The Canadian bank retains its leading position in the domestic retail market after a sustained increase in issuance.

Bank of Montreal (BMO) Financial Group has maintained its strong structured product issuance in the second quarter of 2021 with 340 products as of 30 April 2021. It emerged as the top-ranking issuer group, according to SRP data.

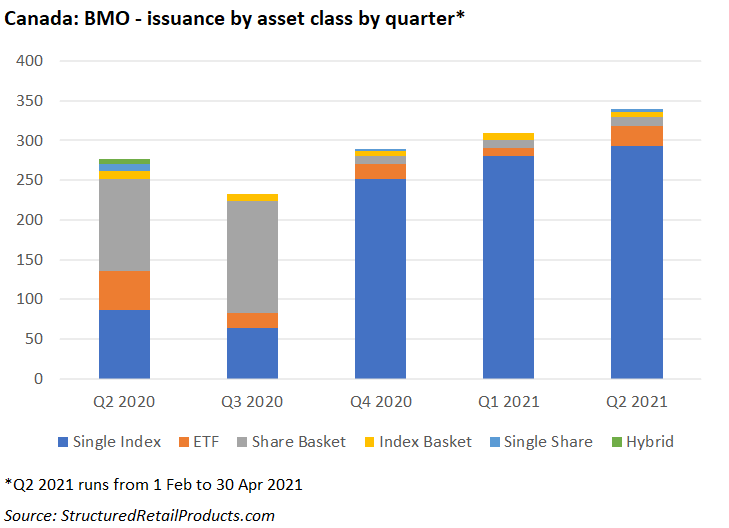

The bank’s product issuance kicked off its second quarter of 2020 with 277 structured products. This figure subsequently dropped to 233 in the third quarter but recovered to 289 in the final quarter, and this figure increased in the first quarter of 2021 to total 310 products.

The country’s issuer ranking is completed by National Bank of Canada with 284 products, CIBC with 232, Scotiabank with 141 products, RBC with 87 products, Desjardins with 69 products, and Toronto Dominion with 60 products.

BMO saw a spike in the volume of products tied to the Solactive Canada Bank 30 AR Index, Pipelines AR Index, Insurance AR Index, and United States Big Banks AR Index during the first quarter of 2021.

The most recent product issued by the bank is the Solactive Equal Weight Canada Banks AR Index Principal Protected Deposit Notes, Series 5 (F-Class). The growth note wrapper has a five-year term with the strike date 30 April 2021 and is linked to the Solactive Equal Weight Canada Banks 5% AR Index.

There has been a notable shift in the popularity of underlying sectors as seen in Q1 20 where banking reigned as the category with the highest level of interest. Currently, the dividend sector is the most sought-after underlying sector across BMO’s structured product issuance.

Earnings

As of 30 April 2021, the bank led by Darryl White (pictured) reported that net income stands at CAD1.3 billion, up from CAD689m in the same quarter a year prior, while adjusted net income currently totals CAD2.1 billion, reflecting an increase from CAD715m.

Provision for credit losses (PCL) reached CAD60m, compared with a whopping CAD1.2 billion in Q2 20.

BMO Capital Markets reported a net income of CAD563m, compared with a reported net loss of CAD74m in the prior year. BMO Wealth Management’s reported net income was CAD346m, reflecting a jump of CAD202m from the prior year.

These results were driven by a strong revenue performance in global markets and investment and corporate banking in the current quarter and a recovery of the provision for credit losses, compared with elevated levels of provisions for credit losses in the prior year.

Click here to view the bank’s earnings release.