Belfius almost doubled its market share in the first quarter of 2022 with KBC the most notable absentee.

Some €250m was collected from 24 publicly offered structured products during Q1 2022 in Belgium – down 37% by sales volume year-on-year (Q1 2021: €398m from 44 products).

Despite a drop in sales, average volumes, at €10.7m, were slightly higher than those in Q1 2021 when products sold on average €9m.

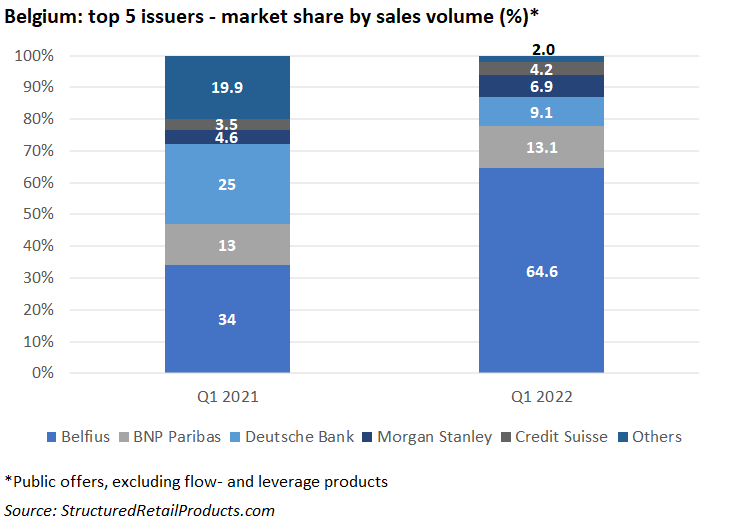

Six different issuer groups were active in Q1 2022 compared to 10 in the prior year quarter. KBC was the most notable absentee. The bank-insurer had claimed a 12.2% market share in the first quarter of last year but issued no products this time around.

ING Bank, Société Générale, Goldman Sachs and Citi also refrained from issuing products this quarter.

Belfius captured 64.6% of the market in Q1 2022 – an increase of 30.6% YoY. The bank collected an estimated €160m from 10 products between 1 January and 31 March 2022 (Q1 2021: €135m from 15 products). Its offering included Belfius Financing Company (LU) Callable Interest 03/2032, a 10-year steepener linked to the constant maturity swap (CMS) rate that was the best-selling product of the quarter with sales of product of the quarter with sales of €49m.

The best-performing product also came from Belfius. Its Megatrends Coupon Private Notes, which were linked to the Solactive Megatrends US-EU Index, matured on 9 March, returning 148.62% (8.24% pa).

BNP Paribas consolidated its position as the second most active product manufacturer, with a market share of 13.1% – level on last year. It sold five products that were distributed via Bpost Bank.

In third, Deutsche Bank’s market share significantly decreased: from 25% in Q1 2021 to 9.1% this year. All its products were available via the branch network of Deutsche Bank Belgium, which also distributed the products issued Morgan Stanley, Credit Suisse and Barclays, the three other active issuers this quarter.