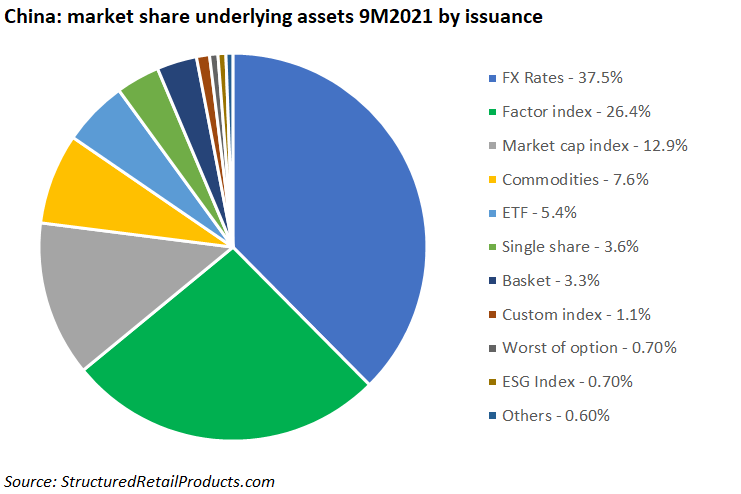

Investors in China had a strong preference for FX rates and factor indices in 9M2021.

Some 2,584 structured products had strike dates in China during the first nine months of 2021.

FX rates and equities, seen in 969 and 1,243 products respectively, dominated underlyings, while there was also a high number of products (195) linked to commodities, including crude oil, gold, methanol, rebar, rubber and soybean.

The most used underlying in 9M 2021 was the CSI Smallcap 500 Index, which appeared in 655 products. The index is designed to reflect the price fluctuation and performance of the 500 smallest and most liquid stocks in the China A-Share market. However, by issuance, FX rates had the biggest share of the market (37.5%), with EUR/USD (510 products), USD/JPY (259), AUD/USD (174) all frequently used.

Check out the below pie-chart for the preferred underlying assets of the Chinese investor.