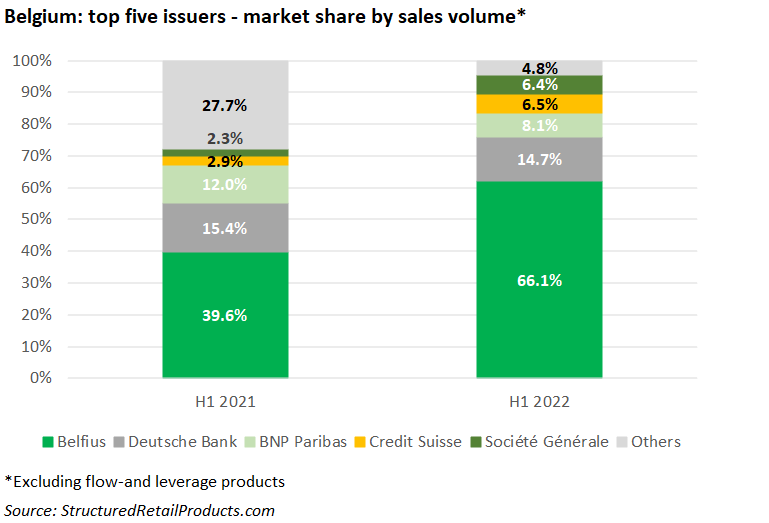

Belfius claimed two thirds of the market in the first half of 2022 with KBC the most notable absentee.

Some €470m was collected from 42 publicly offered structured products during H1 2022 in Belgium – down 36% by sales volume year-on-year (H1 2021: €737m from 77 products).

Despite a drop in sales, average volumes, at €11.2m, were higher than those in H1 2021 when products sold on average €9.6m.

Seven different issuer groups were active in the semester compared to 11 in the prior year period.

KBC, which had a 15.7% market share in the first half of last year (second, behind Belfius only), issued no products this time round although it did start the subscription for KBC-Life MI Step In World 100-1 whose strike date came just outside the reporting period (4 July).

ING Bank, Goldman Sachs and Citi also refrained from issuing products during H1 2022.

Belfius was the number one issuer in H1 2022, capturing 66.1% of the market – an increase of 26.5% YoY. The bank-insurer collected an estimated €310m from 19 products between 1 January and 30 June 2022 (H1 2021: €292m from 25 products). Its offering included Belfius Financing Company (LU) Callable Interest 03/2032, a 10-year steepener linked to the constant maturity swap (CMS) rate that was the best-selling product of the semester with sales of €49m.

Deutsche Bank, in second, claimed a market share of 15.4% (H1 2021: 14.7%). All its products were available via the branch network of Deutsche Bank Belgium, which also distributed the products issued by Barclays, Credit Suisse, Morgan Stanley, and Société Générale, the four other active issuers this semester.

Third placed BNP Paribas saw its market share decrease to 8.1% (from 12% in H1 2022). Its products, six in total, were exclusively available via the Bpost Bank network with the last product distributed via the BNP Paribas Fortis network dating back to August 2021.