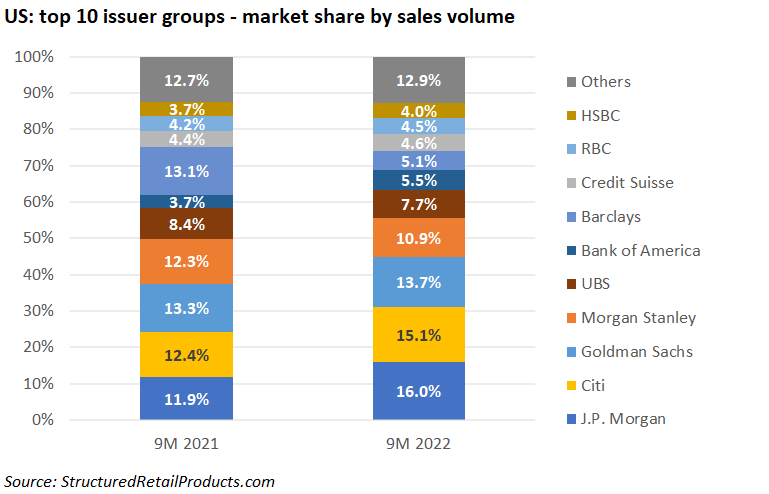

J.P. Morgan replaced Goldman as the number one issuer group in 9M 2022.

Some $72.8 billion was collected from 24,236 structured products in the first nine months of 2022 – a five percent decrease in sales volumes compared to the prior year period (9M 2021: $76.5 billion from 23,559 products).

Average sales volumes stood at $3m, level on 9M 2021.

Eighteen issuer groups were active in the period – they were mixture of US, Canadian and European investment banks.

J.P. Morgan was the most prolific provider during 9M 2022, replacing Goldman Sachs as the number one issuer. The bank captured a 16% share of the US market with sales of $11.7 billion from 5,661 products (9M 2021: $9.1 billion from 3,684 products).

More than 65% of its sales volumes came from products linked to equity indices with the S&P 500 the most popular by far. Structures linked to the US benchmark gathered a combined $5.5 billion while products tied to its proprietary MerQube US Tech+ Vol Advantage and Kronos+ indices collected $95m and $33m, respectively.

In second, Citi increased its market share to 15.1% – up 2.7% from 9M 2021. The bank achieved sales of US$11 billion from 3,756 products that, like at J.P. Morgan, were predominately linked to equities, with single indices and index baskets again the preferred option. However, Citi also accumulated sales of more than $1 billion from 288 products which used exchange-traded funds as underlying.

Goldman Sachs, despite increasing its markets share by 0.4% to 13.7%, dropped to third place with sales of $10 billion from 2,738 products, while Morgan Stanley (10.9% market share) and UBS (7.7%) completed the top five.

Bank of America, which claimed 5.5% of the US market, was responsible for the best-selling product in 9M 2022. Its Cash-Settled Notes (09709UV70) on the share of Merck & Co sold $515m in May 2022, making it the fourth highest selling product since the launch of the SRP US database in 2005 and the best-selling product since J.P. Morgan’s Leveraged Basket-Linked Notes (38148TLP2), which sold $1.1 billion in January 2016.