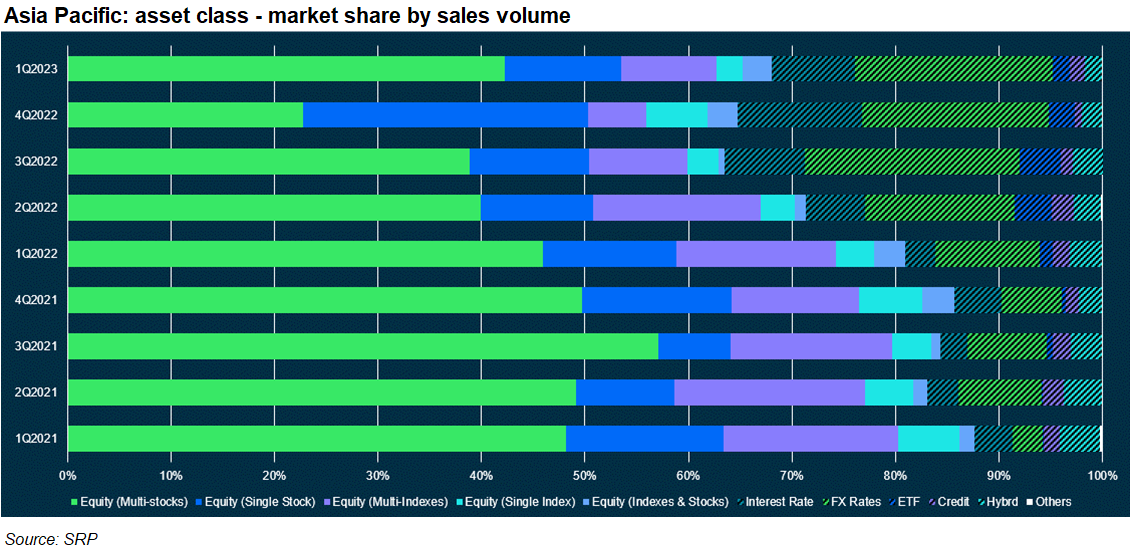

Equity-linked products continued to dominate in the region, despite losing 20% market share, mainly to structures tied to interest rates and FX.

Baskets linked to two or more stocks remained the most popular asset class throughout 2022 and into Q1 2023, when they captured more than 40% market share – an increase of almost 20% quarter-on-quarter (QoQ), but slightly down on the same quarter last year.

The continued demand for products linked to this asset class is driven by investors in Taiwan especially, but also Hong Kong SAR, where they have a market share of 90% and 36%, respectively, in Q1 2023,

Appetite for products linked to single stocks and structures on index baskets was approximately level in the quarter, although the former lost considerable market share compared to Q4 2022. By issuance, single stock products were most seen in Thailand (2,320 products) while the highest sales were achieved in South Korea (US$3 billion) where the most popular share, by some distance, was that of Samsung Electronics (US$2 billion).

Index baskets were almost exclusively the domain of the Korean investor, with US$4.7 billion collected from 2,630 products with a further three products available in Japan (US$11.7m).

Demand for products linked to single indices and hybrid baskets comprising indices and stocks was marginal, but on the other hand, structures linked to interest rates and FX rates were boosted by the attractive interest rate environment.

All in all, equity-linked products claimed a market share of 68% in Q1 2023, up three percent QoQ but down 20% year-on-year (YoY).

The main market for interest-linked products was South Korea where their market share increased to 25% in Q1 2023, up 16 percentage points YoY, with the local Certificate of Deposit Rate 91d the preferred underlying. In Taiwan interest-linked products were mainly tied to the USD constant maturity swap (CMS) rate while investors in Thailand had a fondness for the THOR average three-month interest rate.

In China there is great demand for products on FX rates such as EUR/USD, AUD/USD, and GBP/USD, with Bank of China the dominant issuer (514 products in Q1). Currency pairs are also frequently issued in Hong Kong SAR, mainly via Hang Seng Bank and HSBC.

Products linked to ETFs were seen in four different markets, with the biggest uptake in Hong Kong SAR and China, while credit-linked products were limited to South Korea.