China's Huatai International has pocketed the Deal of the Year accolade at the SRP Apac Awards 2023 in recognition of its booster embedded A-share solutions autocall.

The structure, known as 自动敲出增压 in Chinese, is testimony to how the international arm of Huatai Securities has taken its onshore experience to the offshore market, particularly on the autocall variation.

The booster embedded A-share solution has gained significant traction in onshore trading at Huatai Securities, with its total notional amount exceeding CNY1 billion (US$139m) since 2022, according to Peirong Yao (pictured), head of oversea sales, equity derivatives at Huatai International.

We have noticed that clients are increasingly inclined to trade structures with lower knock-in levels and lower coupon rates, indicating a shift towards lower risk appetite among investors - Peirong Yao, Huatai International

“The growth mainly comes from the past six months as the traditional autocall has struggled to meet investors' expectations on investment returns,” she said.

To address this, the securities house’s EQD team has made a dedicated effort to develop a range of autocall variations by tweaking provisions around knock-out (KO) levels, KO coupon and observation frequency.

They include the enhanced snowball, bonus adjustment autocall, and bufferfly autocall on top of the booster embedded A-share solution.

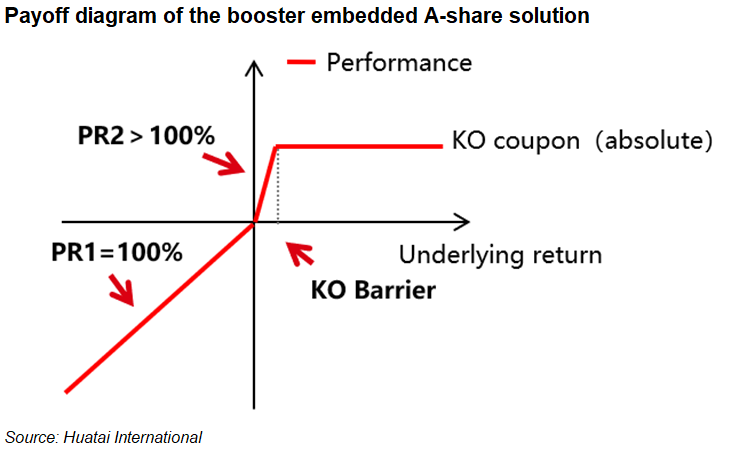

Compared with direct investing in A-shares, the booster embedded A-share structure offers an early redemption of the absolute KO coupon if the underlying price reaches the KO level. Otherwise, investors will hold the product until maturity.

In the event that the underlying price falls between the initial price and the KO level, the structure allows investors to receive multiple times of underlying returns in the most common scenarios. Conversely, investors will suffer the absolute loss 1:1 if the underlying price falls below the initial price.

As a signature offering, autocall structures accounted for over 10% of the volume of the structured products traded by Huatai Securities’ equity derivatives division, which totalled more than US$700m across onshore and offshore in 2022.

Huatai International has issued several booster embedded A-share solutions in the form of structured notes in Hong Kong SAR, which generated nearly US$10m notional. With a common tenor of two years, the products are targeted at wealth management, hedge funds and private banks.

Changing environment

In mid-2022, when the US market went into recession and the A-share market hit its bottom and rebounded following the acceleration of the Federal Reserve's rate increases, Huatai International achieved the first deal of booster embedded A-Share solution linked to the CSI 500, according to Yao.

The product margin was almost 100% of the aggregate nominal amount driven by high Fed fund rates - the KO level was 105% and the participation rate was over 200%.

"As long as the index price rises, clients can either get KO coupon over 10% in terms of absolute coupon or participate in the more-than-doubled underlying return," Yao said.

Another big-seller were bonus adjustment autocalls featuring knock-ins that are observed on a daily basis and KO on a monthly basis - if a KO occurs, the product is redeemed early and pays an annual KO coupon.

In the absence of both knock-in and KO, an annual bonus is gained. The bonus coupon is typically lower than the KO coupon and if knock-in occurs without a subsequent KO event, and the underlying price ultimately falls below the initial price, the product will incur in loses.

“The pause on interest rate hikes has sparked concerns about the US economy among investors and led to growing interest in the Chinese market,” said Yao.

"We have noticed that clients are increasingly inclined to trade structures with lower knock-in levels and lower coupon rates, indicating a shift towards lower risk appetite among investors."

Yao also notes a rising demand from clients for USD-denominated products as higher dollar rate generates better returns offshore compared with the same structure traded in Chinese yuan onshore.

"We anticipate that autocallable structures linked to Hong Kong stock indices, as well as worst-of autocall linked to both the Hong Kong and A-share stock indices, will gain popularity," she said.

The popular underlying assets used by At Huatai International in its structured products are headline A-share indices including the CSI 300, CSI500 and CSI1000 as well as the MSCI China A 50 Connect Index.