Capital protected products increased their market share by 23 percentage points YoY in Q1 2023.

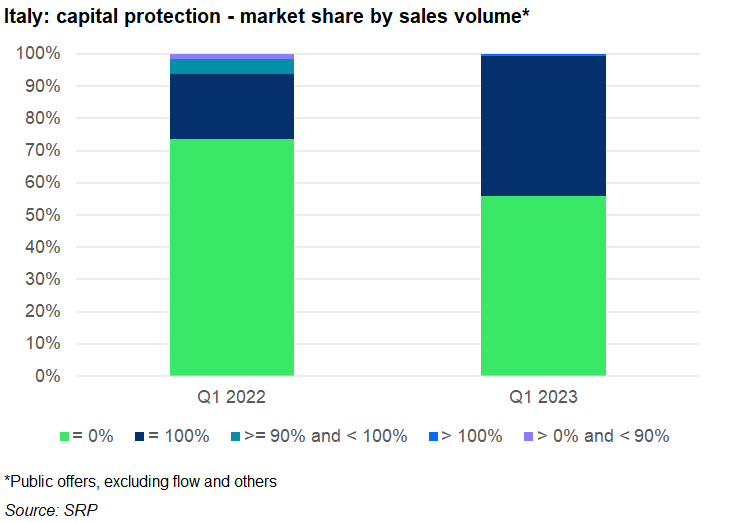

Fully capital-protected structured products claimed a 43% share of the Italian market in the first quarter of 2023 – up 23 percentage points from the prior year period.

Capital-at-risk products captured 56% market share in Q1 2023, down from 74% in the same quarter last year. Products returning between 90 and 100% and those with a capital return of more than 100% held a market share of 0.5% each.

Total volumes of all issued products reached an estimated €4.4 billion in the quarter – up 11% year-on-year (YoY). Average volumes, at €4.7m per product, remained relatively stable compared to Q1 2022 when products sold on average €4.6m.

The 91 products that offered 100% protection sold an estimated €1.9 billion (an average of €21.1m per product). Most of this was invested in products linked to equity indices – either on their own or as part of a basket – the interest rate, or single stocks, while digital, capped participation, and callable were the main payoffs in this segment.

The main issuers of capital protected products were Banco BPM, Intesa SanPaolo, Unicredit. The former’s Equity Protection con Cap e Cedola, a five-year digital on the Swiss Market Index, was the highest seller with sales of €306m during its subscription period.

Intesa Sanpaolo’s Max Long Cap Certificate on the Eurostoxx Select Dividend 30 sold €109m while Unicredit’s Memory Cash Collect Protection 100% linked to the Stoxx Europe ESG Environmental Leaders Select 30 EUR Index gathered €67m.

The number of capital-at-risk structures issued was much higher than that for their capital protected counterparts (858 vs 91) and although total sales for these products, at US$2.5 billion, were higher too, average volumes were quite small by comparison (€2.9m vs €21.1m).

Share baskets and single stocks were the main asset classes for capital-at-risk products, followed by credit, index baskets, and single indices, with barrier reverse convertibles and autocalls the preferred payoffs.

Unicredit was market leader in the capital-at-risk segment, with a share of 35%. However, unlike capital protected products, where local issuers dominated, the other main providers were mostly from abroad including BNP Paribas, Société Générale, Leonteq, Deutsche Bank, and Vontobel.