2021 proved to be an Anglo-French affair with issuers from both countries vying for the number one spot in the UK retail market.

Some 495 structured products worth an estimated £930m (US$1.3 billion) had strike dates in the UK in 2021 – up seven percent by sales volume compared to the previous year (2020: £870m from 418 products).

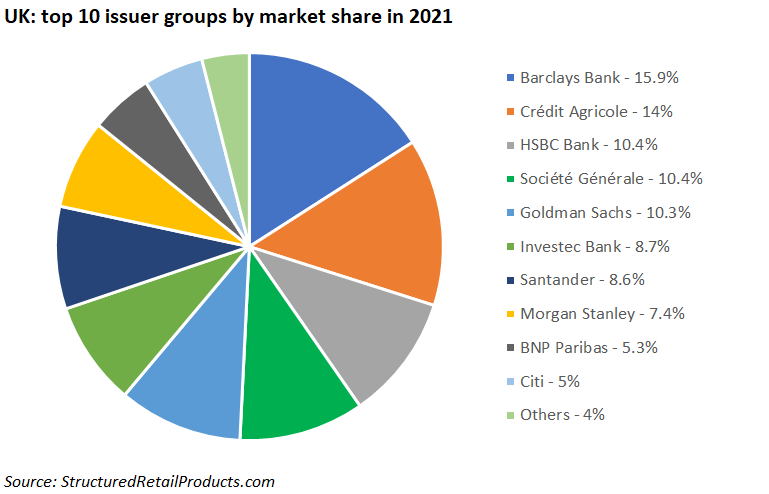

Twelve issuer groups were active during the year. They included the main UK, European and US investment banks – with the exception of J.P. Morgan.

Barclays was the number one issuer group with a 15.9% share of the UK retail market. It collected approximately £150m from 79 products, significantly up from the previous year (2020: £45m from 36 products).

It is the first time Barclays topped the issuer chart in the UK market, which in recent years had been dominated by Investec (since 2014). The South African bank still made the top 10, despite only launching 23 products at the start of the year, after it announced it would stop issuing structured product plans in the UK retail market from April 2021.

Crédit Agricole was the surprise package, in second. The bank, which first entered the UK retail market in 2020, achieved a market share of 14% from 51 products. The majority of its plans (37) were distributed via Meteor, while some were available from Walker Crips (12) and Mariana (two).

HSBC and Société Générale finished joint third, each with a 10.4% share of the market. The former mainly used Walker Crips as distribution partner while SocGen predominately worked with Tempo Structured Products.

Fifth placed Goldman Sachs (10.3% market share) marketed its product via five different parties, including Idad and Causeway Securities.

Issue 27 of Santander’s Defined Return Plan was the best-selling product of the year. The six-year, capital protected note, which is linked to the FTSE 100 and listed at Euronext Dublin, collected £39.4m during its subscription period.

Citi was behind the best-performing product of the year. It came in the shape of a three stock defensive autocall, which was part of Hilbert Investment Solutions’ Kick Out Series. The seven-year note redeemed early after just six-months when the shares of Aviva, Barclays and Vodafone all closed above their respective initial levels. Investors received a return of 110% of the nominal invested (21.2% pa).

Disclaimer: data refers to public distribution products only.

Main image: Kings Church International/Unsplash