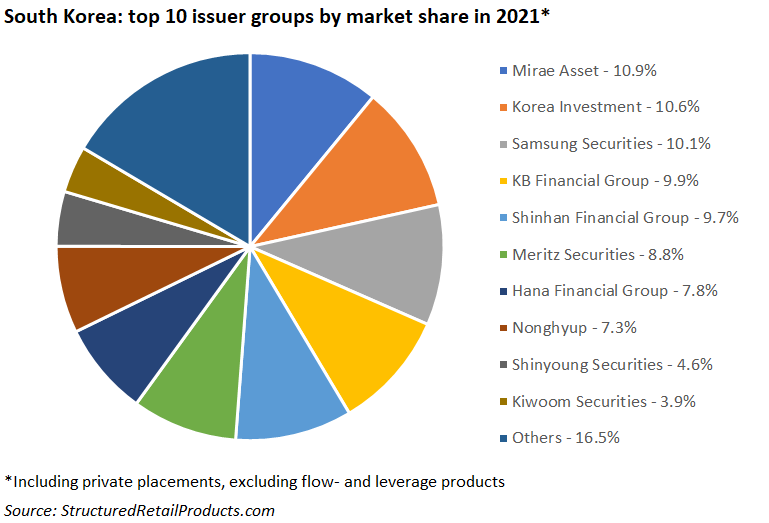

2021 was a year of fine margins in South Korea, with the top three issuer groups seperated by only 0.8 percentage points.

Some 19,610 structured products worth KRW87.9 trillion (US$76.8 billion) had strike dates in South Korea between 1 January and 31 December 2021 – a 5.5% decrease by sales volumes compared to the previous year (FY2020: KRW93.1 trillion from 18,907 products).

Aproximately 80% of total sales was gathered from 13,476 products targetted at retail investors with the remaining volumes coming from private placement.

Twenty-three issuers were active during the year, mainly local securities houses.

Mirae Asset retained its position as the main issuer with a 10.9% share of the market, despite seeing its sales drop by 31% year-on-year (YoY). The company collected KRW9.6 trillion from 1,862 products that were mainly autocalls on a worst-of basket (FY2020: KRW14 trillion from 1,988 products).

Korea Investment and Samsung Securities – in second and third place, with a market share of 10.6% and 10.1%, respectively – also saw a YoY decline in sales, but on a much smaller scale than Mirae. The former accumulated KRW9.3 trillion from 1,770 products (-1.04%) while Samsung achieved sales of KRW8.8 trillion from 2,503 products (-4.84%).

Meritz Securities was responsible for the best-selling structure of the year, which came in the shape of Meritz ELB 218. The one-year, fully capital protected digital was linked to the Kospi 200 and sold KRW1.3 trillion during its subscription period.

KB able ELS 1115, which was distributed via KB Investment & Securities, achieved the highest performance. The product, which was linked to the shares of Samsung Electronics and Naver, returned 145.40% of the nominal invested after one year. UBS was the derivatives counterparty.

Check out the below piechart to view the top 10 issuer groups in the South Korean market.