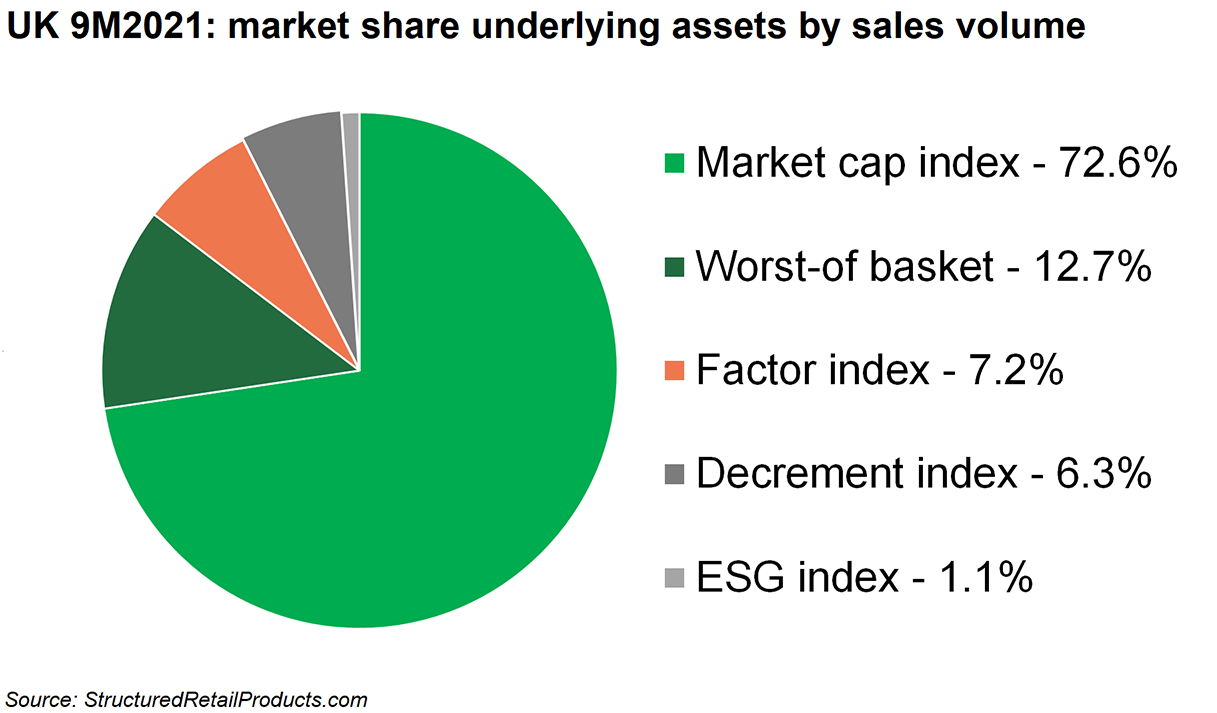

Market cap indices were once again the preferred underlying asset for UK investors in 9M2021.

Some 353 structured products with estimated sales of £630m were issued in the UK during the first nine months of 2021 – slightly up in issuance but down in sales volumes compared to the prior year period (9M2020: £714m from 323 products).

Ninety percent of the products issued in 9M2021 were autocallable plans, and of these 208 were linked to the FTSE 100.

Very few markets are dominated by a single index to the extend the FTSE 100 dominates the UK. All bar two of the 220 products linked to market cap indices that collected combined sales of £460m – the equivalent of 72.6% share of the market – were tied to the UK benchmark. The exception were two structures from Meteor/Natixis on the FTSE Custom 150 Equally Weighted Discounted Return Index.

Furthermore, the FTSE 100 was also used in 24 products linked to a worst-of basket, which, with 62 products in total, was the number two underlying asset in the period (12.7% market share).

Other indices seen in worst-of baskets were the S&P 500 and Eurostoxx 50, while the most used shares were those of Nio, Vodafone, and Enphase Energy.

In third were factor indices, which in this case were limited the FTSE 100 Equal Weight Fixed Dividend Custom Index. The 36 products linked to this index were exclusively distributed via Tempo Structured Products and issued on the paper of Société Générale. They collected estimated sales of £45m (7.2% market share).

Decrement indices achieved estimated sales of £40m from 31 products (6.3% market share). The FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index was the most frequently used (29 products), while MSCI Europe Select Green 50 3.5% Decrement Index and MSCI United Kingdom Sustainable Select 50 3.5% Decrement Index were used in one product each.

The decrement-linked products, which were all marketed via Mariana Capital, were issued by Morgan Stanley (16), Citi (10), Goldman Sachs (three), and Crédit Agricole (two).

Finally, two products, both from Investec, were tied to an ESG index (FTSE4Good UK 50 Index).

Check out the below pie chart for the preferred underlying assets of the UK investor.

SRP is the leading source of data intelligence on structured products globally, enabling you to plan for the future, gain market insights and compete strategically. Contact us to try a free a demo.

Main image: Kings Church International/Unsplash