of structured products more efficiently across the entire value chain.

As of the end of 2020, 1,530 Lynqs users were onboarded, up from 1,056 at end-2019.

In 2020, the risk profile of products issued by Leonteq and its partners changed significantly, primarily as a result of barriers being hit in products and also due to increases in implied volatility that have not returned to the levels seen at the end of 2019, according to Leonteq.

In addition, new products issued to clients during this period tended to have different risk characteristics than the existing portfolio. The resulting changes in the risk characteristics of the structured products issued by Leonteq have increased its exposure to certain risks, including equity correlation and equity dividend risks.

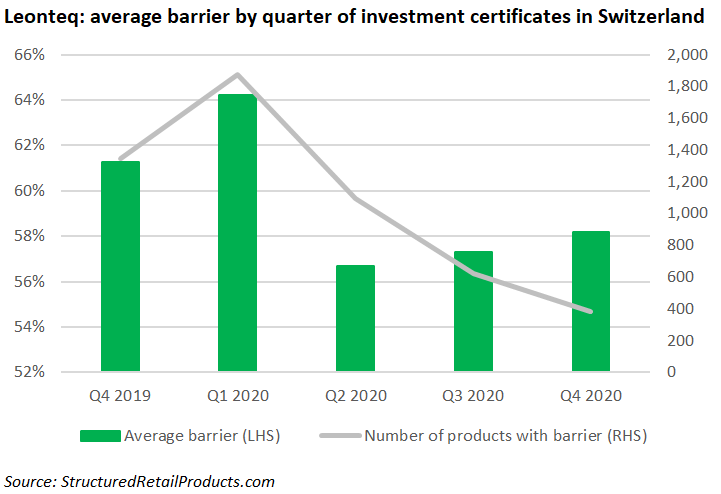

In Switzerland, Leonteq issued 3,972 investment certificates with a barrier in 2020, according to SRP data. The average soft protection barrier for these products was 58.36%, compared to an average barrier of 61.29% for the 4,712 products issued in 2019.

In Q1 2020, the average barrier for Swiss certificates stood at 64.23% (from 1,874 products), but by the end of period the financial markets had become extremely volatile – hit by the uncertainty surrounding Covid-19 – and for the remaining three quarters the average barrier hovered around 57.4%.

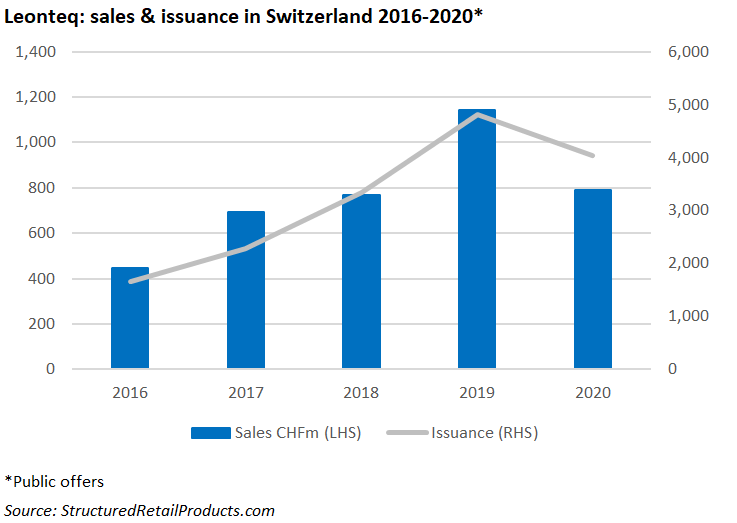

Leonteq issued 4,754 publicly offered structured products in 2020 – distributed across six different jurisdictions (FY2019: 8,468 products). The bulk of the issuance (85% of the total for the year) was targeted at investors in Switzerland, where it launched 4,054 products with estimated sales of CHF790m (FY2019: CHF1.1 billion from 4,818 products). Almost 1,200 structures were issued on the paper of EFG International Finance while 592 products were issued via Cornèr Bank.

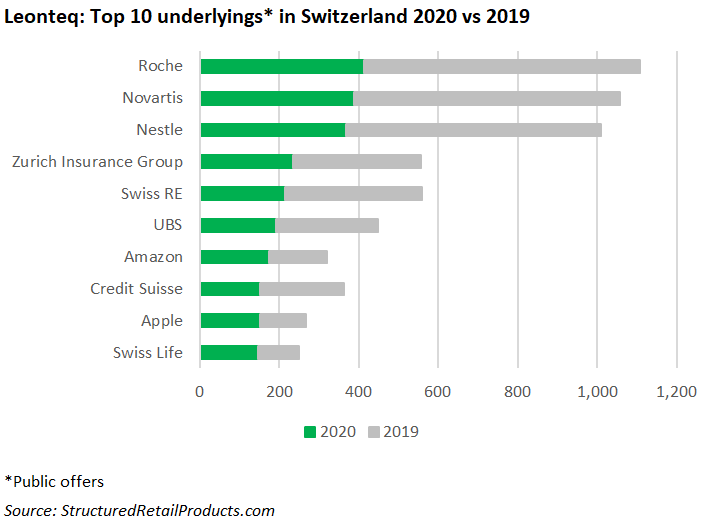

All but 16 products issued in Switzerland had a reverse convertible payoff, including 3,332 products tied to a worst-of basket. The share of Roche was the most used underlying, seen in 414 products, followed by those of Novartis (388) and Nestle (368).

The company made ‘good progress’ in broadening its product offering in 2020 through the addition of products on systematic indices and the extension of the underlying universe for actively managed certificates (AMCs). Leonteq also expanded its efforts in offering tracker certificates on a large range of crypto currencies resulting in an increase in outstanding volumes by 482% to CHF155m at end-2020.

In addition, the Swiss provider launched a number of thematic certificates through its collaborations with Morningstar and Finanz und Wirtschaft, and, most recently, The Market. Similar to features of asset management products, AMCs and tracker certificates are generally open-end certificates with an annual fee on total outstanding volumes. Leonteq’s revenues in this asset management-like business increased by 43% to CHF33m, or 10% of the group’s fee income in 2020.

In 4Q 2020, Leonteq launched a sustainability initiative that will further take shape in 2021. As part of the initiative, it will analyse its sustainability efforts within its own operations and processes as well as identify how it can support its clients and partners in investing responsibly. The company aims to encourage and implement sustainable investing opportunities for its clients and partners and is ambitious to become a leading ESG provider for structured products.

There were also changes in personnel at Leonteq in 2020. Jochen Kühn stepped down from his role as member of Leonteq’s executive committee and head of insurance & wealth planning solutions (IWPS) with Lukas Ruflin (pictured), CEO of Leonteq, directly leading the IWPS business line going forward.

Alessandro Ricci was appointed as head investment solutions and member of the executive committee. Ricci took over the responsibilities of David Schmid, who left Leonteq after 12 years with the company.

Click the link to read the full Leonteq second half and full year 2020 results, presentation and annual report (Leonteq Securities).