Single Platform Investment Repackaging Entity (Spire) has added Unicredit Bank to its multi-dealer programme, expanding the pool of issuers offering repackaged securities on the platform to 16.

The Spire programme allows repackaged notes arranged by the platform’s dealer-members to be issued in standardised formats. Investors can gain exposure to a variety of underlying collateral assets and customisable payoffs.

The platform has transacted in excess of €38 billion-equivalent of repackaged securities issued to major UK, European and Asian institutional investors to date.

‘Complementary to our existing suite of repackaging solutions, we see the Spire platform providing additional choice and benefits that address some of the needs of our institutional client franchise,’ said Amit Sharma, Unicredit’s global head of markets structuring & solutions.

Unicredit is seeking to adapt and upgrade its product platform ‘in line with the evolving needs and preferences of institutional investors, particularly those in the European pension and insurance sector’, according to Guido Filippa, global head of institutional distribution and private investor products at Unicredit.

The Spire platform was established by BNP Paribas, Citigroup, Credit Suisse and J.P. Morgan in May 2017. Barclays, Goldman Sachs, Crédit Agricole CIB and Morgan Stanley joined in 2018. Natixis, BofA Securities Europe SA, Deutsche Bank, HSBC, Société Générale and NatWest Markets joined in 2019. Nomura joined in 2021.

Julius Baer enters BX Swiss structured products segment

BX Swiss continues to grow its 'deriBX' by welcoming Julius Baer now issuing products on BX Swiss

Julius Baer has started issuing its first structured products on BX Swiss, including warrants on underlying assets such as equities and indices from Switzerland, Europe, and the US. In the coming months, Julius Baer will further expand the range of leveraged products tradable on deriBX, the exchange’s structured products segment.

'The partnership with BX Swiss is another step in our efforts to provide innovative solutions and services to our clients and investors via professional platforms. We are pleased and proud that by connecting to the deriBX segment, we are opening up another opportunity to trade our successful and popular leverage products in a fast and easy way, said Luigi Vignola, head markets Julius Baer.

'With our deriBX segment, we offer investors a steadily growing range of exchange-traded structured products. With Julius Baer, we welcome another well-known issuer as a market maker on deriBX and gain a valuable partner in our constantly growing ecosystem,' added Lucas Bruggeman, CEO of BX Swiss.

Strukturinvest becomes Strivo

Swedish structured products provider Strukturinvest Fondkommission has changed its name to Strivo.

The new name, effective 18 October, reflects an increasingly broad offering and, because it is shorter, is considered to be more easily accessible, according to the company

Strukturinvest Fondkommission was founded in 2009 as a product company with a focus on tailored investment solutions.

The company has 643 live structured products worth a combined US$800m listed on the SRP Sweden database. The products are issued in collaboration with a wide range of counterparties, including, among others, Credit Suisse, Danske Bank, BNP Paribas, Goldman Sachs, Nordea, and Handelsbanken.

‘The name change is a logical one steps in our development as a company and gives us the freedom to continue on the path we have set; to offer the market's widest range of attractive investment solutions such as funds, equities, structured products, trackers and various deposit solutions via an innovative, in-house developed digital platform’, stated Declan Mac Guinness (right), CEO of Strivo.

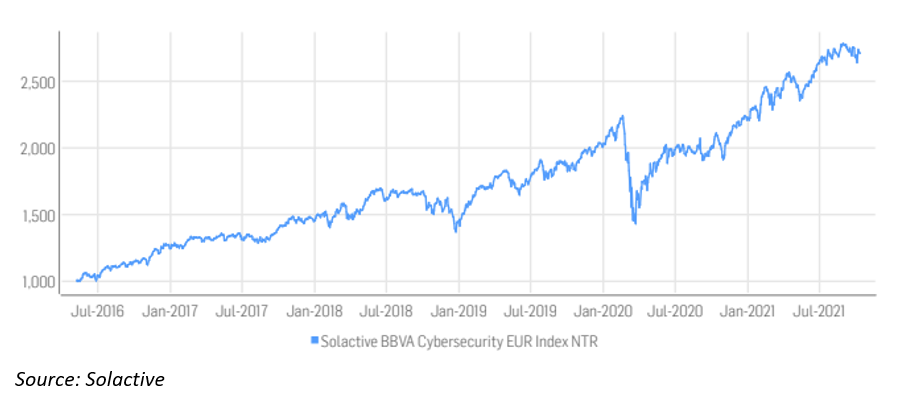

BBVA QIS deploys cyber play

BBVA has added the Solactive BBVA Cybersecurity Index to its range of quantitative investment strategies (QIS).

The new technology index is comprised of equity stocks of companies helping to create a trusted and safe cyberspace companies in the frontline of digital security; data protection and cyber-risk insurance, as well as those creating secure online transaction platforms and heeding the call for cyber defense, thanks to the low-latency network infrastructure and components.

The Solactive BBVA Cybersecurity index is part of BBVA QIS' strategy to offer its clients exposure to one of the most relevant megatrends - technological disruption - and is a fully complementary strategy to the recently launched Solactive BBVA Next Generation Networks index, according to Javier Enrile Mora-Figueroa, head of QIS sales at BBVA.

“Hyperconnectivity is an already visible future, but not without threats,” he said. “Companies, governments and individuals are constantly exposed to cyber-attacks, and the cost is growing steadily. The Solactive BBVA Cybersecurity index strategy is based on the strong growth in the demand for cybersecurity services expected in the near future, due to the increasing frequency and sophistication of cyberattacks, regulatory pressure across the board and the IOT expansion, which calls for another added level of cybersecurity."

The top components of the index include Oracle (5.54%), Microsoft (5.11%), Adyen (4.39%), Paypal (4.22%), Lockheed Martin (4.18%), Chubb (3.63%), Fiserv (3.57%), Analog Devices (3.53%), Fidelity National Information Services (3.44%), and Palo Alto Networks (3.43%).

The new underlying is available now for direct investment and distribution through structured products.

Institutional investors expect strong growth in customised indexing

Increasingly sophisticated and individualised ESG strategies will be key drivers for the continued growing demand of customised portfolio solutions.

Fixed income is seen as the asset class with the biggest need for customisation 60% of institutional investors are already using customised portfolio solutions developed with external partners, according to new research from quant technologies provider SigTech.

According to the survey, 70% of pension funds and other institutional investors believe demand for custom portfolio solutions will increase strongly.

The disruptive market forces of ESG, indexing and digitisation are driving this increased demand for customisation. Two thirds of those surveyed (67%) believe it will become one of the biggest growth areas in asset management and is one of the industry’s most exciting developments.

Customised portfolio solutions are bespoke investment strategies that are developed to meet the specific needs of investors. One of the key reasons for growth in this market is that 75% of the institutional investors surveyed said they are becoming increasingly sophisticated in their individual ESG requirements. In addition, investors are finding it difficult to find off-the-shelf products offered by fund managers that are fully aligned with their needs.

Forty one percent of participants said they believed fixed income was the asset class with the biggest need for customisation, followed by 27% who cited commodities, 18% said equities and 14% mentioned hedge funds.

When it comes to implementing their individual ESG policies, the study found that institutional investors use a combination of solutions. 65% said they use off-the-shelf products (i.e. without any customisation), 60% use customised portfolio solutions with external partners, and 52% said they develop these internally.

SigTech commissioned the market research company Pureprofile to survey 100 pension funds and institutional investors across the UK, US, and Asia. Collectively they have around $935 billion in assets under management. Interviews were conducted online in September 2021.