The autocall market in South Korea has hit its lowest point in terms of issuance while a number of equity-linked securities (ELS) failed to knock out during the first half of 2022.

Both sales volume of ELS and equity-linked bonds (ELBs) in South Korea in the first half of 2022 have reached historical lows in view of the equity drawdown.

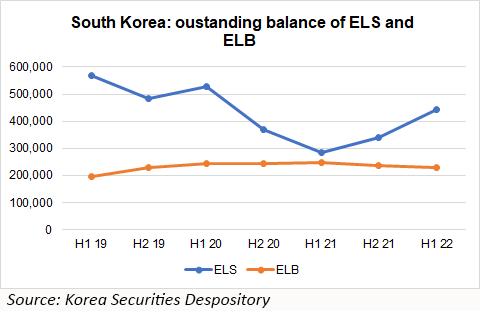

A group of 22 securities houses issued a combined 7,124 ELS worth KRW18.1 trillion (US$13.9 billion) in H1 22, down 37.3% year-on-year (YoY), or a 56.9% decline from the ELS peak in seen in H1 19, according to the latest data from the Korea Securities Depository (KSD).

Meanwhile, 881 ELBs were sold at KRW5.5 trillion during the six months, 17.9% lower YoY. The combined sales of ELS and ELB dropped 33.6% to KRW23.6 trillion YoY.

Public offerings remained the dominant channel while private placements continued the downward trend started three years ago when sales stood at KRW2.3 trillion, down 47.7% YoY.

As a number of ELS failed to trigger knock outs due to the equity drawdown, the ELS segment posted a record-high outstanding balance at KRW44.4 trillion in two years as at the end of June, up 55.1% YoY. In the meantime, ELB delivered a relatively stable balance at KRW22.7 trillion.

The total knock-out volume in H1 22 plunged 77.8% to KRW7.8 trillion YoY, which only represents 54.7% of the entire repayment, or KRW14.4 trillion. An additional KRW5.1 trillion, or 35.4% of the repayment, was collected upon maturity, and the remaining KRW1.4 trillion was interim.

By asset class, ELS and ELB tracking indices fell to a record low at KRW17.6 trillion in H1 22 following the rebound seen a year ago. The decrease was also reflected in the issuance amount linked to domestic stocks and hybrid assets including stocks, indices, funds, ETFs and ETNs.

Overseas stock underlyings kept their momentum despite a marginal market share – the issuance amount linked to foreign assets was stable at KRW463.6 billion compared with a year ago.

Specifically, the issuance amount tracking the performance of the S&P 500, Eurostoxx 50, HSCEI, Nikkei 225, HSI and Kopsi 200 indices dropped 34.9%, 19.1%, 67.3%, 97.3% and 37.4%, respectively, YoY.

The volume tracking the HSI index hit the bottom at KRW7.6 billion, which is at a notable distance from KRW280.2 billion seen a year ago.

Samsung Securities topped the issuance league table of ELS and ELB, replacing Mirae Asset Securities, through KRW2.1 trillion, which accounted for 10.6% of the market share. Next in line were Meritz Securities and KB Securities, which took a respective market share of 10.5%.

Click here to view the report (in Korean) from the Korea Securities Depository.

Image: Engdao /AdobeStock