J.P. Morgan has issued a new range of structured notes linked to the J.P Morgan basket of companies which provide exposure to the cryptocurrency market via a basket of stocks.

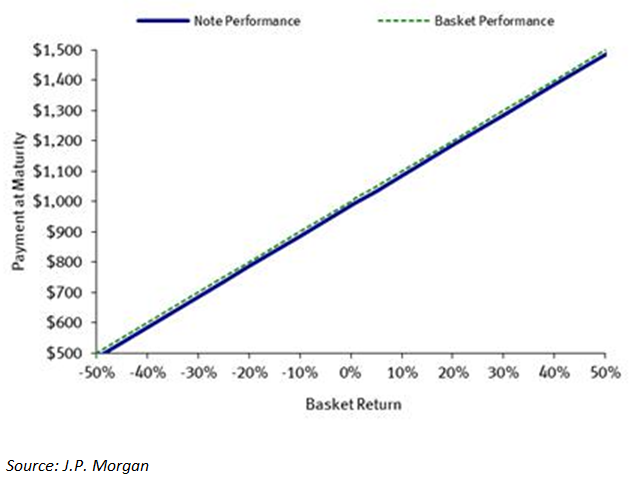

The Insight Notes were registered on 10 March by JPMorgan Chase Financial Company on the US Securities regulator (SEC). The two-year capital at risk structure will pay 100% participation on the performance of the underlying basket minus 1.5% basket deduction. The note, which strikes on 6 April will be available to investors from 31 March from a minimum US$1,000.

The J.P. Morgan basket of companies includes the stocks of 11 US-listed companies that operate businesses that the bank believes ‘to be, directly or indirectly, related to cryptocurrencies or other digital assets, including as a result of bitcoin holdings, cryptocurrency technology products, cryptocurrency mining products, digital payments or bitcoin trading’.

The unequally weighted underlying basket includes MicroStrategy (20%), a company holding more than 90,000 bitcoin; Square (18%), a payments company which derives its revenues from bitcoin trading with 3,318 bitcoin in its balance sheet; graphics card maker Nvidia, whose products are used to mine Ethereum and other cryptocurrencies; and Riot Blockchain (15%); and PayPal (10%). The weights of the reference stocks were determined based in part on exposure to bitcoin, correlation to bitcoin and liquidity.

Eusipa: Volume largely stable on Europe’s structured products markets

Turnover in investment and leverage products listed on reporting European financial markets totalled €35 billion in the fourth quarter of 2020, an increase of five percent quarter-on-quarter and 27% year-on-year, according to the European Structured Investment Products Association (Eusipa).

Fourth quarter turnover in investment products on European trading venues amounted to €13 billion, 37 % of the total. Investment product turnover increased 40 % over the quarter but remained largely stable compared with the last quarter of 2019. Turnover in leverage products including warrants, knock-out warrants, and constant leverage certificates, reached €22 billion in Q4 20, representing 63 % of the total. Turnover in leverage products increased 47 % year on year, but fell eight percent from the previous quarter.

At the end of December, trading venues located in reporting Eusipa markets were offering 448,035 investment products and 1,237,343 leverage products - the number of listed products was stable on a quarterly basis, though contracted seven percent from the previous year.

Banks issued 1,332,686 new investment and leverage products in the fourth quarter of 2020, an increase of two percent on the previous quarter and 19 % year-on-year. In total, 147,704 new investment products were launched, accounting for 11 % of new issues; the 1,184,982 new leverage products represent 89 % of the total. Investment product issuance was up 16 % on the previous quarter; leverage product issuance was unchanged from Q3 2020, though up 22% year-on-year.

For Austria, Belgium, Germany, and Switzerland, the market volume of investment and leverage products issued as securities stood at €281 billion at the end of the fourth quarter, a two percent quarter-on-quarter increase.

The market volume of investment products was a stable €271 billion – up just two percent quarter on quarter and two percent year on year. The outstanding volume of leverage products totalled €10 billion, a 30% year-on-year decrease that can be attributed largely to the Swiss market.

EFG International goes with ‘Investment Navigator’

EFG International has selected Investment Navigator to ‘further enhance’ its compliance framework, and automate suitability assessments of its services and products.

Swiss fintech Investment Navigator platform offers reg-tech solution to automate suitability assessment of services and products including distribution eligibility checks on ISIN level for mutual funds, ETFs and structured products as well as digital compliance guidance on cross-border business activities.

The Investment Navigator solution capabilities will be integrated into Swiss bank’s existing platforms for advisory, discretionary and execution only businesses worldwide, with the first Investment Navigator web-application having been rolled-out in Switzerland earlier in January.

‘Reliable information on service and investment restrictions, especially in the context of cross-border banking, has become essential for wealth managers to comply with international legislation,‘ said Julian Köhler, cofounder and chairman of Investment Navigator.

ETC Group debuts Ethereum play

ETC Group Physical Ethereum ETC listed the ETC Group´s Physical Ethereum ETC on Deutsche Börse’s Xetra platform on 9 March. The exchange-traded cryptocurrency is structured as an asset-backed debt security and will offer exposure to the price of Ethereum

The new ETC is the first Ethereum product to be listed on Xetra and will be central counterparty cleared. The product will be marketed and distributed across Europe by HANetf and has a management fee of 1.49%.

The announcement follows the launch of ETC Group’s first product - BTCetc Bitcoin Exchange Traded Crypto – which was the first cryptocurrency product to launch on Xetra last June, and which has seen its assets under management grow to over US$1 billion in just seven months.

BTCE was the most traded product on the exchange’s ETN segment in the second half of 2020, displacing the highly successful Xetra Gold. In the last 10 days the bid-ask spreads averaged just 13bps.

Bradley Duke, CEO of ETC Group said these types of instruments ‘offer great diversification from traditional assets such as equities and bonds, and strong hedging qualities against inflation’.

GraniteShares rolls out US tech ‘conviction’ leveraged/unleveraged trackers

ETF provider GraniteShares has announced the launch of the world’s first exchange traded products (ETPs) tracking baskets of US technology baskets.

The FAANG (Facebook, Amazon, Apple, Netflix and Google), GAFAM (Google, Apple, Facebook Amazon and Microsoft), and FATANG (Facebook, Amazon, Tesla, Apple, Netflix and Google) ETPs track small ‘baskets’ of stocks and are being marketed as the ‘latest development in conviction investing’.

GraniteShares’ new product suite which went live on 8 March on the London Stock Exchange, offers long, short and 3X leveraged ETFs on FAANG, GAFAM and FATANG indices. The ETFs can traded via ordinary brokerage accounts, and have a 0.99% TER for the leveraged products, and 0.69% TER for the unleveraged.

Image: Fabio / Unsplash