Intesa Sanpaolo continued its stronghold of the Italian structured products market in 2021.

Some 2,246 structured products worth and estimated €10.7 billion were issued in Italy between 1 January and 31 December 2021 – a 22% decrease by sales volumes compared to the previous year (FY2020: €13.7 billion from 1,868 products).

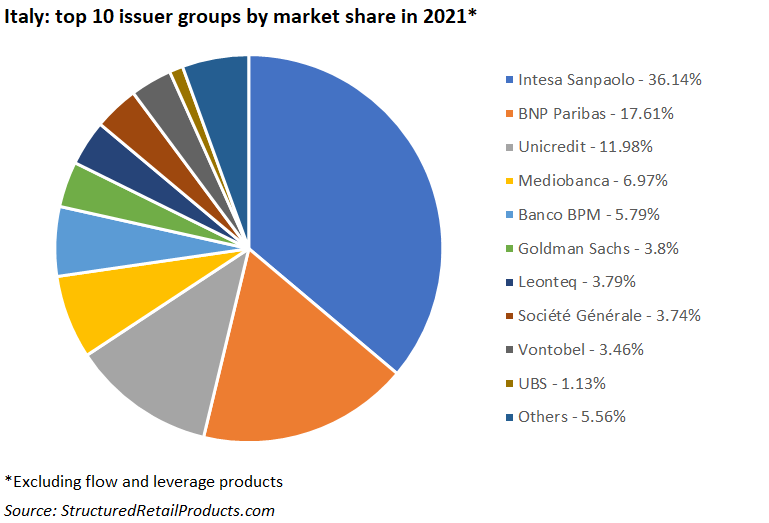

There were 20 issuer groups active in the Italian market during 2021.

Of these, Intesa Sanpaolo was the number one provider, as it has been for the majority of the past 10 years (with the exception of 2012 and 2016 when it finished second behind BNP Paribas). The bank collected €3.9 billion from 116 products – the equivalent of a 36% market share, according to SRP data.

BNP Paribas and Unicredit, with a market share of 17.6% and 12%, respectively, finished second and third, while Mediobanca (6.9%) and Banco BPM (5.8%) completed the top five.

The latter achieved its market share from just eight products, which sold €78m on average and included Equity Protection con Cap e Cedola, a five-year capital protected certificate on the Swiss Market Index that became the best-selling product of the year with sales of €133m.

A barrier express certificate from Leonteq, which sold €1.1m at inception, registered the highest performance of the year. The five-year autocall saw its knockout feature triggered on 28 Januari 2021, at the first time of asking, when the underlying shares of A2A, Electricite de France, Unicredit, and Veolia Environnement, all closed above 75% of their respective starting levels. Investors were due a one percent coupon. However, because a coupon trigger event occurred on 16 November 2020, a welcome coupon of 18% was also paid.

Check out the below piechart to view the top 10 issuer groups in the Italian market.

Main image credit: Jametlene Reskp/Unsplash