Siam Commercial Bank became the most prolific provider in a quarter that registered a significant drop in sales volumes.

Some THB20.5 billion (US$595m) was collected from just under 4,000 structured products in the second quarter of 2023 – down 44% in sales volume from the prior year period (Q2 2022: THB36.3 billion from 6,230 products).

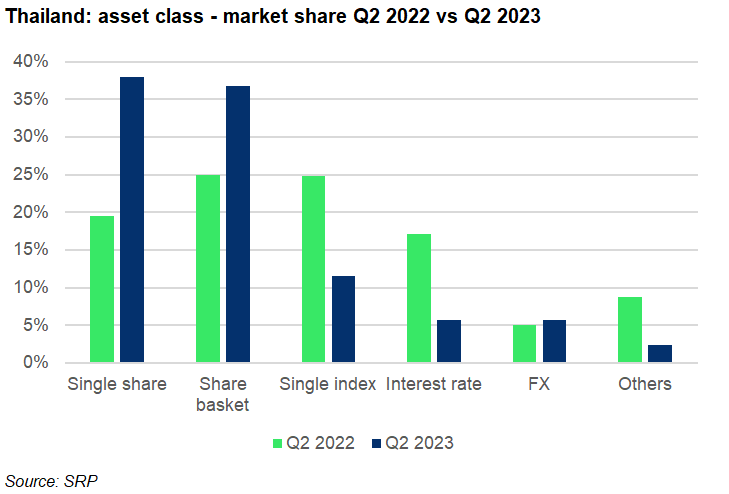

Some 15 issuer groups were active during the quarter, the same number as last year, while asset classes mainly focused on single stocks and share baskets, more so than in Q2 2022.

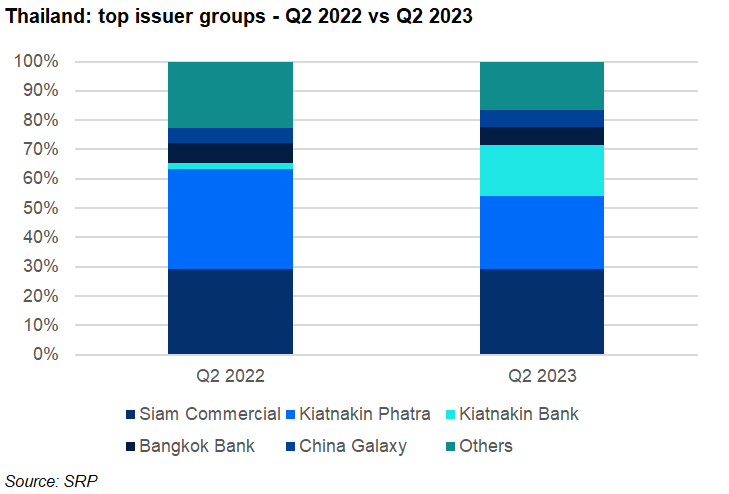

Siam Commercial Bank was the number one issuer group in Thailand in Q2. The bank collected THB6 billion from 1,557 products in the quarter – the equivalent of a 29.3% share of the Thai market, stable compared to the prior year period (Q2 2022: 29.2%). More than 80% of the group’s products were issued on the paper of its subsidiary InnovestX Securities.

Siam Commercial’s products were almost exclusively linked to equities, with 911 linked to a basket of shares and 631 tied to a single stock. However, its best-selling structure – also the highest overall seller in Thailand in Q2 – was a note linked to secured overnight financing rate (Sofr) that collected THB527m.

Kiatnakin Phatra Securities, the main provider in Q2 last year, registered a drop in market share year-on-year: from 34.2% in Q2 2022 to 25% in Q2 2023. The company gathered sales of THB5.1 billion from 943 products, which like Siam Commercial Bank, were mostly linked to equities. Its offering also included 25 structures on the Set 50 Index, which reflects the price movement of the top 50 stocks in terms of market capitalisation and liquidity on the stock exchange of Thailand.

Kiatnakin Bank, in third, was the best performing issuer in the quarter, increasing its market share by 15.5 percentage points to 17.5%. The bank sold 173 products worth THB3.6 billion, with 92% of its sales volumes coming from 102 products linked to a share basket, while a further three percent was invested in 21 products tied to the appreciation of the US dollar relative to the Thai baht.

Bangkok Bank and China Galaxy completed the top five. The former held 6.1% market share that was achieved from selling 454 products worth THB1.2 billion. Most of the bank’s products were linked to single stocks of which those of Kasikornbank (33 products), SCB X (31) and PTT (30) were the most frequently used.

China Galaxy (5.8% market share) issued 477 products that sold THB1.1 billion. Again, almost all its sales came from single stock-linked products with the shares of Tisco Financial Group (67), Bangchak Petroleum (39), and Kasikornbank (36) the most popular amongst its clients.

Other issuer groups active in the quarter included Thanachart Group (4.2% market share), Globex Holdings Management (2.7%), Krung Thai Bank (2.5%), United Overseas Bank (1.9%), and CIMB (1.6%).