Krungthai Bank has expanded its offering of inverse floater notes following six tranches last month, which had collected THB1 billion.

The state-owned Thai bank is pitching two inverse floater notes linked to the three-month Thai overnight repurchase rate (THOR), available from 8 to 12 July. Offering full principal protection, the two-year products pay an interest rate of 3.5% pa. to 0.5% pa. on a quarterly basis – the interest rate is fixed at 2.75% pa. for the first period.

The offerings represented a revisit of inverse floater notes at Krungthai Bank where six tranches had been issued last month with a tenor from 18 months to three years.

‘Even though the market is forecasting a trend to raise interest rates, some investors think Thai interest rates will not increase much during the two investment years as the Thai economy has not fully recovered from inflation, which is caused by supply-side factors such as oil prices,’ said Rawin Boonyanusasna (pictured), head of global markets group at Krungthai Bank

SG: underperformance of skew and fixed strike volatility

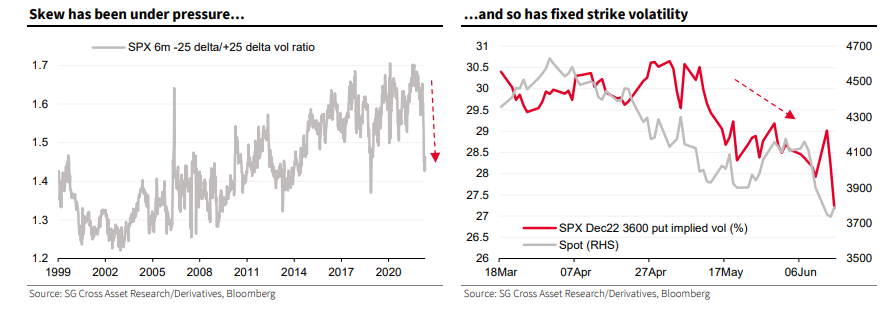

Hedging flows from structured products has resulted in increased implied volatilities in the market, according to a global equity volatility outlook report published by Société Générale on 22 June.

A salient feature of the equity market sell-off in 2022 has been the pressure on skew as well as on fixed strike volatilities, stated the bank. In the initial deleveraging phase of this prolonged and trending selloff, investors seem to be monetising their hedges as the spot moves lower, and in the absence of a chaotic sell-off, this can lead to underperformance in fixed strike volatility. Normalised skew on S&P500 has dropped to multi-year lows, making puts relatively cheap compared to calls.

With spot moving lower, the hedging flows from structured products has also arguably put pressure on implied volatilities, according to SG. ‘Given we were at extreme levels of skew at the beginning of the year, subsequent investor activity seems to have been to monetise hedges, deleverage risk and even to bid up call options to hedge the upside, which be the reason for the larger increase in upside volatility,’ stated the report.

Scientific Beta launches trade tension and pandemic indices

The Singapore Exchange-backed index provider has launched a new suite of indices for the satellite sleeve of institutional investors' portfolios where the offering comprises trade tension and pandemic indices, enabling investors to take tactical bets on particular risks relating to trade tensions and pandemics.

The objective of the satellite indices is to offer a robust conditional reaction or outperformance following shocks to these risks.

For trade tensions, the French firm is providing trade war and trade peace indices that react positively and negatively to negative shocks to trade tensions, such as tariff announcements. For pandemics, the indices react positively and negatively to consequences of pandemic outbreaks, such as social distancing measures.

‘Like all Scientific Beta's indices, the pandemic and trade tension indices are based on academic research, notably on teleworkability and firm-level exposure to epidemic diseases for the pandemic indices and the tradability of goods and risks relating to trade policy in the case of the trade tension indices,’ said Noël Amenc (right), CEO of Scientific Beta.

Hong Kong, China to co-develop Swap Connect

Financial watchdogs in Hong Kong SAR and China are working to set up Swap Connect, a new mutual market access programme which will enable offshore investors to execute interest rate derivatives transactions with onshore investors in China.

‘The extension of market access to over-the-counter derivatives through Swap Connect will be another milestone, enabling global investors to participate more broadly in the vast Mainland bond market,’ said Ashley Alder, CEO of the Securities and Futures Commission (SFC), in a joint announcement with the People’s Bank of China and the Hong Kong Monetary Authority released on 4 July.

Sponsors of the programme include OTC Clearing Hong Kong Limited, China Foreign Exchange Trade System (National Interbank Funding Center) and Shanghai Clearing House.

The northbound link will be introduced first, allowing overseas investors to participate in the Chinese interbank financial derivatives market through mutual access between Hong Kong and China infrastructure institutions in respect of trading, clearing and settlement. Implementation details and the official launch date are to be announced.

MerQube to calculate, admin UBS CMCI family

The US index provider is working with UBS as the calculation agent and administrator of their CMCI Family which will be known as the UBS Constant Maturity Commodity Indices going forward.

This family of approximately 1100 constant maturity commodity indices (CMCI), which were launched in 2007, provides investors with beta exposure to commodity markets offering the broad composite index to more focused options.

‘Delivering on a varied and complex family of indices such as CMCI, is a demonstration of our ability to deliver on both complexity and scale. Our cloud native platform is agile, scalable and cost-efficient,’ said Vinit Srivastava (right), CEO of MerQube.

The UBS Constant Maturity Commodity Index is one of the most successful and innovative next generation commodity indices in the street, according to David Rouse, UBS QIS Platform.