Large French financial institutions captured almost 90% of their domestic market in 2021.

2021 was an excellent year for the French structured products market.

Sales volumes, at an estimated €23.4 billion, were up by more than 50% year-on-year (FY2020: €15.4 billion), while issuance stood at approximately 2,500 products, an increase of 26% from the prior year (1,988).

In fact, sales were at their highest levels since the launch of the SRP France database in 2004. The previous high was reached in 2007 when volumes reached €22.8 billion, although back then it was achieved from far fewer products (251), according to SRP data.

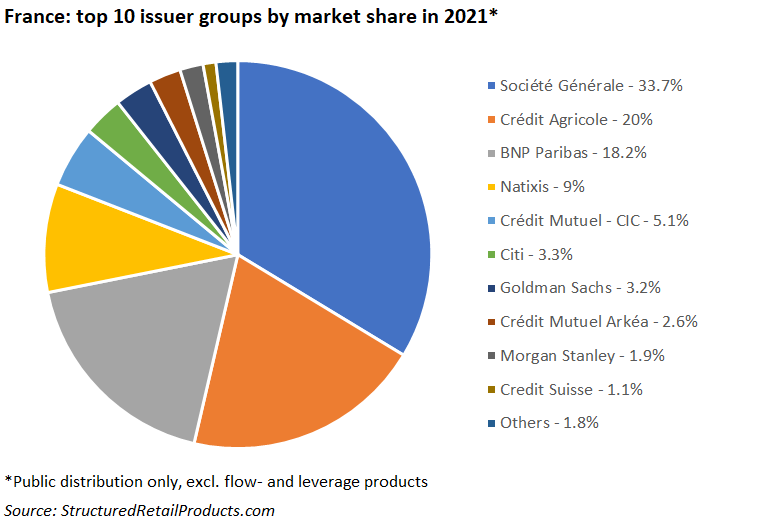

Thirteen issuer groups were active during the year. They included all the main French providers and a number of foreign (mainly US) investment banks.

Société Générale was the number one provider with a 33.7% share of the French market. It accumulated estimated sales of €7.9 billion from 1,122 publicly distributed products, which were almost exclusively issued on the paper of SG Issuer.

In Second, Crédit Agricole held a 20% market share, collecting €4.7 billion from 145 products. The group issued its products via LCL Emissions, Amundi and its corporate and investment bank (CIB). The former achieved the highest sales, at €2.2 billion (from 14 products), including €455m that was collected by LCL Autocall AV Mars 2021, which was the best-selling French product for the year.

BNP Paribas issued 634 products, predominately through its Dutch domiciled BNP Paribas Issuance BV vehicle. The bank sold an estimated €4.3 billion – the equivalent of an 18.7% market share – while Natixis in fourth place captured 9.4% of the market (€2.1 billion from 111 products).

Crédit Mutuel CIC completed the top five with a 5.1% market share from 66 products sold (€1.2 billion)

The highest ranking non-French group was Citi. The US bank collected €780m from 114 products sold (3.3% market share). Citi was the first to offer French investors access to autocalls on single stock decrement indices, including iStoxx FP GR Decrement 2.54 Price EUR Index (TotalEnergies), iStoxx ORA GR Decrement 0.7 EUR Index (Orange), and iStoxx Engi GR Decrement 0.71 Price EUR Index (Engie).

Crédit Mutuel Arkéa also made the top 10, with a market share of 2.6%, which meant that French institutions captured 88.6% of their local market in 2021.

Disclaimer: data refers to public distribution products only.