Citi replaced Goldman as the number one issuer in the US structured products market during Q1 2023.

Some US$26.6 billion was collected from 8,362 structured products in the first quarter of 2023 – a 7.2% drop in sales volumes year-on-year (YoY). However, sales were up by 3.9% compared to Q4 2022 when US$25.6 billion was gathered from 7,383 products.

Average sales, at US$3.2m per product, were stable compared to Q1 2022 when products sold on average US$3.3m.

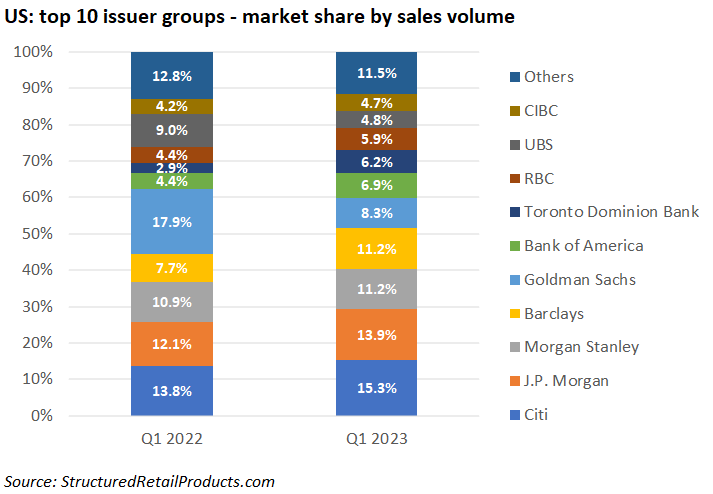

Seventeen different issuer groups, a mixture of US, Canadian and European investment banks, were active in the quarter (Q1 2022: 17).

Citi was the number one issuer during the quarter. The bank captured a 15.3% share of the US market with sales of US$4.1 billion from 1,243 products (Q1 2022: US$3.9 billion from 1,186 products). Almost halve of the bank’s sales in the quarter, at US$2 billion, was tied in 717 products linked to the S&P 500.

In second, J.P. Morgan increased its market share to 13.9% with sales of US$3.7 billion from 1,841 products. Like Citi, a large chunk of its sales came from structures linked to the S&P 500 (US$1.7 billion from 865 products) although its best-selling product, Callable Fixed Rate Notes (48133PDZ3), was linked to the interest rates. The one-year registered note, which pays a fixed coupon of five percent, sold US$307.5m during its offering period, making it the highest selling US product of the quarter.

Morgan Stanley and Barclays both captured 11.2% of the US market while Goldman Sachs, which was the main issuer in Q1 2022, completed the top five with a market share of 8.3% – down 9.6 percentage points YoY. Goldman’s sales dropped by almost 60% compared to the prior year quarter while its issuance was down 29% YoY.

The only newcomer in the top 10 was Toronto Dominion Bank, which replaced Credit Suisse.